- Netherlands

- /

- Electrical

- /

- ENXTAM:SIFG

Sif Holding N.V.'s (AMS:SIFG) 28% Jump Shows Its Popularity With Investors

Sif Holding N.V. (AMS:SIFG) shareholders have had their patience rewarded with a 28% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 50% in the last year.

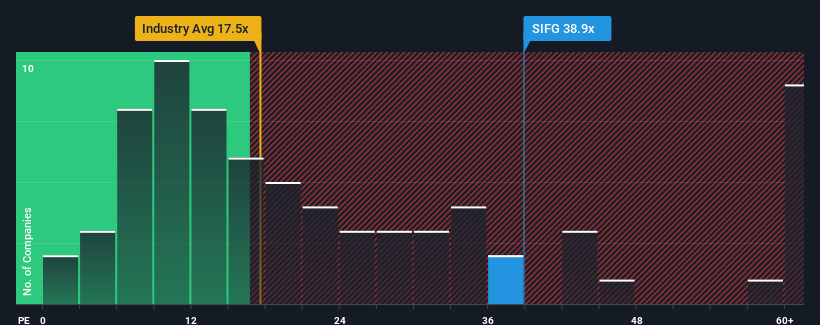

Following the firm bounce in price, Sif Holding's price-to-earnings (or "P/E") ratio of 38.9x might make it look like a strong sell right now compared to the market in the Netherlands, where around half of the companies have P/E ratios below 17x and even P/E's below 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been advantageous for Sif Holding as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Sif Holding

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Sif Holding's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 35%. However, this wasn't enough as the latest three year period has seen a very unpleasant 30% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 56% per annum during the coming three years according to the four analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 11% per year, which is noticeably less attractive.

With this information, we can see why Sif Holding is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Sif Holding's P/E

Shares in Sif Holding have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Sif Holding's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Sif Holding that you should be aware of.

Of course, you might also be able to find a better stock than Sif Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:SIFG

Sif Holding

Manufactures and sells foundation piles for offshore wind farms and metal structures in the Netherlands, the United Kingdom, the United States, Norway, South Korea, Spain, France, Poland, Belgium, Germany, rest of the European Union, and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives