- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

Envipco Holding (AMS:ENVI) rallies 11% this week, taking five-year gains to 809%

We think all investors should try to buy and hold high quality multi-year winners. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the Envipco Holding N.V. (AMS:ENVI) share price. It's 809% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. It's also good to see the share price up 23% over the last quarter. It really delights us to see such great share price performance for investors.

Since it's been a strong week for Envipco Holding shareholders, let's have a look at trend of the longer term fundamentals.

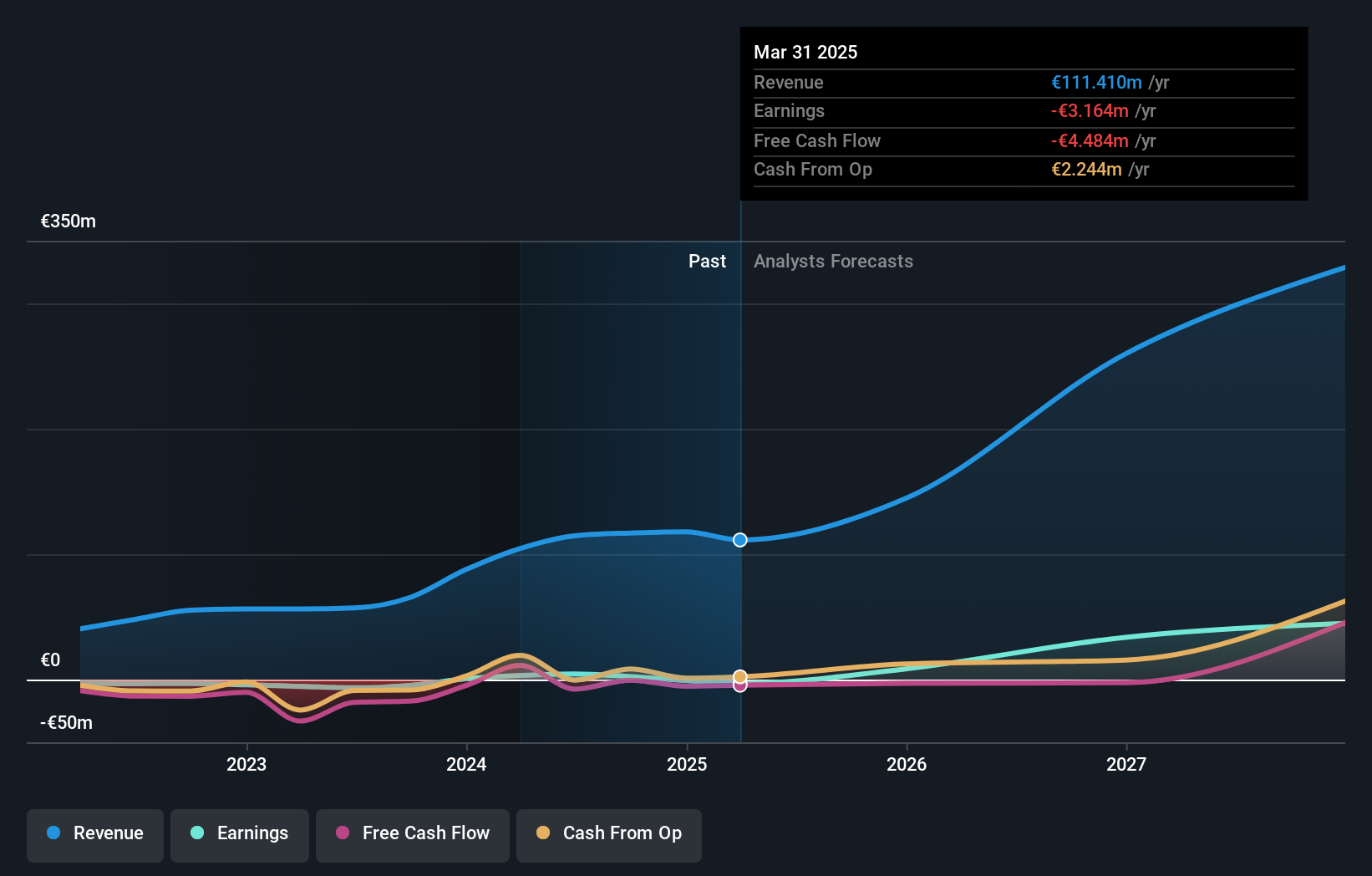

Because Envipco Holding made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Envipco Holding can boast revenue growth at a rate of 31% per year. Even measured against other revenue-focussed companies, that's a good result. Arguably, this is well and truly reflected in the strong share price gain of 55%(per year) over the same period. Despite the strong run, top performers like Envipco Holding have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Envipco Holding shareholders have received a total shareholder return of 13% over the last year. Having said that, the five-year TSR of 55% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Envipco Holding that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Envipco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines (RVM) to collect and process used beverage containers primarily in the Netherlands, North America, and rest of Europe.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives