- Netherlands

- /

- Capital Markets

- /

- ENXTAM:CVC

CVC Capital Partners (ENXTAM:CVC) Plans Clean-Up Trade for Exit From HCG

Reviewed by Simply Wall St

CVC Capital Partners (ENXTAM:CVC) is planning to exit its remaining stake in HealthCare Global Enterprises Limited through a block deal involving marquee investors. During the last quarter, the company's share price declined by 6%, despite reports of strong earnings with a significant rise in revenue and net income. These financial results might have helped steady the stock amidst broader market trends, where major indices like the S&P 500 reached record highs, driven by expectations of imminent interest rate cuts. However, this positive sentiment was countered by the ongoing discussions of the company's strategic exits from various investments.

We've spotted 1 risk for CVC Capital Partners you should be aware of.

The potential exit of CVC Capital Partners from HealthCare Global Enterprises Limited might influence its strategic trajectory highlighted in your earlier analysis. This move could impact the company's ongoing diversification efforts into private wealth and insurance sectors. Over the past year, CVC Capital Partners has experienced a negative total return of 17.21%, highlighting the challenges it faces amidst market fluctuations and strategic exits.

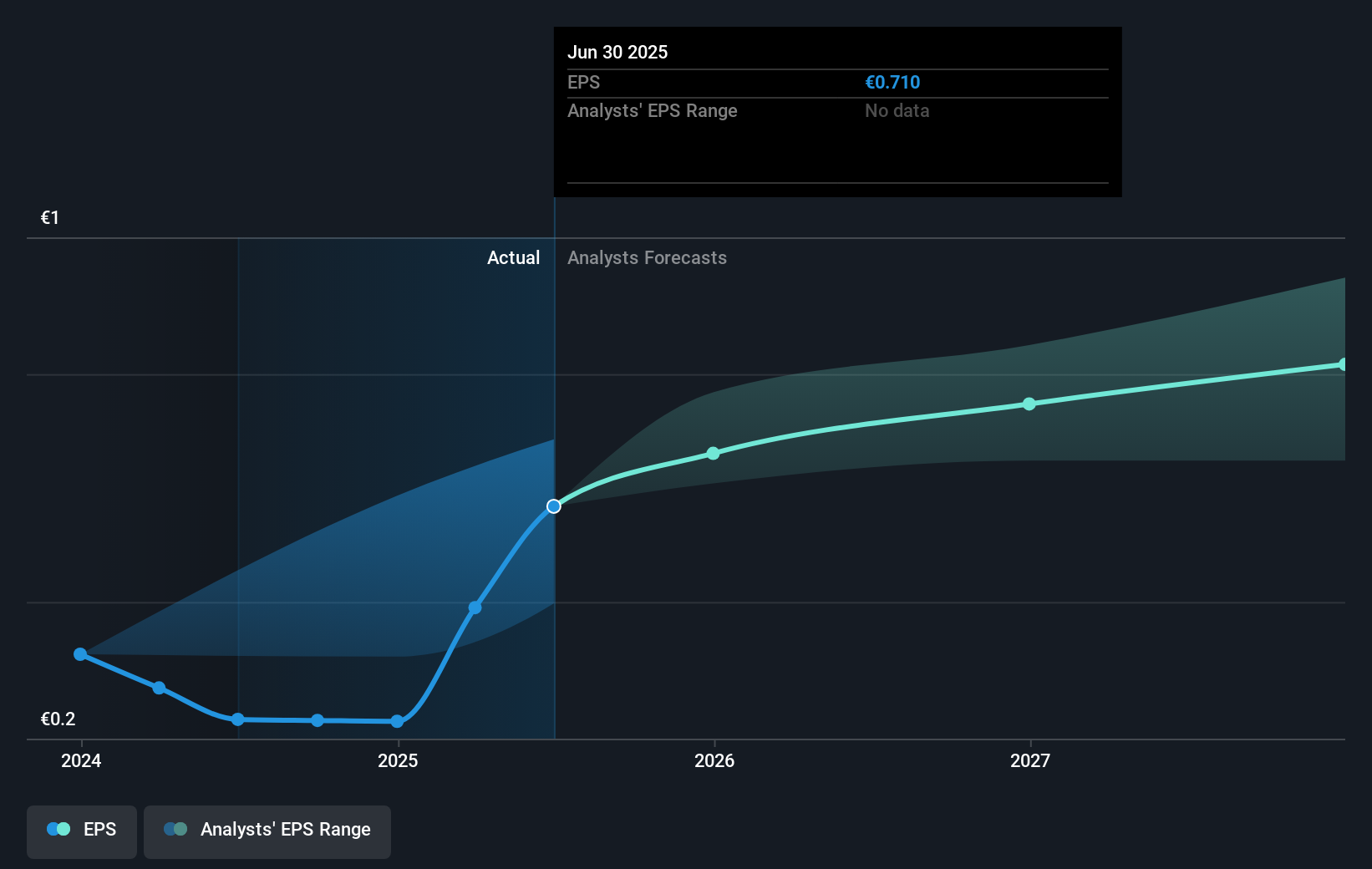

Relative to the Dutch Capital Markets industry, CVC has underperformed over the past year, given its recent inability to keep pace with industry players and market trends. The negative returns contrast with analysts' more optimistic outlook, as reflected in a price target of €19.51, which signifies a potential upside from the current share price of €15.29. This apparent undervaluation could suggest market skepticism regarding the company's future earnings and revenue growth.

The announced strategic exit does not inherently alter existing revenue and earnings forecasts, which anticipate €1.1 billion in earnings by 2028. However, successful capital reallocation from such exits could enhance operational efficiencies and revenue streams. With these projections, CVC would need to achieve significant improvements in profitability metrics to align with analyst targets, suggesting possible volatility in the short term. These dynamics underscore the importance of sustained execution on expansion initiatives to meet market expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CVC

CVC Capital Partners

A private equity and venture capital firm specializing in middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature, recapitalizations, strip sales, and spinouts.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives