- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:ADYEN

Will Adyen's (ENXTAM:ADYEN) Refined 2026 Growth Guidance Reshape Its Long-Term Revenue Narrative?

Reviewed by Sasha Jovanovic

- Adyen N.V. recently reaffirmed its 2025 revenue guidance, announced stronger-than-expected third-quarter results powered by robust retail activity, and refined its 2026 revenue outlook to a narrower growth range in the low to mid-twenties percent.

- This updated forecast offers investors greater clarity on the company’s growth expectations while highlighting challenges such as U.S. trade tariffs and changing client dynamics for major partners.

- We’ll examine how Adyen’s refined 2026 growth guidance shapes the investment narrative and outlook for net revenue expansion.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Adyen Investment Narrative Recap

To be a shareholder in Adyen, you need to believe in its ability to grow transaction volumes and expand with existing enterprise clients, despite facing ongoing regulatory and competitive pressures. The latest guidance narrowing 2026 revenue growth provides more transparency but does not materially change the near-term catalyst, which remains the pace of value-added module adoption, or the biggest risk, a potential slowdown in U.S. merchant volumes due to tariffs.

Among the recent announcements, Adyen's partnership with Affirm to offer new payment options in Canada is most relevant. This move highlights the company’s ongoing efforts to expand services, supporting future transaction growth and reinforcing the short-term catalyst of deeper client relationships and product adoption.

By contrast, investors should be aware of the lingering uncertainty around macro headwinds and how shifts in...

Read the full narrative on Adyen (it's free!)

Adyen's narrative projects €3.9 billion revenue and €1.8 billion earnings by 2028. This requires 21.3% yearly revenue growth and an earnings increase of approximately €803 million from current earnings of €996.5 million.

Uncover how Adyen's forecasts yield a €1813 fair value, a 20% upside to its current price.

Exploring Other Perspectives

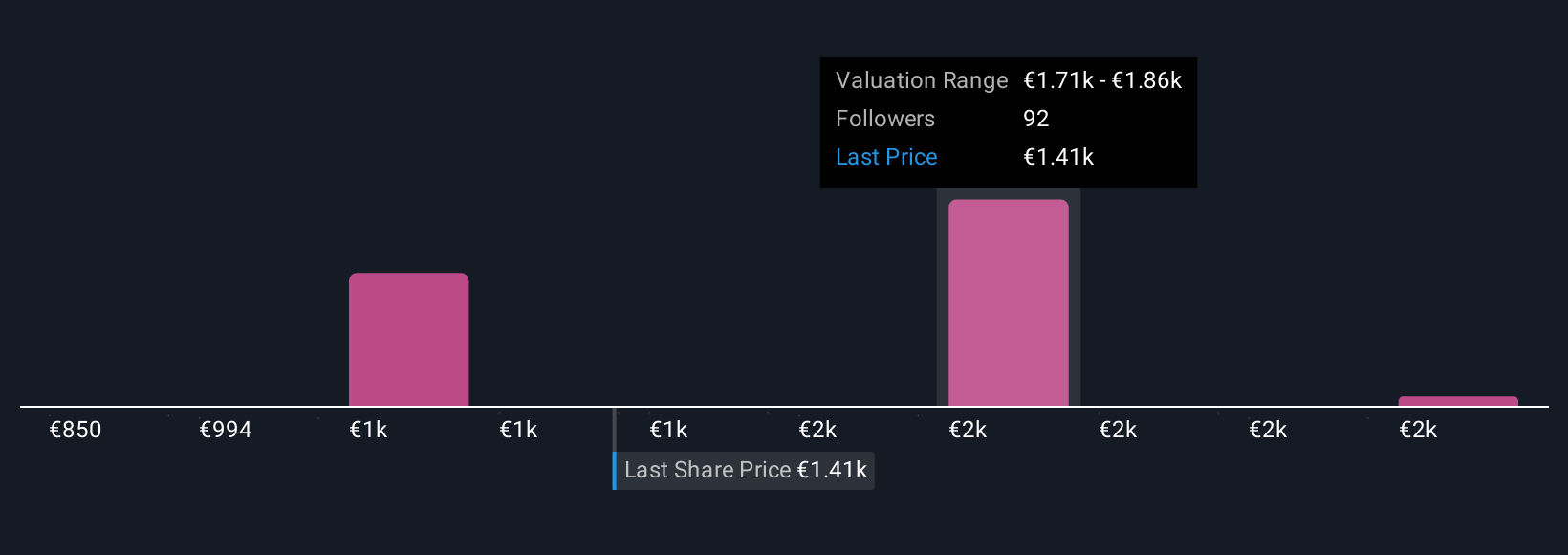

Sixteen Simply Wall St Community fair value estimates for Adyen range from €850 to €2,286, with nearly €1,500 between lowest and highest views. While many see room for revenue expansion, recent guidance reflects the importance of monitoring execution risk and competitive pressures. Consider exploring the diverse viewpoints our Community offers.

Explore 16 other fair value estimates on Adyen - why the stock might be worth as much as 51% more than the current price!

Build Your Own Adyen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adyen research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Adyen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adyen's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ADYEN

Adyen

Operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives