- Netherlands

- /

- Food and Staples Retail

- /

- ENXTAM:AD

How Recent Developments Are Rewriting the Story for Ahold Delhaize

Reviewed by Simply Wall St

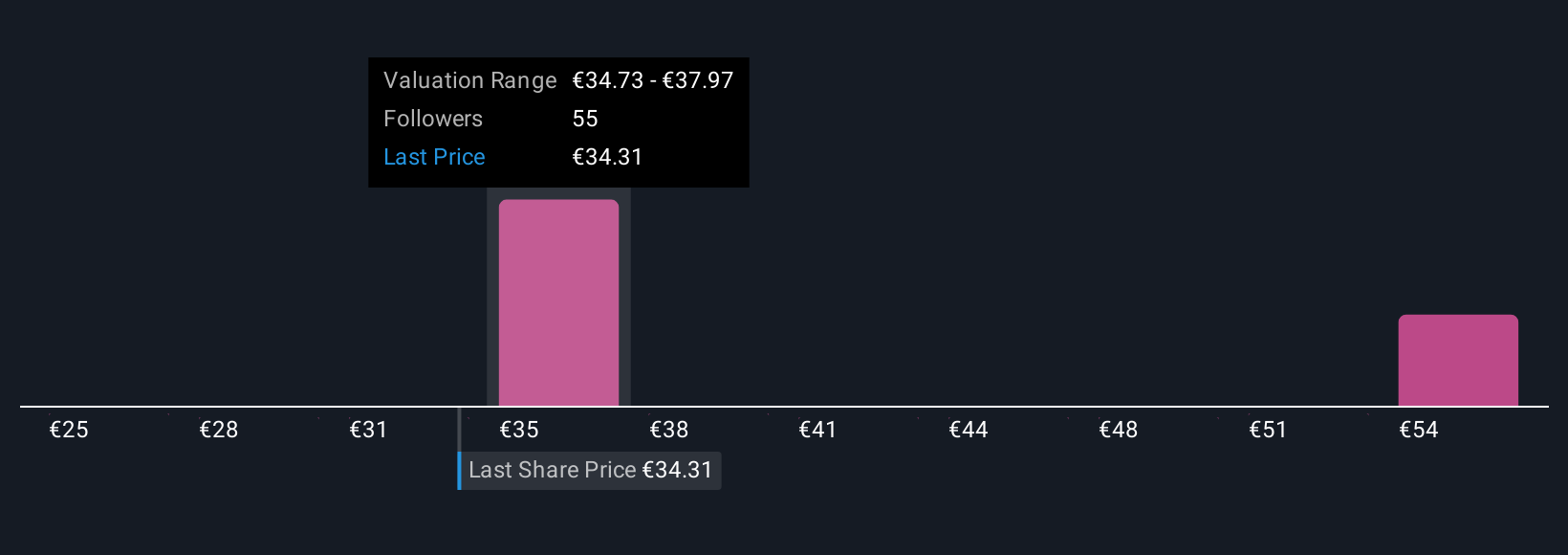

Koninklijke Ahold Delhaize’s consensus analyst price target has seen only a slight increase, moving from €35.90 to €36.47. Analysts remain divided, with some cautious voices citing margin pressures and competitive challenges. Others highlight ongoing resilience and disciplined management as reasons to support the stock’s valuation. Stay tuned to discover how you can keep up with the evolving narrative around Ahold Delhaize’s market outlook.

What Wall Street Has Been Saying

Analyst commentary on Koninklijke Ahold Delhaize continues to reflect a divided market. While some institutions remain optimistic about the company’s core strengths and potential, others voice caution regarding future growth and profitability. Below, we summarize the main bullish and bearish perspectives underpinning recent price target updates and ratings actions.

🐂 Bullish Takeaways

- Bullish and neutral analysts note the company’s consistently strong cash flow generation and disciplined capital allocation. These factors are seen as supporting long-term shareholder value.

- Positive mentions highlight management’s successful execution on cost control measures and a transparent operating model, which has contributed to operational resilience in a challenging retail landscape.

- Analysts reward growth momentum in digital and e-commerce, viewing strategic investments in these areas as key in sustaining future profitability.

- Firms such as ING and Berenberg recently reiterated higher price targets around €40, citing the company’s ability to navigate industry disruptions while maintaining steady performance. Some bullish voices acknowledge that much of the upside may now be priced in, and valuations reflect this strength.

🐻 Bearish Takeaways

- Bearish analysts, including JPMorgan, maintain reservations about persistent margin pressures and heightened competition across European grocery markets. JPMorgan, for example, left its target unchanged while expressing caution despite the minor upward revision by the broader consensus.

- Ongoing inflationary headwinds and concerns about muted consumer spending growth are central to the more conservative outlooks. Analysts forecast possible challenges to near-term results.

- Cautious voices point to uncertainty around the payoff of strategic investments in digital and technology infrastructure, noting that market expectations could outpace actual improvements in profitability.

- Several analysts have restrained their price target increases or maintained holds, emphasizing concerns about valuation and potential downside risks if current macroeconomic pressures persist.

What's in the News

- Koninklijke Ahold Delhaize has successfully completed its share buyback program, repurchasing a total of 12,834,857 shares. This represents 1.41% of its outstanding shares, for a total consideration of €546.52 million.

- Recent company filings indicate continued investment in digital innovation. Resources are being allocated to e-commerce platforms and technology-driven efficiencies in the supply chain.

- Market analysts are closely monitoring Ahold Delhaize’s response to ongoing competitive pressures in the European grocery sector as inflation and shifting consumer habits impact the retail landscape.

- Stakeholders are also reacting to updates regarding the company’s capital allocation strategy, including the balance between shareholder returns and reinvestment in growth initiatives.

How This Changes the Fair Value For Koninklijke Ahold Delhaize

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from €35.90 to €36.47.

- The Consensus Revenue Growth forecasts for Koninklijke Ahold Delhaize have significantly risen from 2.0% per annum to 2.2% per annum.

- The Future P/E for Koninklijke Ahold Delhaize has risen slightly from 14.04x to 14.68x.

🔔 Never Miss an Update: Follow The Narrative

A Narrative is a simple and dynamic way to connect a company’s story to its financial forecast and fair value. On Simply Wall St's Community page, millions of investors use Narratives to see not just the numbers, but the story behind them — from business drivers to risks, and how these all tie together. Narratives make it easy to compare fair value to current price and are updated as news or results come in. This helps you always stay informed.

Curious about the real drivers behind Ahold Delhaize’s outlook? Read the full Narrative on how omnichannel expansion and digital platforms could reshape its future and follow along for:

- Insight into how Ahold Delhaize’s digital grocery, health-focused offerings, and own-brand expansions are building customer loyalty and margin resilience.

- An objective look at the impact of operational efficiency, acquisitions, and competition on long-term revenue, earnings, and fair value estimates.

- Regular updates as new risks, opportunities, and valuation changes emerge. This helps you spot the right time to buy, hold, or sell.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Ahold Delhaize might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:AD

Koninklijke Ahold Delhaize

Operates retail food stores and e-commerce in the Netherlands, the United States, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives