- Netherlands

- /

- Food and Staples Retail

- /

- ENXTAM:ACOMO

Top Dividend Stocks On Euronext Amsterdam

Reviewed by Simply Wall St

As the European Central Bank continues to ease monetary policy with consecutive interest rate cuts, the pan-European STOXX Europe 600 Index has experienced modest gains, reflecting a cautiously optimistic market sentiment. Against this backdrop of economic adjustments, dividend stocks on Euronext Amsterdam stand out as attractive options for investors seeking reliable income streams amidst fluctuating market conditions.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.48% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.28% | ★★★★☆☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.83% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 7.03% | ★★★★☆☆ |

| Aalberts (ENXTAM:AALB) | 3.43% | ★★★★☆☆ |

| ING Groep (ENXTAM:INGA) | 6.97% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.66% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Acomo (ENXTAM:ACOMO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acomo N.V. operates in the sourcing, trading, processing, packaging, and distribution of conventional and organic food ingredients for the food and beverage industry across various regions including Europe and North America, with a market cap of €511.79 million.

Operations: Acomo N.V.'s revenue is primarily derived from its segments in Spices and Nuts (€445.76 million), Organic Ingredients (€429.28 million), Edible Seeds (€246.52 million), Tea (€124.04 million), and Food Solutions (€23.47 million).

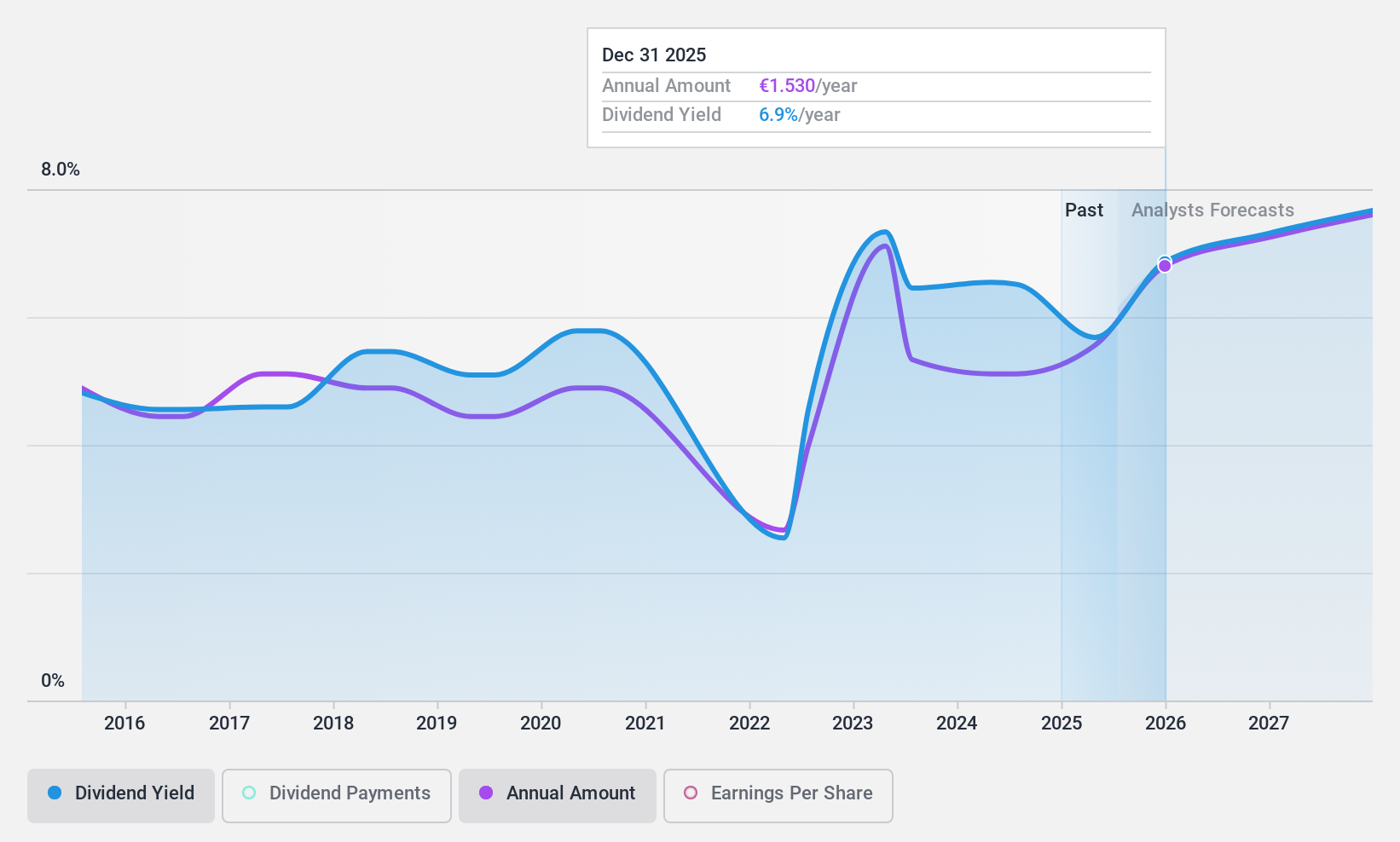

Dividend Yield: 6.7%

Acomo's dividend yield of 6.66% places it among the top 25% of Dutch dividend payers, yet its sustainability is questionable due to a high payout ratio of 95.7%, indicating dividends aren't well covered by earnings. Despite a reasonable cash payout ratio of 51%, suggesting coverage by cash flows, Acomo's dividends have been volatile over the past decade and are not consistently reliable. The company also carries a high level of debt, impacting financial stability.

- Dive into the specifics of Acomo here with our thorough dividend report.

- Our valuation report here indicates Acomo may be overvalued.

ING Groep (ENXTAM:INGA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ING Groep N.V. offers a range of banking products and services across the Netherlands, Belgium, Germany, the rest of Europe, and internationally, with a market cap of €49.96 billion.

Operations: ING Groep N.V.'s revenue segments include Retail Banking in the Netherlands (€4.97 billion), Belgium (€2.61 billion), and Germany (€2.97 billion), as well as Wholesale Banking (€6.69 billion) and Corporate Line Banking (€334 million).

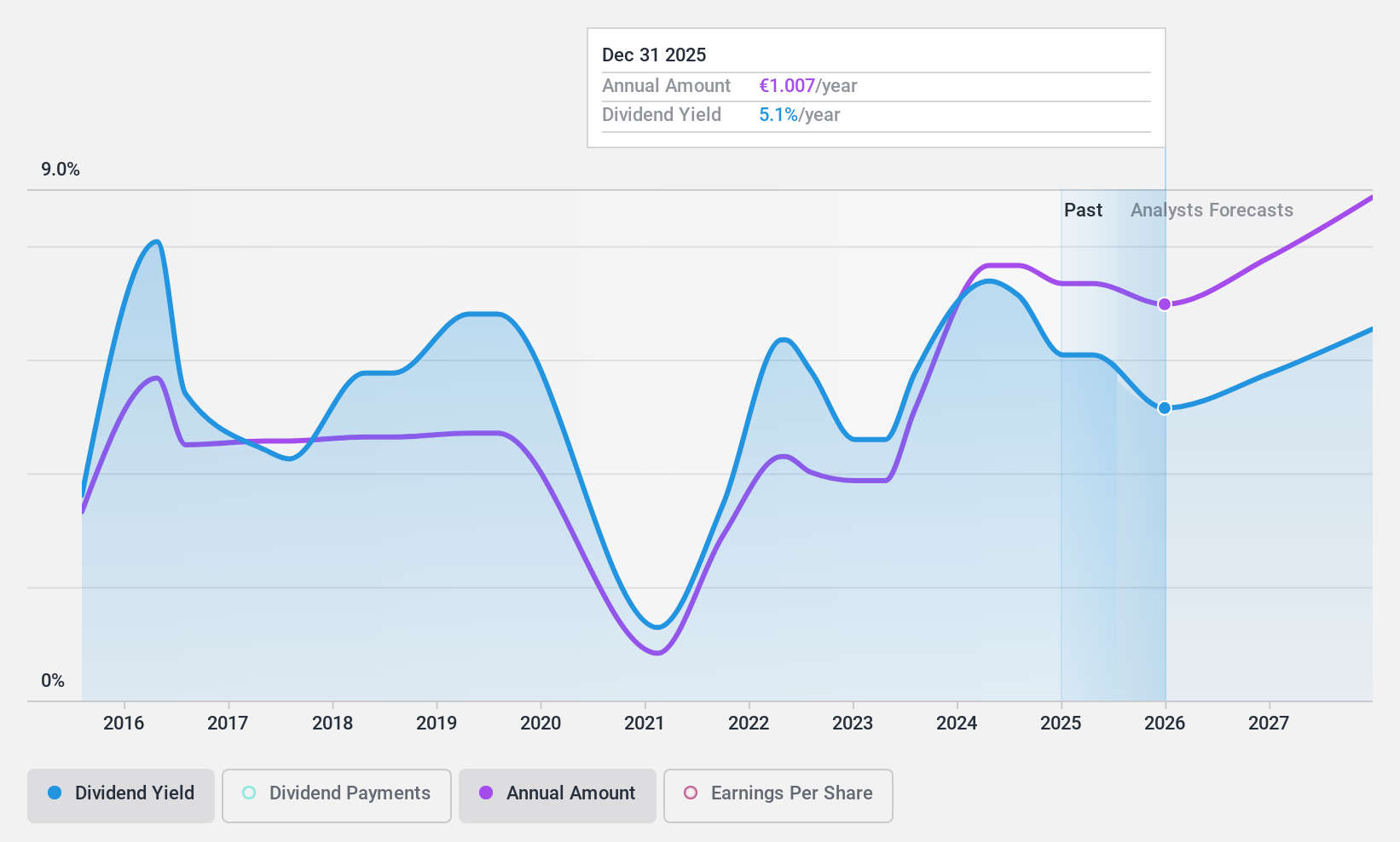

Dividend Yield: 7.0%

ING Groep's dividend yield of 6.97% ranks in the top quarter of Dutch dividend payers, supported by a moderate payout ratio of 69.8%, indicating coverage by earnings. However, its dividends have been unstable over the past nine years, experiencing significant volatility with occasional drops exceeding 20%. Despite this instability, recent share buybacks totaling €2.49 billion may enhance shareholder value and support future dividend sustainability amidst modest earnings growth forecasts.

- Click to explore a detailed breakdown of our findings in ING Groep's dividend report.

- The analysis detailed in our ING Groep valuation report hints at an inflated share price compared to its estimated value.

Signify (ENXTAM:LIGHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. is a company that offers lighting products, systems, and services across Europe, the Americas, and internationally with a market cap of €2.78 billion.

Operations: Signify N.V.'s revenue segments include Conventional lighting, which generated €519 million.

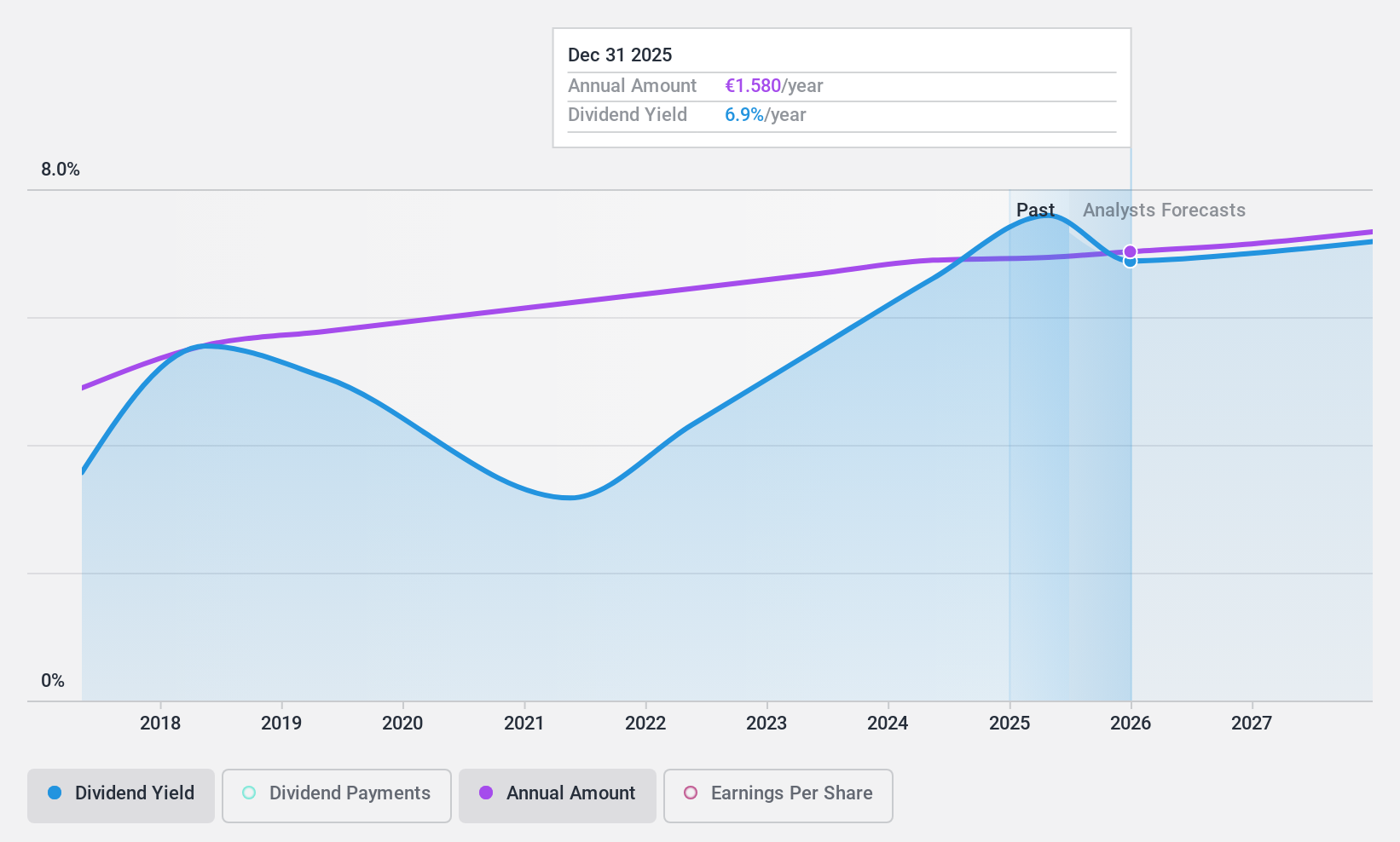

Dividend Yield: 7.0%

Signify's dividend yield of 7.03% places it in the top 25% of Dutch dividend payers, with a payout ratio of 80.4% covered by earnings and a low cash payout ratio of 34.2%. Despite this, its dividends have been volatile over its eight-year history, reflecting instability. Recent financials show improved net income but declining sales for the second quarter and first half of 2024, while removal from the FTSE All-World Index may impact investor perception.

- Get an in-depth perspective on Signify's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Signify's share price might be too pessimistic.

Summing It All Up

- Click this link to deep-dive into the 7 companies within our Top Euronext Amsterdam Dividend Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ACOMO

Acomo

Engages in sourcing, trading, processing, packaging, and distributing conventional and organic food ingredients and solutions for the food and beverage industry in the Netherlands, other European countries, North America, and internationally.

Adequate balance sheet average dividend payer.