- Netherlands

- /

- Hospitality

- /

- ENXTAM:AGIL

Agility Capital Holding Inc. (AMS:AGIL) Could Be Riskier Than It Looks

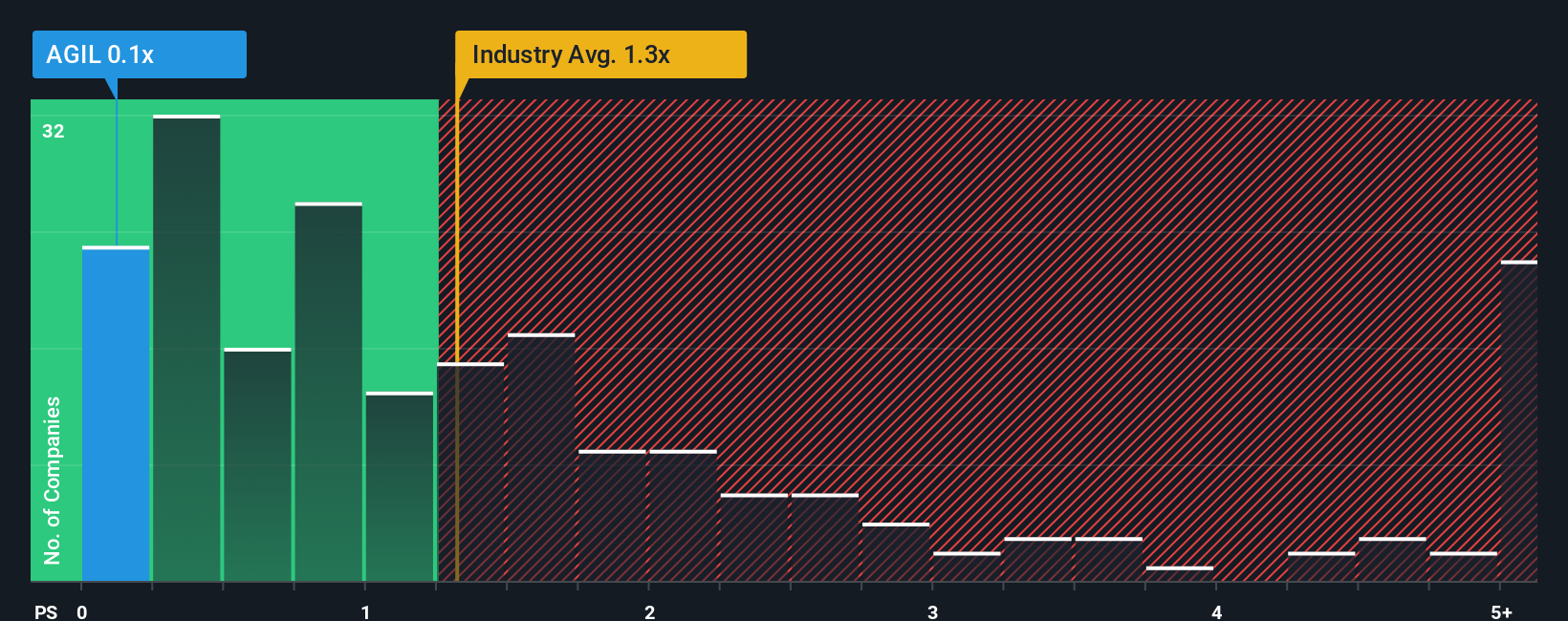

When close to half the companies operating in the Hospitality industry in the Netherlands have price-to-sales ratios (or "P/S") above 1.3x, you may consider Agility Capital Holding Inc. (AMS:AGIL) as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Agility Capital Holding

What Does Agility Capital Holding's Recent Performance Look Like?

Revenue has risen firmly for Agility Capital Holding recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Agility Capital Holding will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Agility Capital Holding's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Agility Capital Holding's to be considered reasonable.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. The latest three year period has also seen a 30% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 7.9% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, we find it intriguing that Agility Capital Holding's P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Agility Capital Holding's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Agility Capital Holding currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. medium-term

You always need to take note of risks, for example - Agility Capital Holding has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:AGIL

Agility Capital Holding

Develops, owns, and operates real estate properties in Peru and Nicaragua.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives