- Netherlands

- /

- Food and Staples Retail

- /

- ENXTAM:SLIGR

Shareholders Will Most Likely Find Sligro Food Group N.V.'s (AMS:SLIGR) CEO Compensation Acceptable

Key Insights

- Sligro Food Group will host its Annual General Meeting on 22nd of March

- CEO Koen Slippens' total compensation includes salary of €603.0k

- The total compensation is similar to the average for the industry

- Sligro Food Group's EPS grew by 4.5% over the past three years while total shareholder return over the past three years was 35%

CEO Koen Slippens has done a decent job of delivering relatively good performance at Sligro Food Group N.V. (AMS:SLIGR) recently. As shareholders go into the upcoming AGM on 22nd of March, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for Sligro Food Group

How Does Total Compensation For Koen Slippens Compare With Other Companies In The Industry?

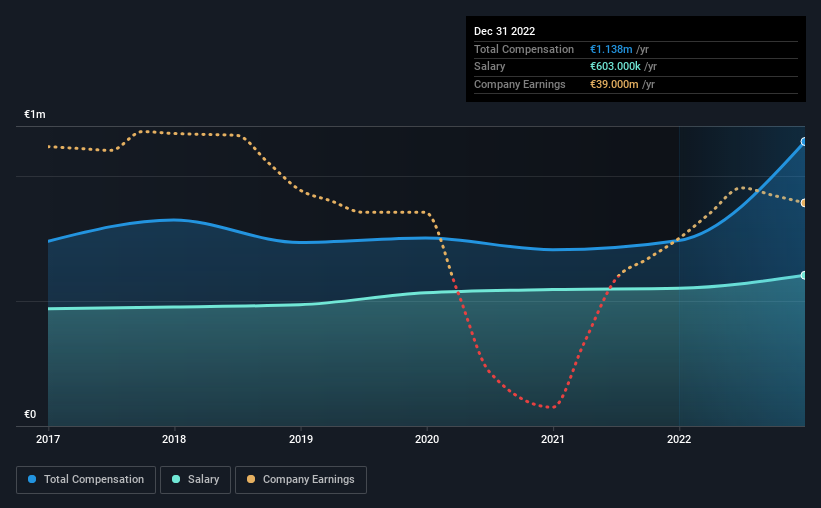

At the time of writing, our data shows that Sligro Food Group N.V. has a market capitalization of €680m, and reported total annual CEO compensation of €1.1m for the year to December 2022. Notably, that's an increase of 53% over the year before. In particular, the salary of €603.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

For comparison, other companies in the the Netherlands Consumer Retailing industry with market capitalizations ranging between €378m and €1.5b had a median total CEO compensation of €1.0m. This suggests that Sligro Food Group remunerates its CEO largely in line with the industry average. What's more, Koen Slippens holds €1.7m worth of shares in the company in their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | €603k | €551k | 53% |

| Other | €535k | €191k | 47% |

| Total Compensation | €1.1m | €742k | 100% |

Speaking on an industry level, nearly 36% of total compensation represents salary, while the remainder of 64% is other remuneration. Sligro Food Group is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Sligro Food Group N.V.'s Growth

Over the past three years, Sligro Food Group N.V. has seen its earnings per share (EPS) grow by 4.5% per year. It achieved revenue growth of 31% over the last year.

We like the look of the strong year-on-year improvement in revenue. Combined with modest EPS growth, we get a good impression of the company. We'd stop short of saying the business performance is amazing, but there are enough positives to justify further research, or even adding the stock to your watch-list. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Sligro Food Group N.V. Been A Good Investment?

Boasting a total shareholder return of 35% over three years, Sligro Food Group N.V. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Sligro Food Group that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:SLIGR

Sligro Food Group

Engages in the foodservice businesses in the Netherlands and Belgium.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.