- Netherlands

- /

- Professional Services

- /

- ENXTAM:WKL

Wolters Kluwer (ENXTAM:WKL): Exploring Valuation After Health Division’s Latest AI Innovations

Reviewed by Simply Wall St

Wolters Kluwer (ENXTAM:WKL) recently spotlighted new AI features in its Ovid Synthesis platform and unveiled UpToDate Expert AI at major healthcare events, drawing attention for their focus on transforming clinical decision support and organizational efficiency.

See our latest analysis for Wolters Kluwer.

Against the backdrop of these high-profile AI launches and product showcases, Wolters Kluwer’s share price has struggled to find traction, falling over 31% year-to-date and delivering a -29.6% total shareholder return over the past year. While short-term momentum has faded, the company’s five-year total shareholder return remains robust at 65%. This suggests that longer-term investors have still come out well ahead despite recent volatility.

If healthcare innovation grabs your interest, it’s the perfect moment to discover other standout companies shaping the sector. See the full list with our See the full list for free..

With shares trading at a significant discount to both analyst targets and intrinsic value, is the market overlooking Wolters Kluwer’s prospects after these AI advances? Or is future growth already reflected in today’s price?

Most Popular Narrative: 24.9% Undervalued

Wolters Kluwer’s narrative fair value estimate sits well above its recent close, suggesting analysts expect significant upside if projections hold. This sets the backdrop for a deeper look at the drivers shaping that outlook.

The accelerating migration of customers from on-premise software to cloud-based SaaS solutions is driving a substantial increase in recurring revenues, which now make up 84% of total revenues and are growing at 7% organically. This transition is supporting improved revenue visibility and expanding margins, indicating the potential for more stable earnings growth and higher net margins over time.

Curious about the financial engine behind this bold price target? It is all about sustained revenue growth, stronger margins, and a profit forecast that pushes valuation multiples higher than the industry norm. Want to see how far the expectations go? Uncover the assumptions fueling this valuation.

Result: Fair Value of €147.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent declines in print revenues and ongoing challenges with the SaaS migration could affect growth and complicate the analyst narrative.

Find out about the key risks to this Wolters Kluwer narrative.

Another View: Market Multiples Paint a Cautious Picture

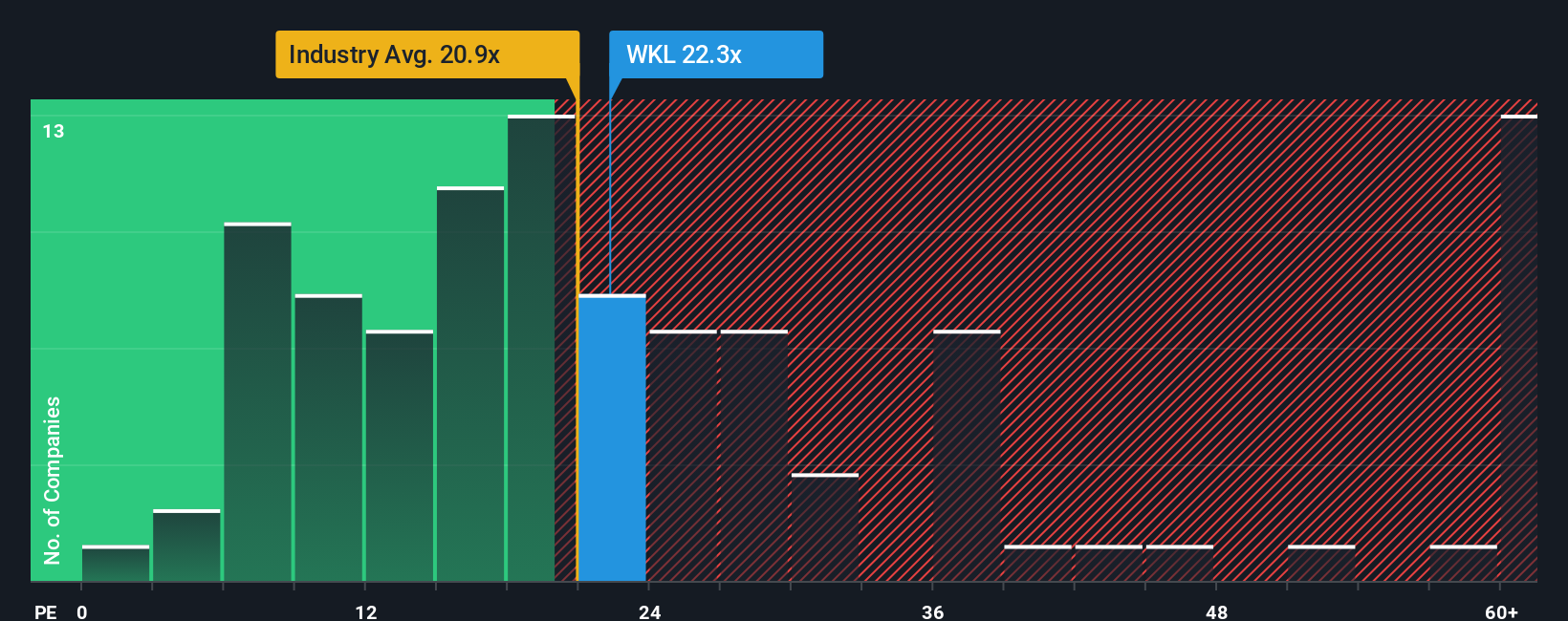

While the narrative and analyst targets point to strong upside, the market’s current valuation based on earnings tells a more restrained story. Wolters Kluwer is trading at 22.5 times earnings, which is pricier than the European industry average of 20.9, but well below the steep peer average of 53.4. Interestingly, this also sits under its fair ratio of 27.8, suggesting some value relative to long-term trends.

So, is the current valuation a signal of hidden opportunity, or a sign that investors expect slower growth ahead? See what the numbers say about this price, find out in our valuation breakdown.

Build Your Own Wolters Kluwer Narrative

If you want to dig deeper or challenge the latest consensus, you can analyze the numbers and craft a personalized story in just minutes with our easy narrative builder. Then Do it your way.

A great starting point for your Wolters Kluwer research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game and seize fresh opportunities with our handpicked stock lists. Make sure you do not miss these standout ideas making waves right now:

- Find stocks delivering above-average yields and tap into reliable income streams by checking out these 21 dividend stocks with yields > 3%.

- Spot undervalued potential before the crowd does and capture value-driven opportunities through these 866 undervalued stocks based on cash flows.

- Ride the momentum of artificial intelligence and get ahead with companies accelerating growth in this rapidly evolving sector using these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolters Kluwer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:WKL

Wolters Kluwer

Provides professional information, software solutions, and services in the Netherlands, rest of Europe, the United States, Canada, the Asia Pacific, Africa, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives