- Netherlands

- /

- Professional Services

- /

- ENXTAM:ARCAD

Can Arcadis' (ENXTAM:ARCAD) Portfolio Shift Unlock Durable Growth Beyond Recent Buybacks?

Reviewed by Sasha Jovanovic

- In late October 2025, Arcadis N.V. repurchased 61,852 of its own shares as part of its recently announced capital reduction program, bringing total buybacks under this initiative to 448,008 shares to date.

- The company also reported a return to organic growth in Q3 2025, achieving €936 million in net revenues and an operating EBITA margin expansion to 11.6%, driven by portfolio shifts toward energy, water, climate, and technology markets with strong demand in North America and Europe.

- To assess how Arcadis's return to organic growth and margin improvement may affect its investment outlook, we examine the broader narrative and forecasts.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Arcadis Investment Narrative Recap

To hold Arcadis stock, an investor needs to believe in its ability to drive sustainable growth through leadership in energy, water, and climate projects, supported by continued strength in North America and Europe. While the Q3 return to organic growth and margin expansion are encouraging, persistent client delays in large project decisions remain the key risk and the main catalyst for near-term share price movement. The recent share repurchases and margin improvements do not materially offset this risk.

Among Arcadis’s recent announcements, the ongoing share buyback program is most relevant, as it signals confidence in the business and could support the stock price during periods of volatility. However, the most important catalyst continues to be the pace at which delayed projects and new contracts in energy transition and infrastructure markets are executed, since this is what underpins backlog quality and earnings visibility over the coming year.

On the other hand, investors should be aware that even with recent growth, persistent delays in capital project decisions by key clients could...

Read the full narrative on Arcadis (it's free!)

Arcadis is projected to reach €4.4 billion in revenue and €376.6 million in earnings by 2028. This outlook assumes annual revenue will decline by 3.9%, with earnings increasing by €138.6 million from the current €238.0 million.

Uncover how Arcadis' forecasts yield a €57.93 fair value, a 40% upside to its current price.

Exploring Other Perspectives

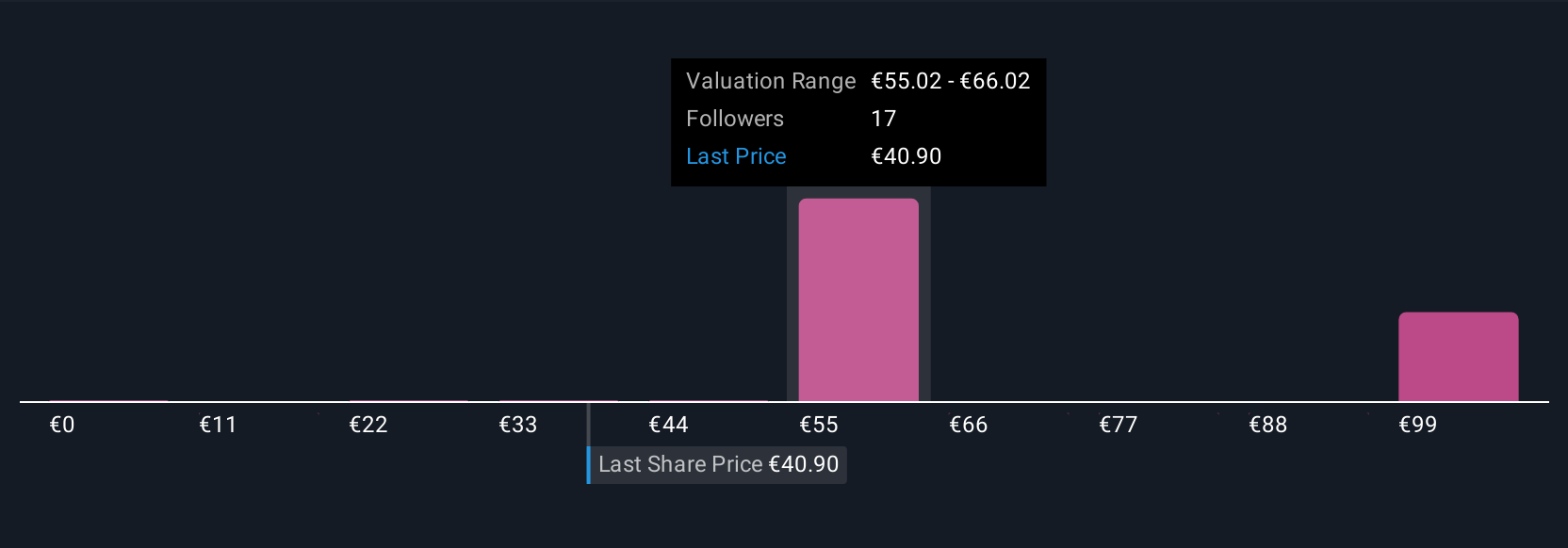

Five members of the Simply Wall St Community estimate Arcadis’s fair value between €10.75 and €107.48, underscoring a wide divergence in views. Many are focused on how recurring client delays in capital expenditures may pressure revenue growth and operating results into 2026, so it’s worth reviewing several outlooks before making up your mind.

Explore 5 other fair value estimates on Arcadis - why the stock might be worth over 2x more than the current price!

Build Your Own Arcadis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arcadis research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Arcadis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arcadis' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ARCAD

Arcadis

Offers design, engineering, architecture, and consultancy solutions for natural and built assets in The Americas, Europe, the Middle East, and the Asia Pacific.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives