- Netherlands

- /

- Electrical

- /

- ENXTAM:LIGHT

Signify (ENXTAM:LIGHT) Margin Surge Reinforces Bull Case Despite Slow Revenue Outlook

Reviewed by Simply Wall St

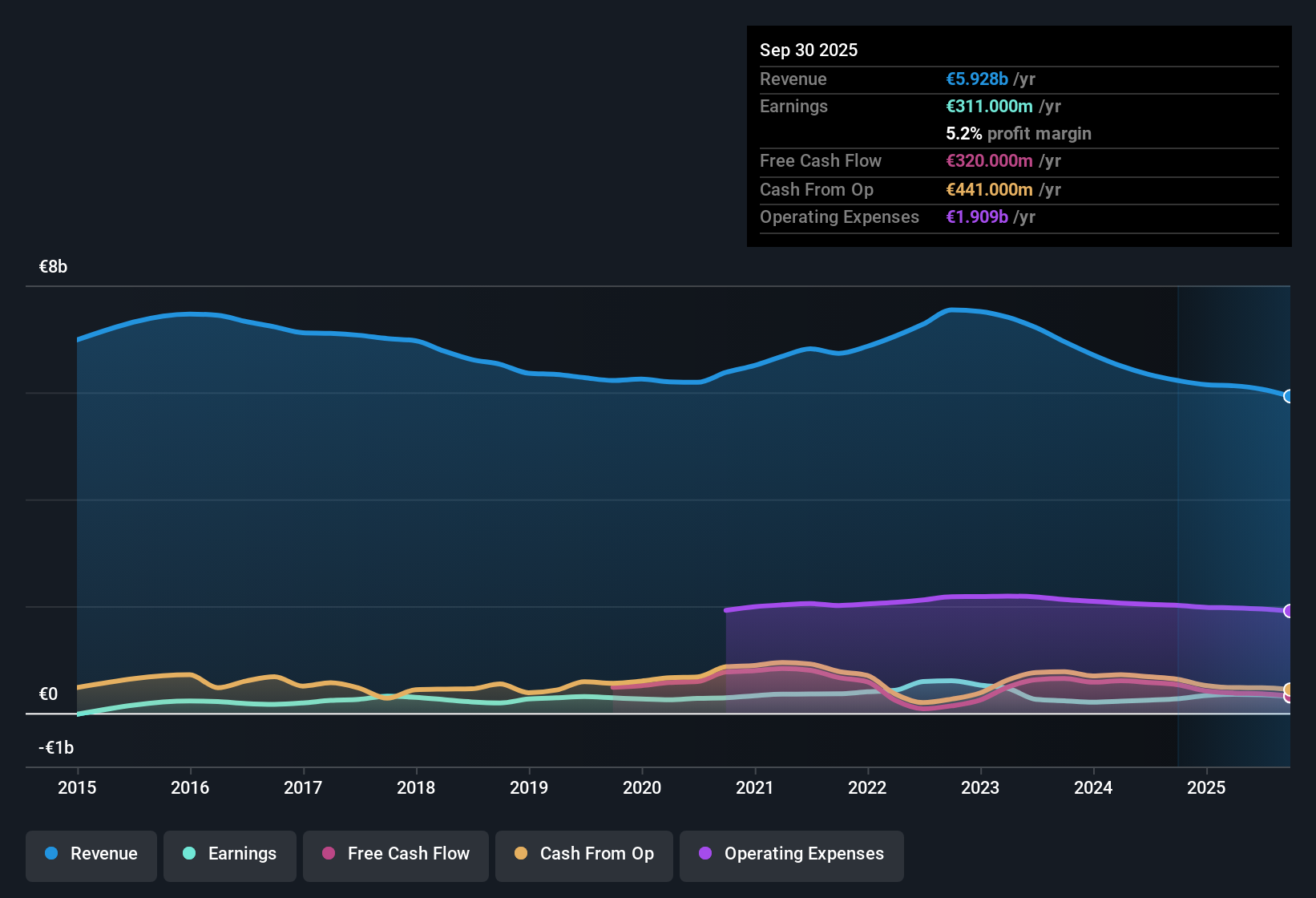

Signify (ENXTAM:LIGHT) delivered a net profit margin of 5.7%, up from 3.8% the previous year, and posted a robust 41.2% earnings growth over the last twelve months. Despite forecasts for earnings to grow at 7.49% per year and revenue at just 0.7% per year, both trailing the broader Dutch market, the shift from a five-year average earnings decline of 6.2% per year to positive momentum is a noticeable turnaround. Investors will be watching closely, especially given the company’s favorable valuation metrics and rising profitability.

See our full analysis for Signify.Up next, we stack these latest numbers against the market narratives around Signify to see where the perspectives match up and where they diverge.

See what the community is saying about Signify

DCF Fair Value Stands Far Above Market Price

- Signify's DCF fair value sits at €43.83, more than double its current share price of €21.10. This creates a substantial gap that stands out even among value names in the electrical industry.

- Analysts' consensus view points out that while the discounted cash flow suggests a significant undervaluation, analysts’ own price target is €24.68, just 17% higher than the market price. This reflects real concern over flat revenue forecasts and ongoing margin headwinds.

- Consensus notes that the current net margin at 5.7% is only expected to rise slightly to 5.8% in three years, limiting the justification for rapid price appreciation.

- The valuation debate hinges on whether resilient profit margins and slow revenue trends can support higher multiples, as the consensus price implies a future PE of 10.2x versus the current 7.9x. This is still a discount to the GB Electrical industry’s 14.6x average.

Don't miss the full consensus narrative breaking down where earnings results support and challenge mainstream analyst thinking: 📊 Read the full Signify Consensus Narrative.

Legacy Lighting Drag Sparks Growth Concerns

- Legacy lighting revenues are under pressure, with sales in the Conventional business segment falling nearly 29% year-on-year. This amplifies worries about the durability of long-term topline growth as new business lines ramp up.

- Consensus narrative weighs these concerns. Bulls emphasize growth in connected and specialty lighting as key to offsetting the decline, but persistent legacy erosion raises the bar for new offerings to deliver.

- The expected annual revenue change is actually a 0.2% decrease over the next three years, underscoring that market expansion rests squarely on winning share in advanced lighting, not overall demand improvement.

- While connected solutions and sustainability trends support pricing power and margin mix, continued dependence on legacy lines could restrain overall progress and keep topline momentum muted.

Buybacks and Margins Cushion EPS Outlook

- Signify is projected to reduce its shares outstanding by 2.19% per year, supporting per-share earnings even as aggregate profits only edge up from €343.0 million to €349.6 million by 2028.

- Consensus view highlights that shareholder returns hinge just as much on financial discipline as top-line growth, with recurring buybacks and cost programs providing a critical buffer.

- Despite revenue stagnation, these programs enable earnings per share to reach €3.12 by September 2028, up from current levels. Some analysts expect results as low as €265.2 million, underlining uncertainty.

- The modest margin expansion (from 5.7% to 5.8%) will be key to sustaining confidence, especially if inflation or macro shocks challenge cost discipline and limit future buyback firepower.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Signify on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spotting different trends in the data? Take just three minutes to present your unique view and shape the next market story, Do it your way.

A great starting point for your Signify research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Signify’s muted revenue growth and ongoing legacy headwinds mean its topline is forecast to stay flat, even with recent profitability gains.

If you want steadier expansion and more consistent results, use stable growth stocks screener (2099 results) to find companies that deliver reliable growth through challenging cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:LIGHT

Signify

Provides lighting products, systems, and services in Europe, the Americas, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives