- Canada

- /

- Commercial Services

- /

- TSX:GDI

3 Undervalued Small Caps With Insider Action In Global

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have shown a notable rally, with the Russell 2000 Index gaining 2.16% following the Federal Reserve's decision to cut short-term interest rates for the first time this year. This rate cut, along with ongoing trade developments between major economies like the U.S. and China, has created an environment where smaller companies may benefit from increased investor interest due to their sensitivity to economic shifts and potential for growth. In such conditions, identifying promising small-cap stocks often involves looking at those with strong fundamentals and insider activity that suggests confidence in their future performance.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 17.2x | 4.3x | 12.32% | ★★★★☆☆ |

| East West Banking | 3.2x | 0.8x | 16.03% | ★★★★☆☆ |

| GDI Integrated Facility Services | 18.9x | 0.3x | 1.90% | ★★★★☆☆ |

| Cettire | NA | 0.3x | 29.21% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.34% | ★★★★☆☆ |

| Sagicor Financial | 7.3x | 0.4x | -75.65% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 13.4x | 7.0x | 10.35% | ★★★★☆☆ |

| Pizu Group Holdings | 13.7x | 1.3x | 34.69% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 19.25% | ★★★☆☆☆ |

| CVS Group | 45.9x | 1.3x | 36.95% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

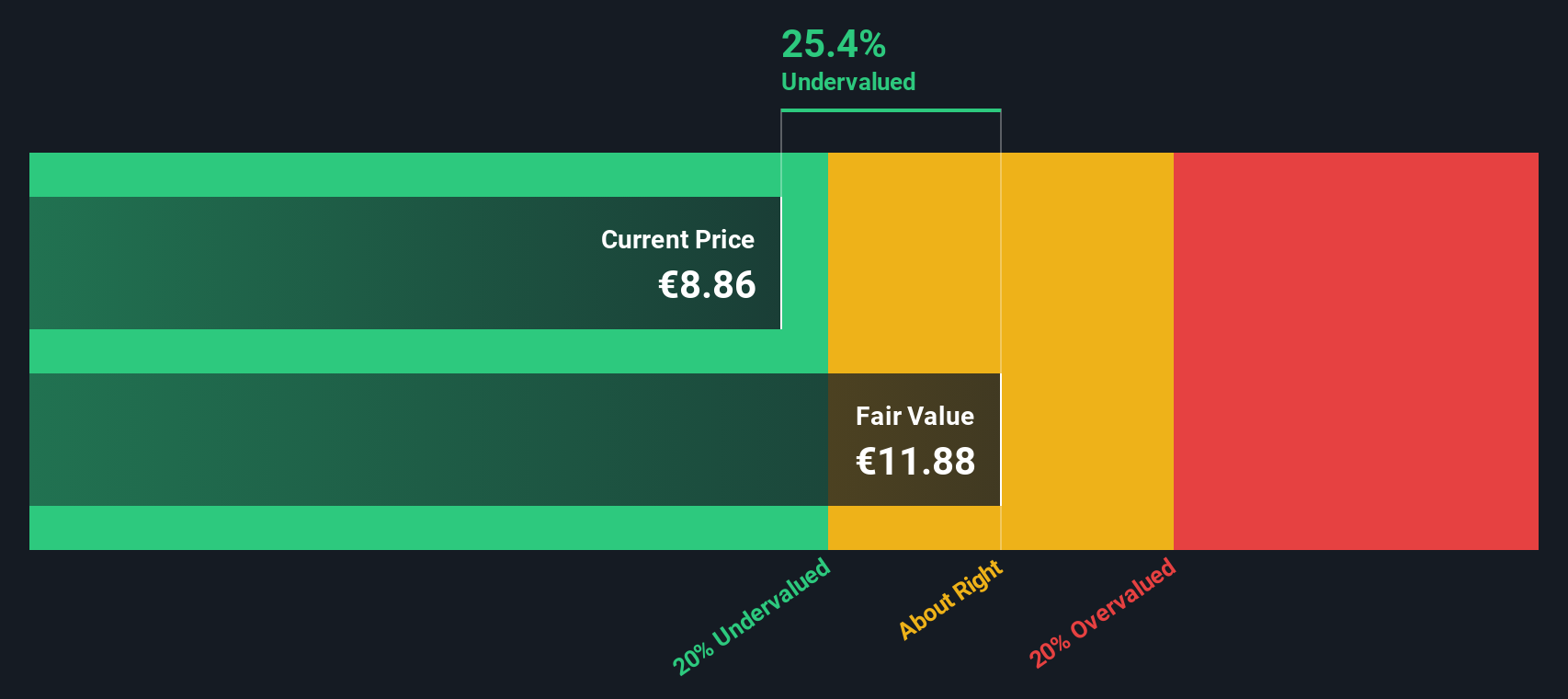

Fugro (ENXTAM:FUR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fugro is a company specializing in providing geotechnical, survey, subsea, and geoscience services for various industries worldwide; it operates across multiple regions including the Americas, Asia Pacific, Europe-Africa, and the Middle East & India with a market capitalization of €1.29 billion.

Operations: The company's revenue streams are primarily derived from its operations across the Americas, Asia Pacific, Europe-Africa, and the Middle East & India regions. Over recent periods, it has experienced fluctuations in its gross profit margin, which reached 37.21% by December 2024. Operating expenses have been a significant component of costs, with general and administrative expenses consistently contributing to this category.

PE: 7.8x

Fugro, a smaller company in the industry, has faced challenges with its financial guidance for 2025 due to changing market conditions. Sales dropped to €904.7 million for H1 2025 from €1.09 billion last year, resulting in a net loss of €18.3 million compared to a previous net income of €112.5 million. Despite these hurdles, insider confidence is evident as an insider purchased 17,400 shares worth approximately €199,230 recently. Earnings are expected to grow at 11.82% annually moving forward, although profit margins have decreased from last year's levels of 13.1% to 6.3%.

- Click here and access our complete valuation analysis report to understand the dynamics of Fugro.

Explore historical data to track Fugro's performance over time in our Past section.

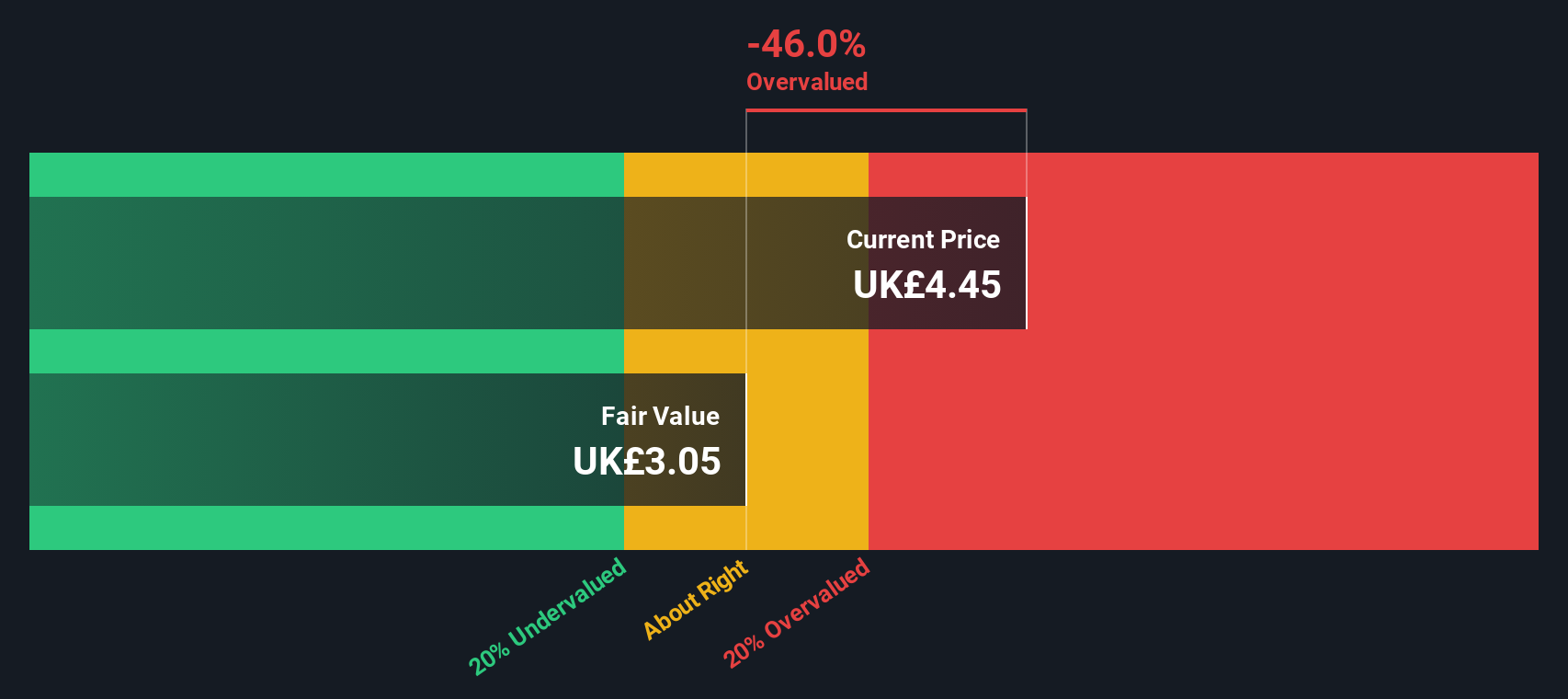

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Pinewood Technologies Group specializes in providing software solutions for the automotive retail sector and has a market capitalization of £2.45 billion.

Operations: Pinewood Technologies Group generates revenue primarily through its sales, with a significant portion of costs attributed to the cost of goods sold (COGS). The company's net income margin has shown variability, reflecting fluctuations in profitability over time. Notably, there was a period where gross profit margin reached as high as 89.98% and 90.38%, indicating periods of strong operational efficiency relative to revenue. Operating expenses include general and administrative costs which have varied across different reporting periods.

PE: 72.8x

Pinewood Technologies Group, recently added to the FTSE 250 and 350 indices, has shown a mixed financial performance. For the half-year ending June 2025, sales increased to £19.6 million from £16.1 million last year, yet net loss stood at £0.7 million against a previous net income of £5 million. Insider confidence is evident with recent share purchases by executives this year, suggesting belief in future growth prospects despite current challenges like high-risk funding sources and one-off earnings impacts.

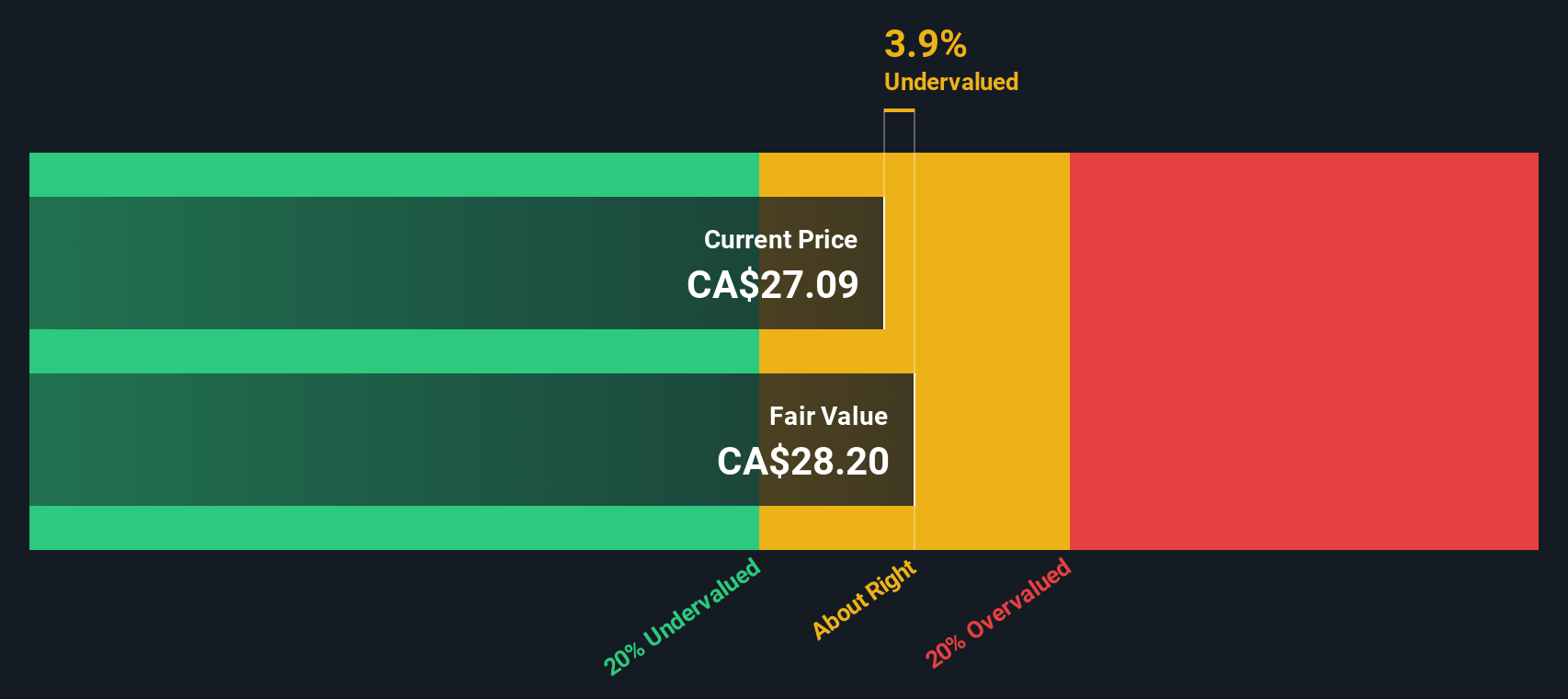

GDI Integrated Facility Services (TSX:GDI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: GDI Integrated Facility Services operates as a provider of facility management services, including technical services and business services across the USA and Canada, with a market cap of CA$1.28 billion.

Operations: GDI Integrated Facility Services generates revenue primarily from Technical Services, Business Services USA, and Business Services Canada. The company has seen fluctuations in its gross profit margin, with recent figures showing a decrease to 17.80% by September 2024 before rising slightly to 18.40% by June 2025. Operating expenses are significant with General & Administrative Expenses consistently forming a large portion of these costs.

PE: 18.9x

GDI Integrated Facility Services, a smaller player in the facility management industry, has seen its earnings forecasted to grow by 11.77% annually. Despite this positive outlook, recent financial results showed a net loss of C$1 million for Q2 2025 compared to a net income of C$2 million the previous year. Interest payments remain poorly covered by earnings due to reliance on external borrowing. Insider confidence is evident as Craig Stanford increased their shareholdings by 154%, investing over C$101K in shares recently.

Key Takeaways

- Dive into all 110 of the Undervalued Global Small Caps With Insider Buying we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GDI

GDI Integrated Facility Services

Operates in the outsourced facility services industry in Canada and the United States.

Fair value with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success