- Netherlands

- /

- Electrical

- /

- ENXTAM:LIGHT

Koninklijke Heijmans And 2 Other Top Dividend Stocks On Euronext Amsterdam

Reviewed by Simply Wall St

As European equity markets experience mixed performance amid varied earnings reports and economic data, the Dutch market continues to offer investors opportunities for stable returns. This article explores three top dividend stocks on Euronext Amsterdam, including Koninklijke Heijmans, which stand out for their potential to provide consistent income in a fluctuating market environment.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.35% | ★★★★☆☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.26% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.72% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.08% | ★★★★☆☆ |

| Aalberts (ENXTAM:AALB) | 3.21% | ★★★★☆☆ |

| Van Lanschot Kempen (ENXTAM:VLK) | 9.95% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.73% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

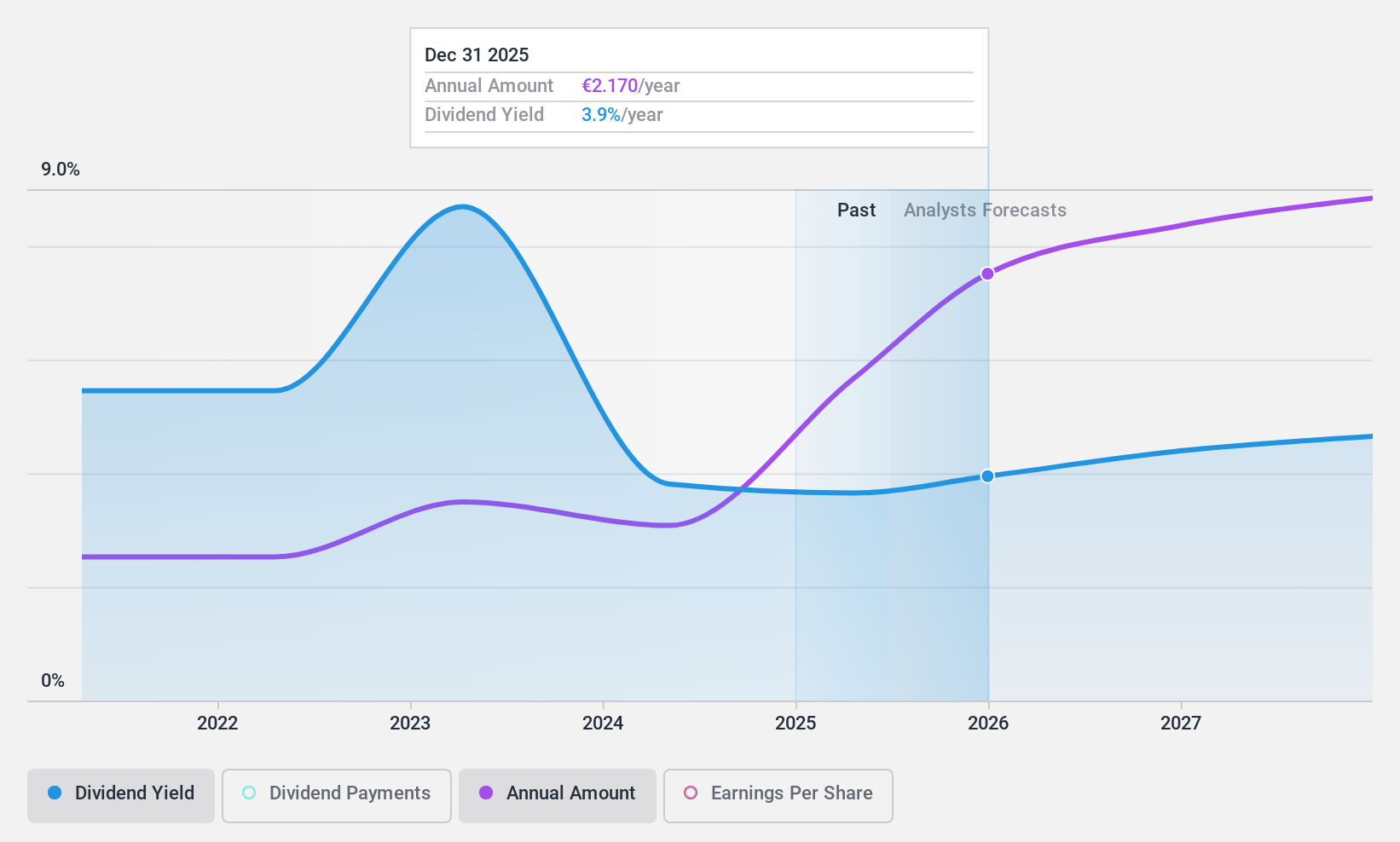

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors in the Netherlands and internationally, with a market cap of €713.57 million.

