As we step into January 2025, global markets are navigating mixed signals with the S&P 500 and Nasdaq Composite closing out a strong year despite recent volatility, while economic indicators like the Chicago PMI signal challenges in manufacturing. Amidst these dynamics, discerning investors often seek out lesser-known stocks that show potential resilience and growth opportunities, especially as small-cap indices like the Russell 2000 demonstrate notable gains. Identifying such undiscovered gems requires a keen eye for companies with solid fundamentals and adaptability to current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| AB Traction | NA | 7.12% | 6.96% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Sif Holding (ENXTAM:SIFG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sif Holding N.V. specializes in the manufacturing and sale of tubular steel foundations for offshore wind farms and metal structures for the offshore industry, with a market capitalization of approximately €374.80 million.

Operations: Sif Holding N.V. generates its revenue primarily from the wind segment, contributing €431.62 million, while marshalling adds €3.72 million.

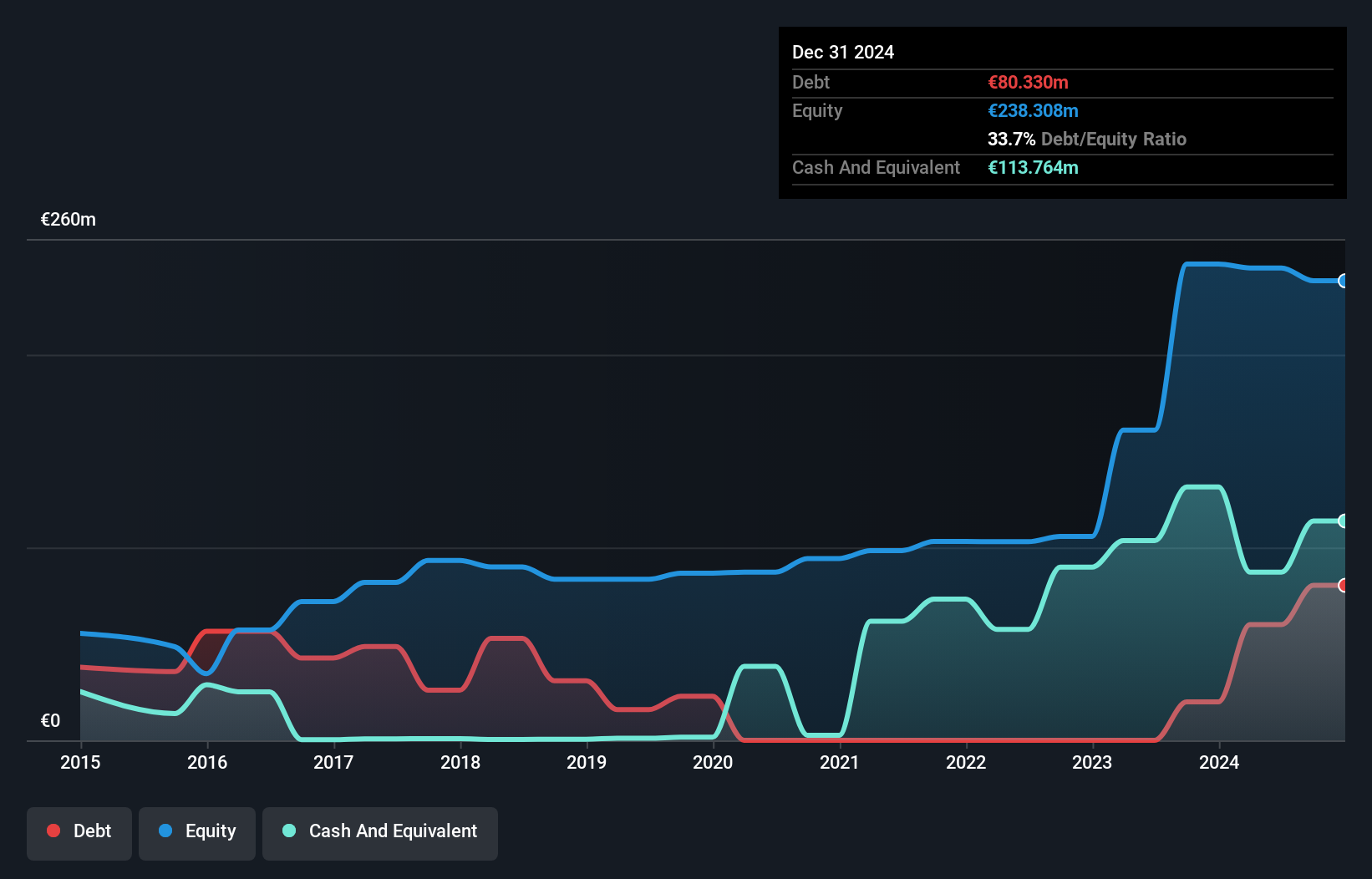

Sif Holding, a relatively small player in its sector, has shown impressive earnings growth of 48.9% over the past year, outpacing the Electrical industry average of 4.4%. Despite a debt to equity ratio increase from 19% to 24.5% over five years, it holds more cash than total debt, indicating robust financial health. Trading at a significant discount of 94.3% below estimated fair value suggests potential upside for investors. However, free cash flow remains negative and high levels of non-cash earnings might raise concerns about quality and sustainability in future performance projections where earnings are expected to grow by 78.4%.

- Click to explore a detailed breakdown of our findings in Sif Holding's health report.

Review our historical performance report to gain insights into Sif Holding's's past performance.

Kerur Holdings (TASE:KRUR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kerur Holdings Ltd., with a market cap of ₪988.13 million, operates in the food sector in Israel through its subsidiaries.

Operations: Kerur Holdings generates its revenue primarily from its operations in the food sector in Israel. The company's financial performance is characterized by a focus on managing costs and optimizing profit margins.

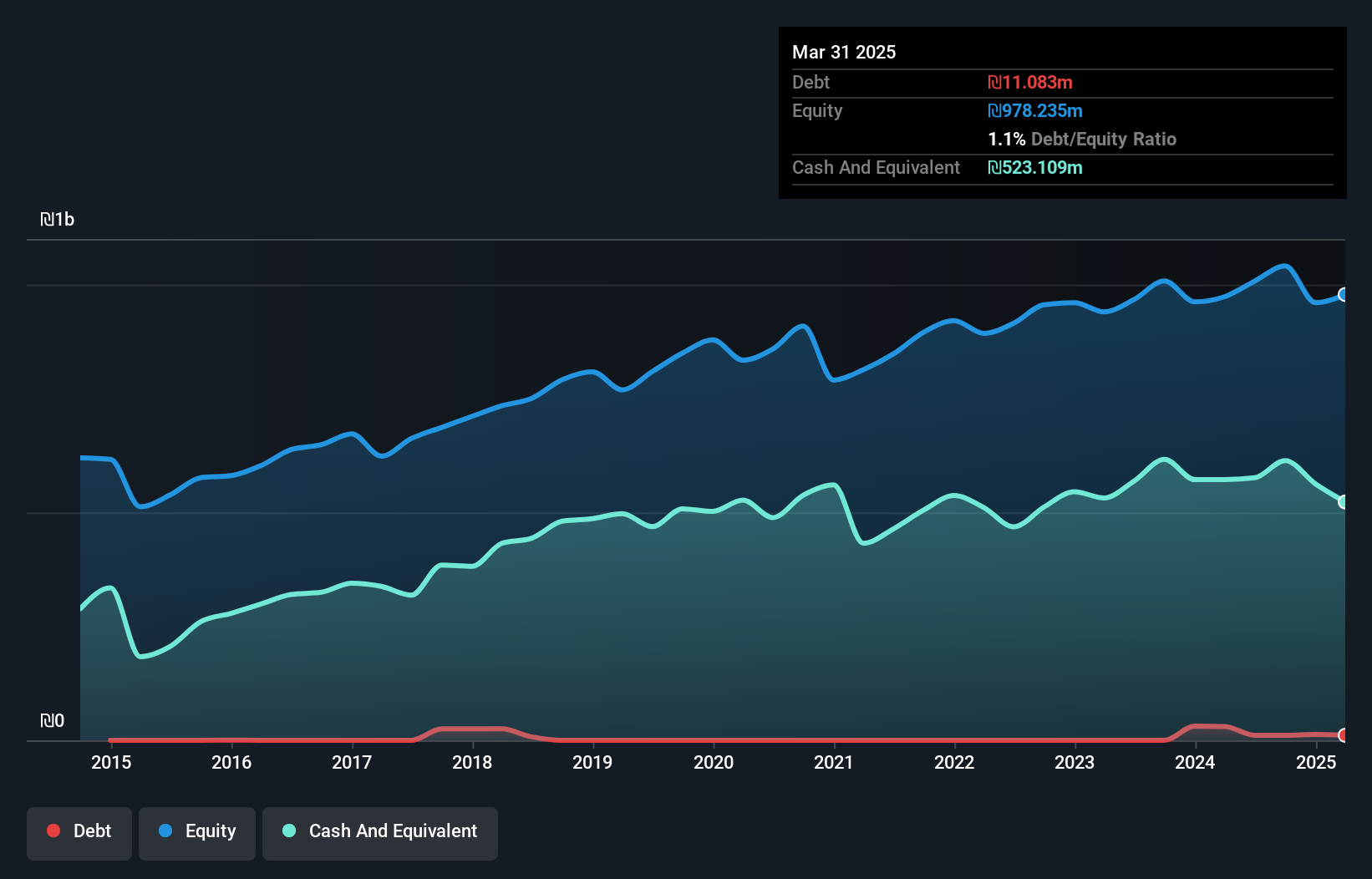

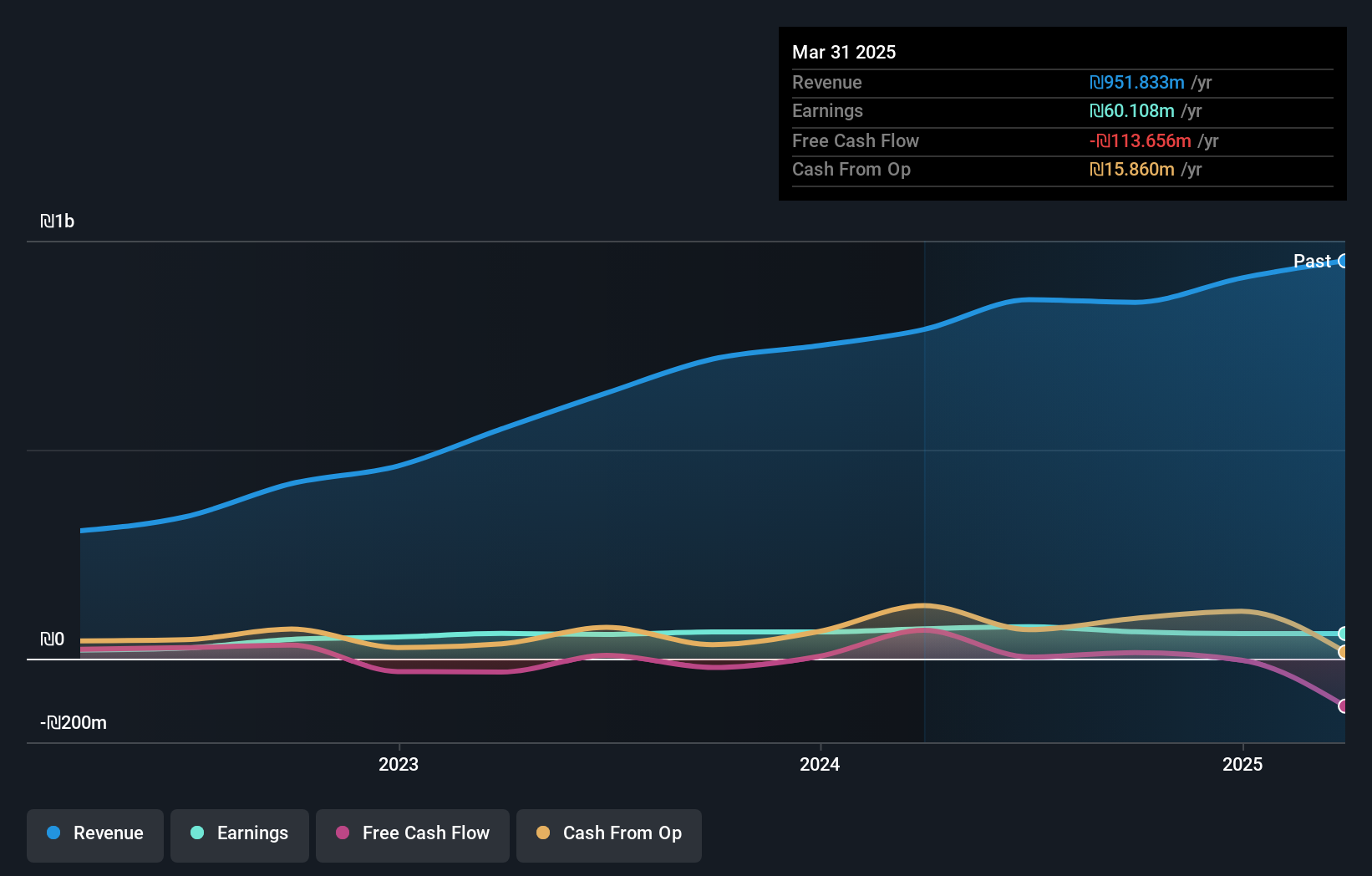

Kerur Holdings, a small cap player in the beverage industry, has shown resilience despite some challenges. Over the past year, its earnings grew by 1.2%, though this lags behind the industry's 10.8% growth rate. The company reported net income of ILS 29.97 million for Q3 2024, slightly up from ILS 28.91 million the previous year, with basic earnings per share rising to ILS 2.38 from ILS 2.3 a year ago. Despite a debt-to-equity ratio increase to just 1.1% over five years, Kerur's financial health remains solid with more cash than total debt and positive free cash flow of US$178 million as of September 2023.

- Dive into the specifics of Kerur Holdings here with our thorough health report.

Gain insights into Kerur Holdings' historical performance by reviewing our past performance report.

Rimon Consulting & Management Services (TASE:RMON)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rimon Consulting & Management Services Ltd. operates in various sectors including water, energy, gas entrepreneurship, and infrastructure execution both domestically and overseas, with a market capitalization of ₪1.57 billion.

Operations: Rimon Consulting & Management Services generates revenue primarily from Israel Execution Infrastructures (₪650.74 million) and Energy and Gas Entrepreneurship (₪138.55 million). The company also earns from Water Entrepreneurship (₪76.09 million) and Overseas Execution Infrastructures (₪54.54 million).

Rimon Consulting & Management Services, a small player in the consulting space, has shown resilience with earnings growth of 0.5%, outpacing the construction industry's -1.4%. Despite a satisfactory net debt to equity ratio of 30%, their recent performance saw sales dip slightly to ILS 228 million from ILS 235 million year-over-year for Q3, while net income fell to ILS 16.62 million from ILS 28.61 million. However, high-quality earnings and strong interest coverage at 121x EBIT indicate financial robustness amidst fluctuating sales figures and capital expenditures reaching -ILS 82 million recently suggest strategic reinvestment efforts are underway.

Taking Advantage

- Click this link to deep-dive into the 4673 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kerur Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:KRUR

Kerur Holdings

Through its subsidiaries, operates in the food sector in Israel.

Excellent balance sheet and fair value.

Market Insights

Community Narratives