- Netherlands

- /

- Capital Markets

- /

- ENXTAM:FLOW

It Might Be Better To Avoid Flow Traders N.V.'s (AMS:FLOW) Upcoming 1.4% Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Flow Traders N.V. (AMS:FLOW) is about to trade ex-dividend in the next 4 days. Ex-dividend means that investors that purchase the stock on or after the 12th of August will not receive this dividend, which will be paid on the 15th of August.

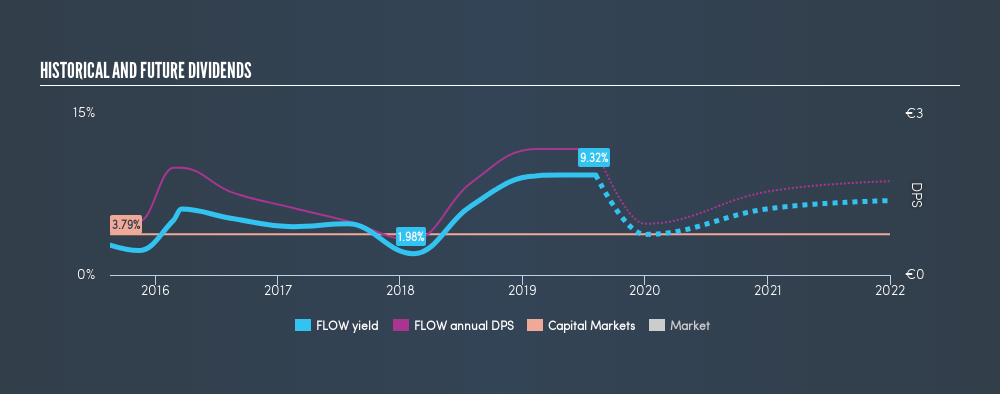

Flow Traders's next dividend payment will be €0.35 per share, and in the last 12 months, the company paid a total of €2.35 per share. Based on the last year's worth of payments, Flow Traders has a trailing yield of 9.3% on the current stock price of €25.22. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Flow Traders

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Last year Flow Traders paid out 93% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings.

When a company pays out a dividend that is not well covered by profits, the dividend is generally seen as more vulnerable to being cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Flow Traders's earnings per share have fallen at approximately 12% a year over the previous 5 years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Flow Traders has delivered 24% dividend growth per year on average over the past 4 years. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. Flow Traders is already paying out 93% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

To Sum It Up

Is Flow Traders worth buying for its dividend? Earnings per share are in decline and Flow Traders is paying out what we feel is an uncomfortably high percentage of its profit as dividends. Generally we think dividend investors should avoid businesses in this situation, as high payout ratios and declining earnings can lead to the dividend being cut. This is not an overtly appealing combination of characteristics, and we're just not that interested in this company's dividend.

Wondering what the future holds for Flow Traders? See what the five analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTAM:FLOW

Flow Traders

Operates as a financial technology-enabled multi-asset class liquidity provider in Europe, the Americas, and Asia.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion