- France

- /

- Diversified Financial

- /

- ENXTPA:PEUG

Exploring 3 Undiscovered European Gems with Promising Potential

Reviewed by Simply Wall St

As European markets navigate the turbulence of escalating global trade tensions, reflected in a recent decline of 1.92% in the STOXX Europe 600 Index, investors are increasingly vigilant about potential opportunities amidst volatility. In this environment, identifying promising stocks often involves looking for companies with strong fundamentals and resilience to economic shifts—qualities that can help them thrive even when broader market sentiment is uncertain.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| FRoSTA | 6.15% | 4.62% | 14.67% | ★★★★★★ |

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Moury Construct | 2.93% | 10.42% | 27.28% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Value Rating: ★★★★★★

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors both in the Netherlands and internationally, with a market cap of approximately €1.02 billion.

Operations: Heijmans generates revenue from three primary segments: Living (€994.30 million), Connect (€996.60 million), and Work (€634.60 million). The company's cost structure and profitability are influenced by these diverse operations, with each segment contributing significantly to its overall financial performance.

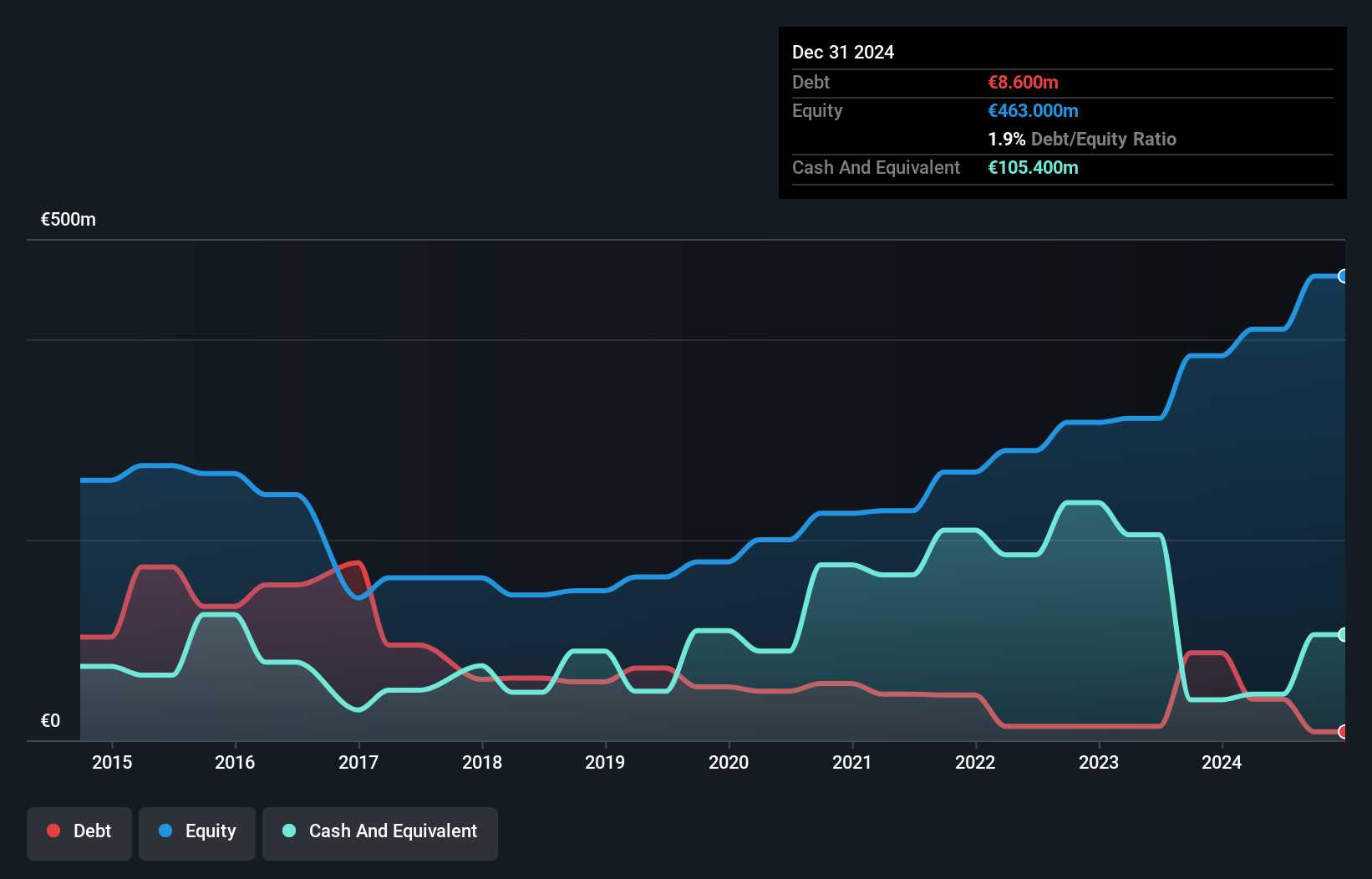

Koninklijke Heijmans, a notable player in the construction sector, has demonstrated impressive growth with earnings increasing by 50.8% over the past year, outpacing industry norms. The company’s debt-to-equity ratio significantly decreased from 29.9% to 1.9% over five years, highlighting improved financial health and leverage management. Despite recent share price volatility and its removal from the Netherlands ASCX AMS Small Cap Index, Heijmans remains a strong contender with its strategic focus on energy transition projects and housing developments addressing market demands while maintaining high-quality earnings and robust interest coverage at 17.8 times EBIT.

Peugeot Invest Société anonyme (ENXTPA:PEUG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Peugeot Invest Société anonyme operates as an investment company with a market capitalization of €1.58 billion.

Operations: Peugeot Invest Société anonyme generates revenue through its investment activities, with a market capitalization of €1.58 billion.

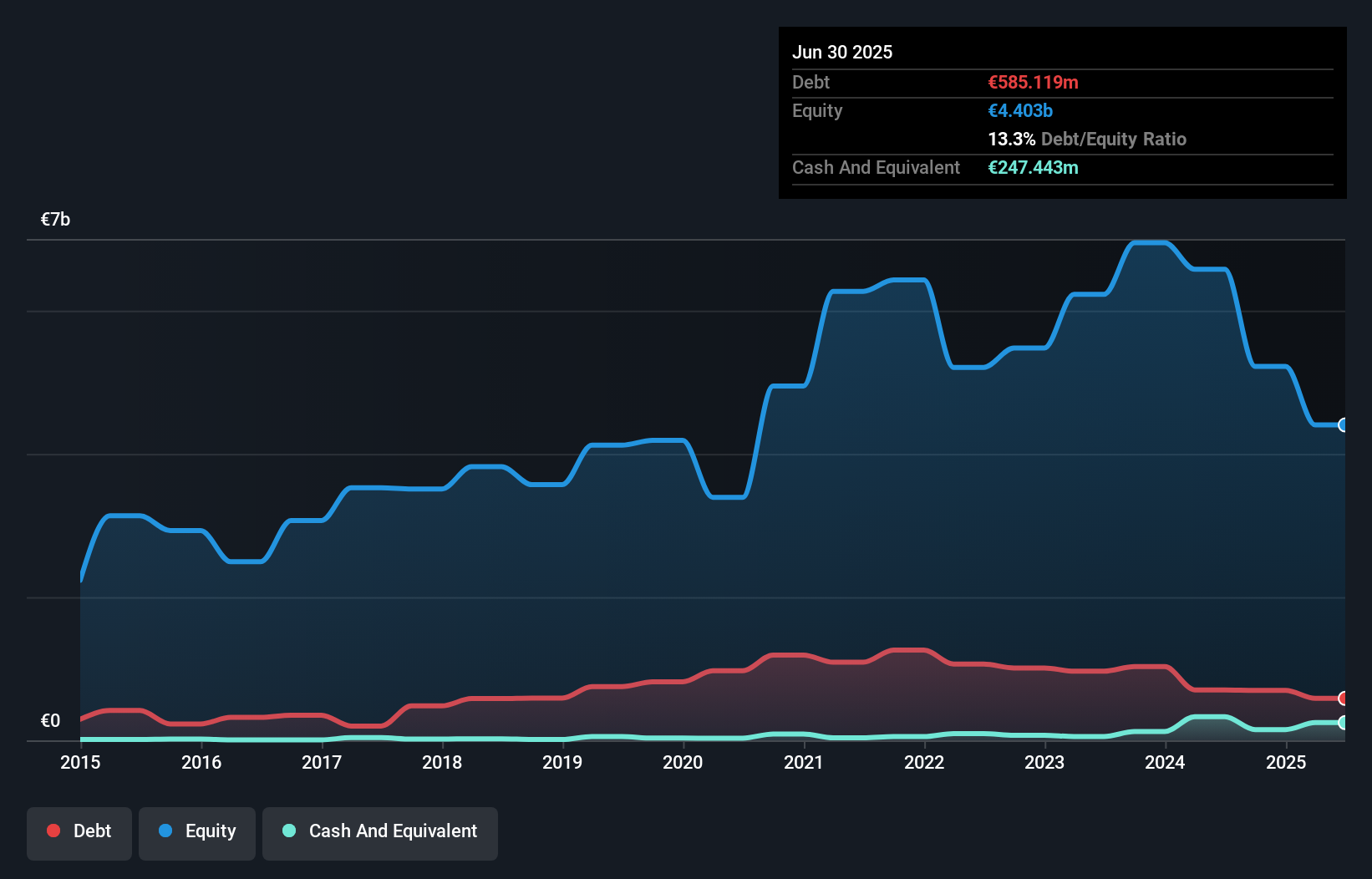

Peugeot Invest, a nimble player in the European market, stands out with its debt-free status, contrasting its previous 19.5% debt to equity ratio five years ago. Trading at 53.8% below estimated fair value suggests potential undervaluation compared to peers. The company reported net income of €146 million for 2024, up from €137 million the previous year, despite a dip in revenue to €250 million from €271 million. With earnings growth of 7.1%, surpassing the Diversified Financial industry's -1.9%, it seems poised for further expansion with forecasts indicating annual growth of over 17%.

Mayr-Melnhof Karton (WBAG:MMK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mayr-Melnhof Karton AG is a company that produces and distributes cartonboard and folding cartons across Germany, Austria, and globally, with a market capitalization of €1.46 billion.

Operations: Mayr-Melnhof Karton generates revenue primarily from three segments: MM Board & Paper (€1.95 billion), MM Food & Premium Packaging (€1.70 billion), and MM Pharma & Healthcare Packaging (€615.69 million).

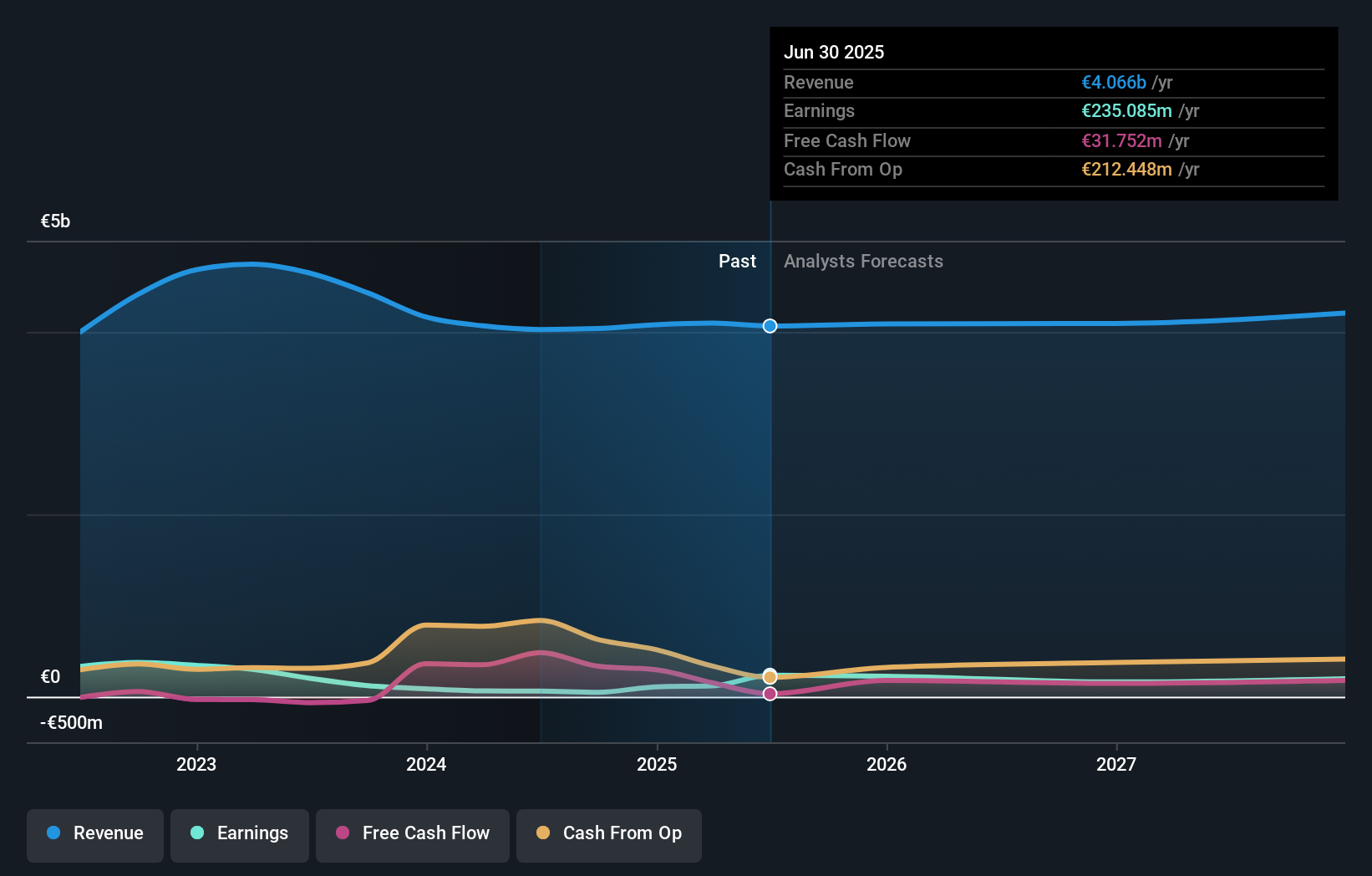

Mayr-Melnhof Karton, a small cap player in the packaging industry, has shown robust earnings growth of 24.1% over the past year, outpacing the industry's -20.8%. The company trades at a good value, 40.8% below its estimated fair value, despite having a net debt to equity ratio of 47.3%, considered high by industry standards. Recent strategic initiatives include investing €300 million to enhance its Pharma and Healthcare Packaging division's efficiency and profitability. While earnings are forecasted to grow annually by 26.65%, potential risks such as weak pricing power in recycled markets could affect future performance.

Seize The Opportunity

- Get an in-depth perspective on all 350 European Undiscovered Gems With Strong Fundamentals by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:PEUG

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives