- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:ADYEN

Adyen (ENXTAM:ADYEN): Assessing Valuation Following 2025 Guidance Reaffirmation and New 2026 Outlook

Reviewed by Simply Wall St

Adyen (ENXTAM:ADYEN) is in the spotlight after reaffirming its revenue guidance for 2025 and sharing new targets for 2026. This gives investors a clearer sense of the company’s growth path over the coming years.

See our latest analysis for Adyen.

Adyen’s reaffirmed guidance has brought some fresh attention, though recent momentum has softened with a 7.52% drop in the 7-day share price return and a 1.46% decline year-to-date. Still, looking longer term, total shareholder return is up 2.24% over the past year, which hints at slow but positive progress as investors weigh growth prospects against changing sentiment.

If you’re keeping an eye on high-potential names in tech and fintech, don’t miss the chance to discover opportunities in the broader sector with See the full list for free.

The latest guidance adds fuel to the debate, with investors wondering if Adyen’s current valuation leaves room for meaningful upside or whether the market has already factored in all of the company’s growth potential. Is this a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 22% Undervalued

Adyen’s narrative points to a fair value far above today’s closing price, suggesting untapped upside driven by future top-line expansion and margin gains. The current share price lags the narrative’s consensus target and reflects bold projections by analysts about Adyen’s market leadership and operational leverage.

Strong expansion of share of wallet with existing customers, underpinned by demand for comprehensive digital payment solutions and new value-added modules (e.g. Adyen Uplift, Protect), is likely to drive sustained top-line growth and support higher net revenues in the coming years. The rapid growth in merchant wins and onboarding of new enterprise and vertical SaaS platforms, especially with the 2025 cohort outpacing prior years, significantly expands Adyen's future addressable base and transaction volumes and supports multi-year revenue acceleration.

What is fueling this upbeat outlook? There is a hidden formula of accelerating customer uptake, innovation wins, and ambitious growth rates included in the narrative’s valuation math. Want to see what assumptions pushed the price target so far above the market? Dive into all the details and discover the numbers the market is missing.

Result: Fair Value of €1,813 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential headwinds such as competitive margin pressure and reliance on large enterprise customers could challenge Adyen’s optimistic outlook if trends shift unexpectedly.

Find out about the key risks to this Adyen narrative.

Another View: Gauging Value by Peer Comparison

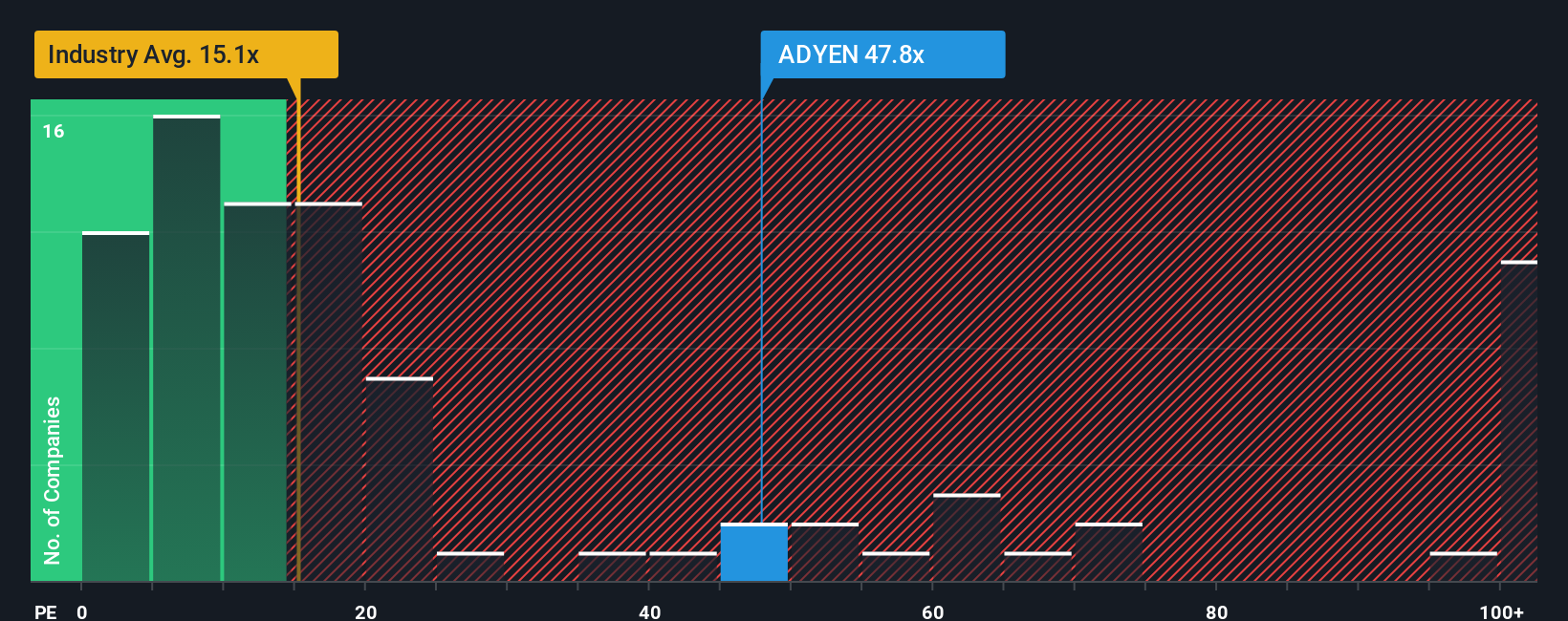

Looking at Adyen through its price-to-earnings ratio, the stock stands out as more expensive than both industry peers and the market average. It is trading at 44.5x earnings, compared to 14.5x for the sector and a fair ratio of just 21.3x. This steep premium raises real questions about how much future growth is already reflected in the share price, and how significant the valuation risk could be if expectations change. Could this leave little margin for error if there is a shift in sentiment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Adyen Narrative

If you want to challenge the consensus or feel more confident building your own thesis, you can quickly craft a personal Adyen narrative in just a few minutes, with Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Adyen.

Looking for More Investment Ideas?

Don’t let the next big opportunity pass you by. Use the Simply Wall Street Screener to quickly target stocks that fit your strategy and uncover exciting potential today.

- Supercharge your search for tomorrow’s breakthroughs by investigating these 27 quantum computing stocks, where emerging companies are pushing boundaries in computation and innovation.

- Boost your portfolio’s income potential by targeting steady performers using these 20 dividend stocks with yields > 3%. This screener highlights businesses delivering robust yields above 3%.

- Get ahead of major trends by tracking these 26 AI penny stocks. Here, industry leaders are shaping the rise of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ADYEN

Adyen

Operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives