- Sweden

- /

- Real Estate

- /

- OM:EAST

Exploring 3 Undervalued Small Caps In The European Market With Insider Activity

Reviewed by Simply Wall St

As the European market navigates through a mixed performance with France's CAC 40 Index rallying and Germany's DAX experiencing declines, investors are closely watching economic indicators such as industrial production and labor market trends. In this context, identifying small-cap stocks that may be undervalued can be appealing, especially when insider activity suggests potential confidence in these companies' future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 11.9x | 1.5x | 31.52% | ★★★★★★ |

| Bytes Technology Group | 16.7x | 4.1x | 20.58% | ★★★★★☆ |

| Boozt | 18.2x | 0.8x | 48.18% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 30.31% | ★★★★★☆ |

| BEWI | NA | 0.5x | 40.19% | ★★★★★☆ |

| Senior | 24.9x | 0.8x | 26.26% | ★★★★☆☆ |

| Eastnine | 15.8x | 8.3x | 35.42% | ★★★★☆☆ |

| Nyab | 21.2x | 0.9x | 38.28% | ★★★☆☆☆ |

| Renold | 10.8x | 0.7x | -0.17% | ★★★☆☆☆ |

| Social Housing REIT | NA | 7.0x | 34.64% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Fugro (ENXTAM:FUR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fugro is a company specializing in providing geotechnical, survey, subsea, and geoscience services globally with operations across the Americas, Asia Pacific, Europe-Africa, and Middle East & India regions.

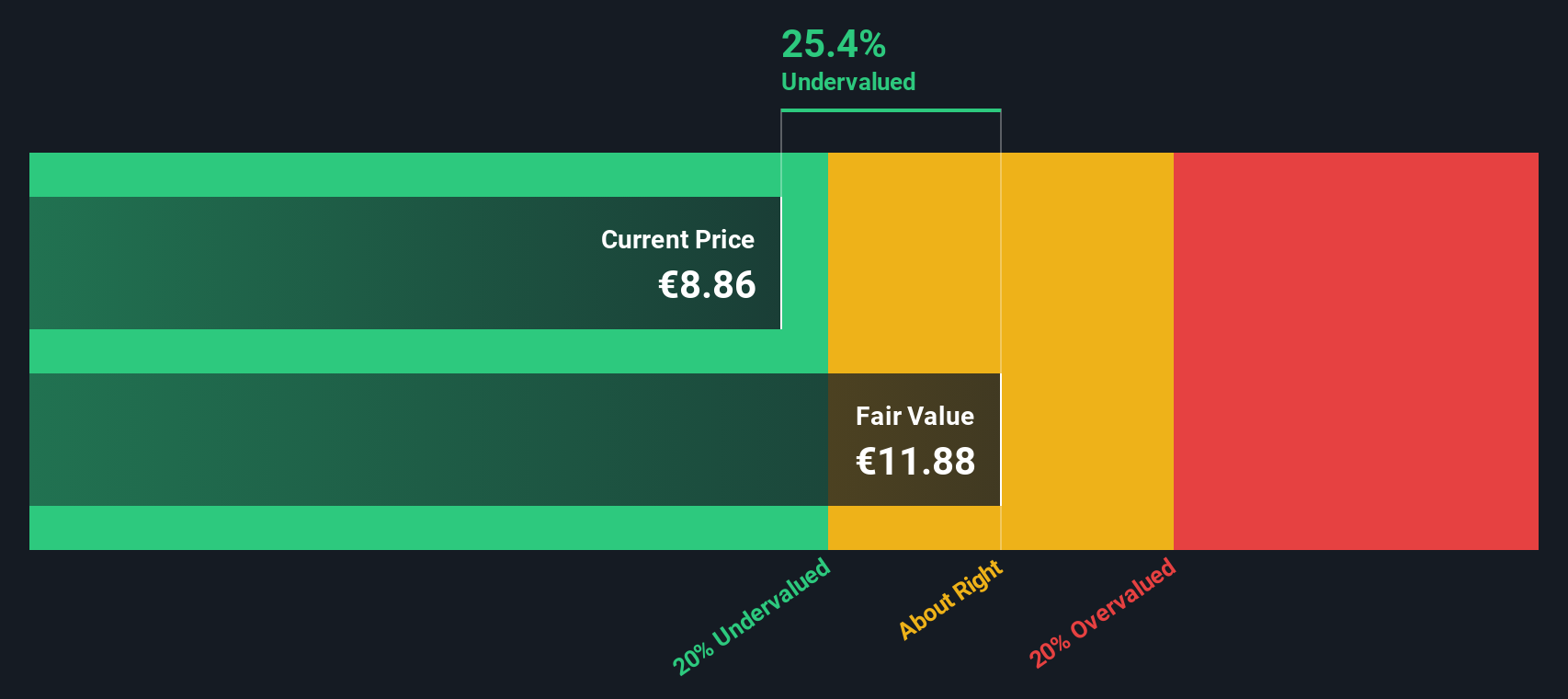

Operations: The company's revenue streams are geographically diversified, with significant contributions from Europe-Africa (€1.02 billion) and the Americas (€472.12 million). Over recent periods, the gross profit margin has shown an upward trend, reaching 37.21% by mid-2025. Operating expenses include notable allocations for general and administrative purposes and depreciation & amortization costs.

PE: 7.6x

Fugro, a smaller European company, is experiencing some turbulence. Recent earnings showed sales of €904.7 million for the first half of 2025, down from €1.09 billion last year, with a net loss of €18.3 million compared to a previous profit of €112.5 million. Despite withdrawing its financial guidance for 2025 due to market shifts and not meeting EBIT margin targets below 8%, insider confidence remains strong with recent share purchases in August and September 2025 indicating potential value recognition within the company’s future growth prospects amidst challenging conditions.

Harworth Group (LSE:HWG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Harworth Group is a UK-based company focused on the regeneration of brownfield land and property development, with a market cap of approximately £0.43 billion.

Operations: Harworth Group generates revenue primarily from the sale of development properties (£127.10 million) and other property activities (£35.84 million). The company's gross profit margin has shown variability, with a notable increase to 54.39% in recent periods, reflecting changes in cost management or pricing strategies. Operating expenses have consistently risen over time, impacting overall profitability.

PE: 10.4x

Harworth Group, a prominent player in the European real estate sector, showcases potential as an undervalued investment. Despite a dip in net income to £9.69 million for H1 2025 from £14.78 million the previous year, earnings are projected to grow annually by 27%. Recent inclusion in the S&P Global BMI Index and a dividend increase reflect positive momentum. Insider confidence is evident with recent purchases, suggesting faith in future growth prospects amidst strategic executive changes and expanded leadership roles.

- Navigate through the intricacies of Harworth Group with our comprehensive valuation report here.

Evaluate Harworth Group's historical performance by accessing our past performance report.

Eastnine (OM:EAST)

Simply Wall St Value Rating: ★★★★☆☆

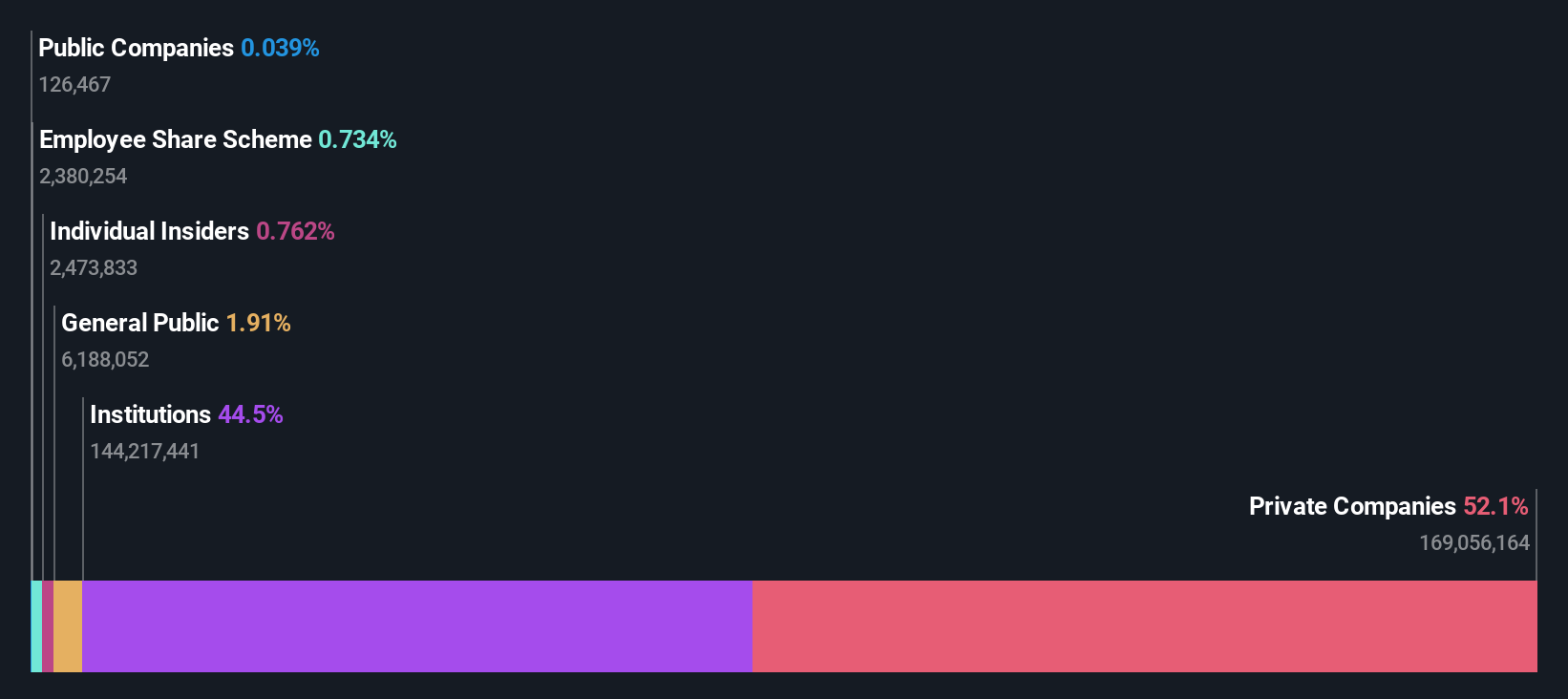

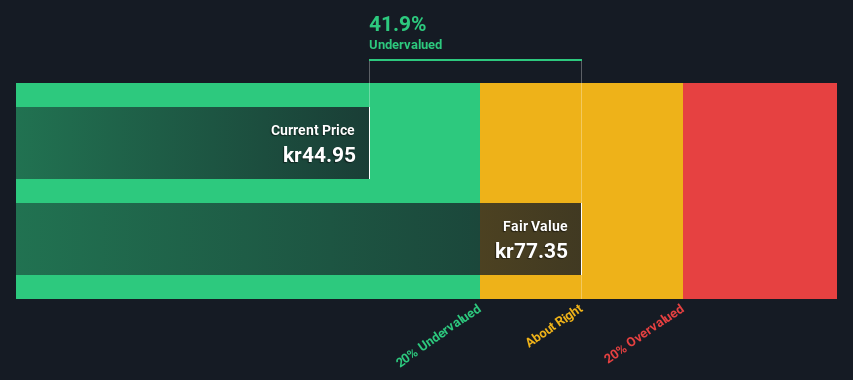

Overview: Eastnine is a real estate company focused on commercial properties in the Baltic region, with a market cap of approximately €0.18 billion.

Operations: Eastnine's revenue streams have shown fluctuations, with recent figures reaching €53.88 million by June 2025. The company has consistently reported a high gross profit margin of around 93% in the same period, indicating effective cost management relative to revenue generation. Operating expenses have remained steady, with general and administrative expenses accounting for a significant portion, such as €4.31 million in June 2025. Net income margins have varied widely over time, reflecting changes in non-operating expenses and other financial factors affecting profitability.

PE: 15.8x

Eastnine, a European small-cap, recently reported strong financial results for Q3 2025 with sales of €15.53 million and net income soaring to €9.65 million from €0.801 million the previous year. Basic earnings per share also jumped to €0.1 from €0.01 last year, reflecting significant growth despite primarily relying on external borrowing for funding which poses higher risk compared to customer deposits. Insider confidence is evident as executives purchased shares over the past few months, indicating belief in the company's potential amidst challenges like forecasted earnings decline and uncovered interest payments by current earnings levels.

- Dive into the specifics of Eastnine here with our thorough valuation report.

Examine Eastnine's past performance report to understand how it has performed in the past.

Seize The Opportunity

- Click here to access our complete index of 54 Undervalued European Small Caps With Insider Buying.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastnine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EAST

Established dividend payer and good value.

Market Insights

Community Narratives