Operations: Koninklijke Heijmans N.V. generates revenue from its Connecting segment amounting to €871.03 million and Segment Adjustment totaling €1.83 billion.

Dividend Yield: 3.3%

Koninklijke Heijmans reported strong H1 2024 results with sales of €1.22 billion and net income of €37 million, doubling from a year ago. Despite a volatile dividend history, the company maintains a low cash payout ratio (20.7%) and earnings payout ratio (30%), ensuring dividends are well-covered by both earnings and cash flows. However, its 3.35% dividend yield is below the top quartile in the Dutch market, making it less attractive for high-yield seekers despite recent profit growth.

- Click to explore a detailed breakdown of our findings in Koninklijke Heijmans' dividend report.

- Our comprehensive valuation report raises the possibility that Koninklijke Heijmans is priced lower than what may be justified by its financials.

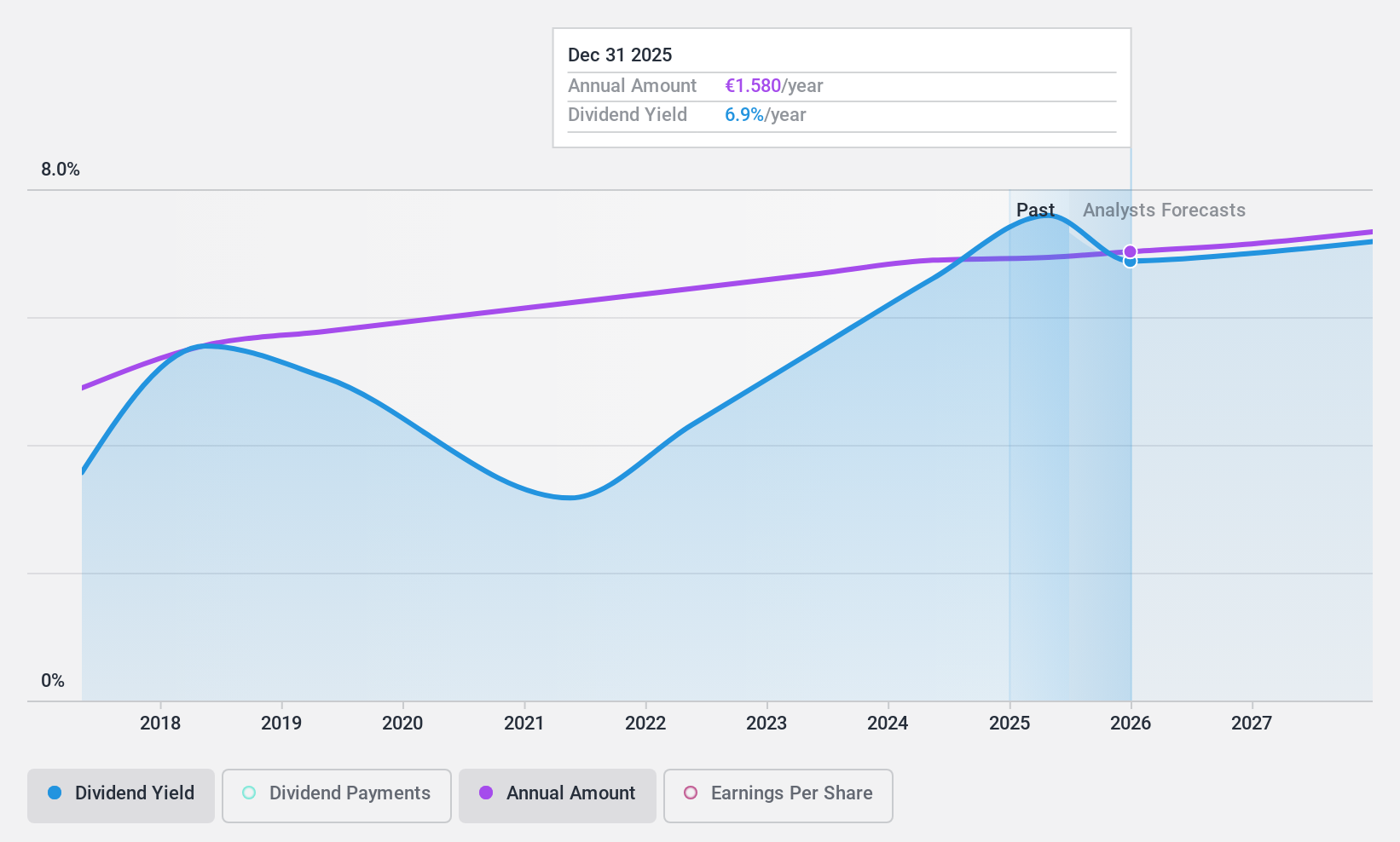

Signify (ENXTAM:LIGHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. offers lighting products, systems, and services across Europe, the Americas, and internationally with a market cap of €2.86 billion.

Operations: Signify N.V. generates revenue primarily from its Conventional segment, which accounted for €519 million.

Dividend Yield: 6.7%

Signify's dividend yield of 6.72% is among the top 25% in the Dutch market, supported by an earnings payout ratio of 80.4% and a cash payout ratio of 33.6%. Despite this, its dividend history is less than a decade old and has been volatile, with significant annual drops. Recent Q2 results showed improved net income (€62 million) despite lower sales (€1.48 billion). The company also completed a €11.9 million share buyback program in May 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Signify.

- In light of our recent valuation report, it seems possible that Signify is trading behind its estimated value.

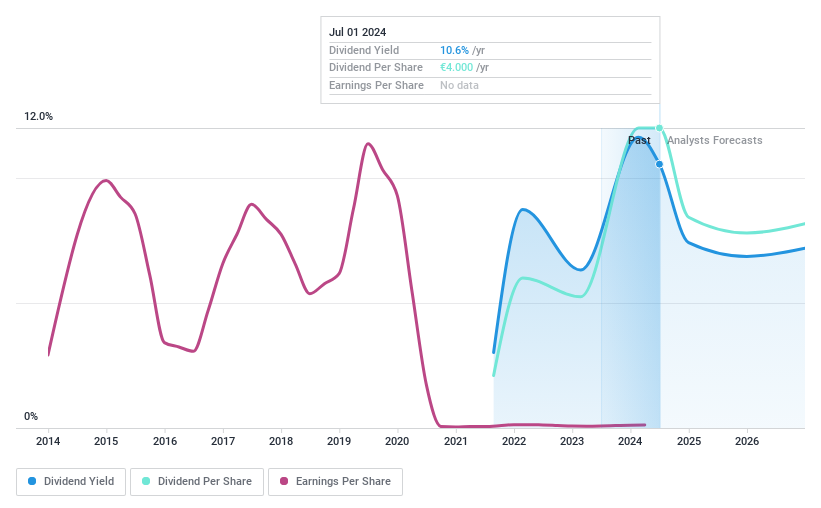

Van Lanschot Kempen (ENXTAM:VLK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Van Lanschot Kempen NV, with a market cap of €1.70 billion, offers a range of financial services both in the Netherlands and internationally.

Operations: Van Lanschot Kempen NV generates revenue primarily from its Wholesale & Institutional Clients (€83.10 million) and Investment Banking Clients (€41 million).

Dividend Yield: 10%

Van Lanschot Kempen's dividend yield of 9.95% places it in the top 25% of Dutch dividend payers, with a payout ratio currently at 70.9%, forecasted to be 84.6% in three years, indicating sustainability. Despite only paying dividends for less than ten years, payments have been stable and increasing over the past three years. The company recently completed a €22.66 million share buyback program, repurchasing 700,000 shares (1.65%).

- Take a closer look at Van Lanschot Kempen's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Van Lanschot Kempen shares in the market.

Key Takeaways

- Embark on your investment journey to our 7 Top Euronext Amsterdam Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:LIGHT

Signify

Provides lighting products, systems, and services in Europe, the Americas, and internationally.

Flawless balance sheet, good value and pays a dividend.