- Netherlands

- /

- Professional Services

- /

- ENXTAM:WKL

Will Wolters Kluwer's (ENXTAM:WKL) AWS Push Reshape Its Cloud Value Proposition for CFOs?

Reviewed by Sasha Jovanovic

- Wolters Kluwer has launched its AI-powered CCH Tagetik Intelligent Platform on AWS Marketplace as a private offer, enabling enterprise clients to access advanced financial management solutions with customized pricing and streamlined cloud procurement.

- This initiative allows customers to leverage advanced AI features, flexible licensing, and AWS billing integration, potentially accelerating cloud adoption for CFO offices and enhancing value through financial workflow automation.

- We'll explore how the expanded availability of CCH Tagetik on AWS Marketplace could influence Wolters Kluwer's cloud-driven growth narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Wolters Kluwer Investment Narrative Recap

To be a Wolters Kluwer shareholder today, you need conviction in the company’s ability to drive digital transformation of expert solutions in health, legal, and finance through cloud and AI-enabled platforms. While the recent addition of CCH Tagetik to AWS Marketplace advances the cloud story, it does not fundamentally reshape the near-term outlook; adoption speed of SaaS/cloud solutions remains the most important catalyst, with continued pressure from declining print and nonrecurring revenues as the main risk, both of which appear largely unaffected by this announcement.

Among recent developments, the reaffirmed 2025 guidance stating organic growth should remain broadly in line with last year is most relevant, signaling no immediate change in revenue trajectory despite new AI offerings and enhanced go-to-market channels. This suggests the transition to cloud and SaaS is proceeding steadily, but does not immediately alter growth expectations or ease underlying risks around print revenue and migration pace.

However, investors should be aware that even with compelling cloud catalysts, the ongoing decline in print and nonrecurring revenue remains an area of concern that...

Read the full narrative on Wolters Kluwer (it's free!)

Wolters Kluwer's outlook anticipates €7.1 billion in revenue and €1.4 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 5.2% and a €0.3 billion increase in earnings from the current €1.1 billion level.

Uncover how Wolters Kluwer's forecasts yield a €147.50 fair value, a 57% upside to its current price.

Exploring Other Perspectives

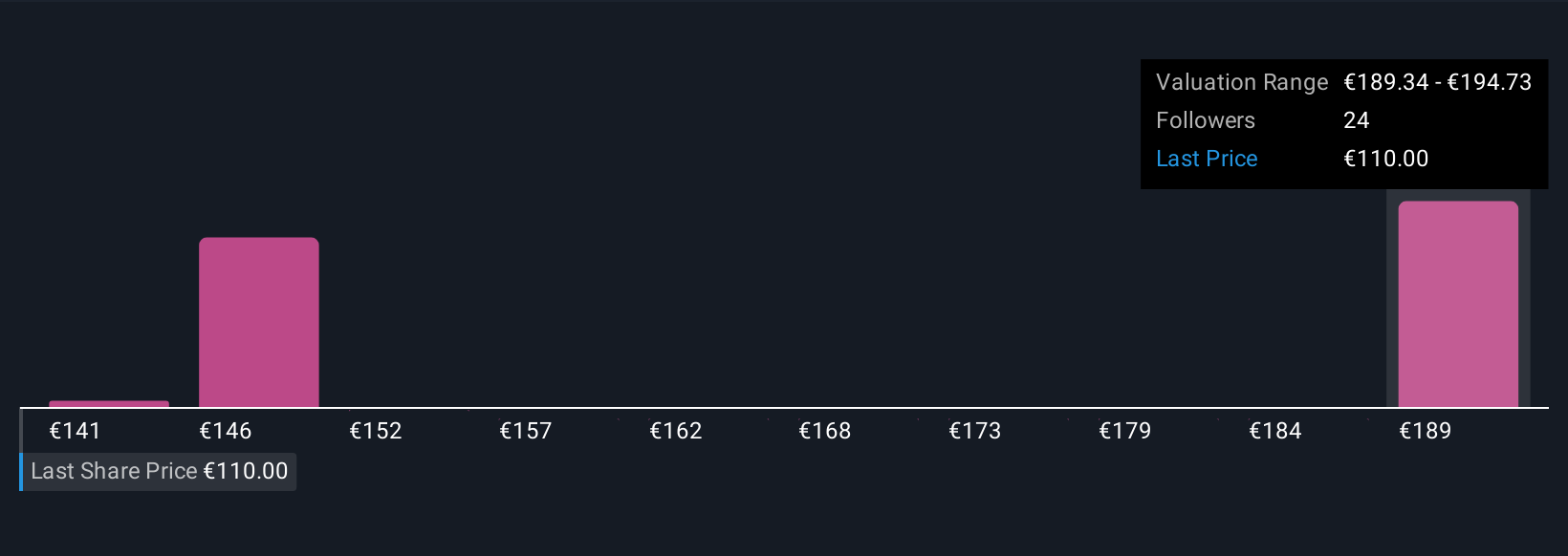

Six fair value estimates from the Simply Wall St Community cluster tightly from €131.09 to €193.06 per share, reflecting strong but varied conviction. Many believe recurring revenue growth from cloud adoption could drive further upside, though you should explore why some expect persistent headwinds for the business.

Explore 6 other fair value estimates on Wolters Kluwer - why the stock might be worth over 2x more than the current price!

Build Your Own Wolters Kluwer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wolters Kluwer research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wolters Kluwer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wolters Kluwer's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolters Kluwer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:WKL

Wolters Kluwer

Provides professional information, software solutions, and services in the Netherlands, rest of Europe, the United States, Canada, the Asia Pacific, Africa, and internationally.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives