- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASML

Discover 3 Euronext Amsterdam Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As European markets navigate through a period of mixed signals and economic uncertainties, the Euronext Amsterdam has managed to show resilience amidst broader volatility. In this environment, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential growth opportunities. A good stock in such conditions typically exhibits strong fundamentals, a solid business model, and is trading below its intrinsic value due to temporary market inefficiencies.

Top 5 Undervalued Stocks Based On Cash Flows In The Netherlands

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Majorel Group Luxembourg (ENXTAM:MAJ) | €29.45 | €55.97 | 47.4% |

| Alfen (ENXTAM:ALFEN) | €14.79 | €27.53 | 46.3% |

| Ctac (ENXTAM:CTAC) | €3.10 | €4.25 | 27% |

| ASML Holding (ENXTAM:ASML) | €784.60 | €878.31 | 10.7% |

| Envipco Holding (ENXTAM:ENVI) | €5.80 | €7.68 | 24.4% |

| Ordina (ENXTAM:ORDI) | €5.70 | €10.64 | 46.4% |

Here's a peek at a few of the choices from the screener.

Alfen (ENXTAM:ALFEN)

Overview: Alfen N.V., with a market cap of €321.23 million, operates through its subsidiaries to design, engineer, develop, produce, and service smart grids, energy storage systems, and electric vehicle charging equipment.

Operations: Revenue Segments (in millions of €): Smart Grid Solutions: 188.38, EV Charging Equipment: 153.12, Energy Storage Systems: 162.98

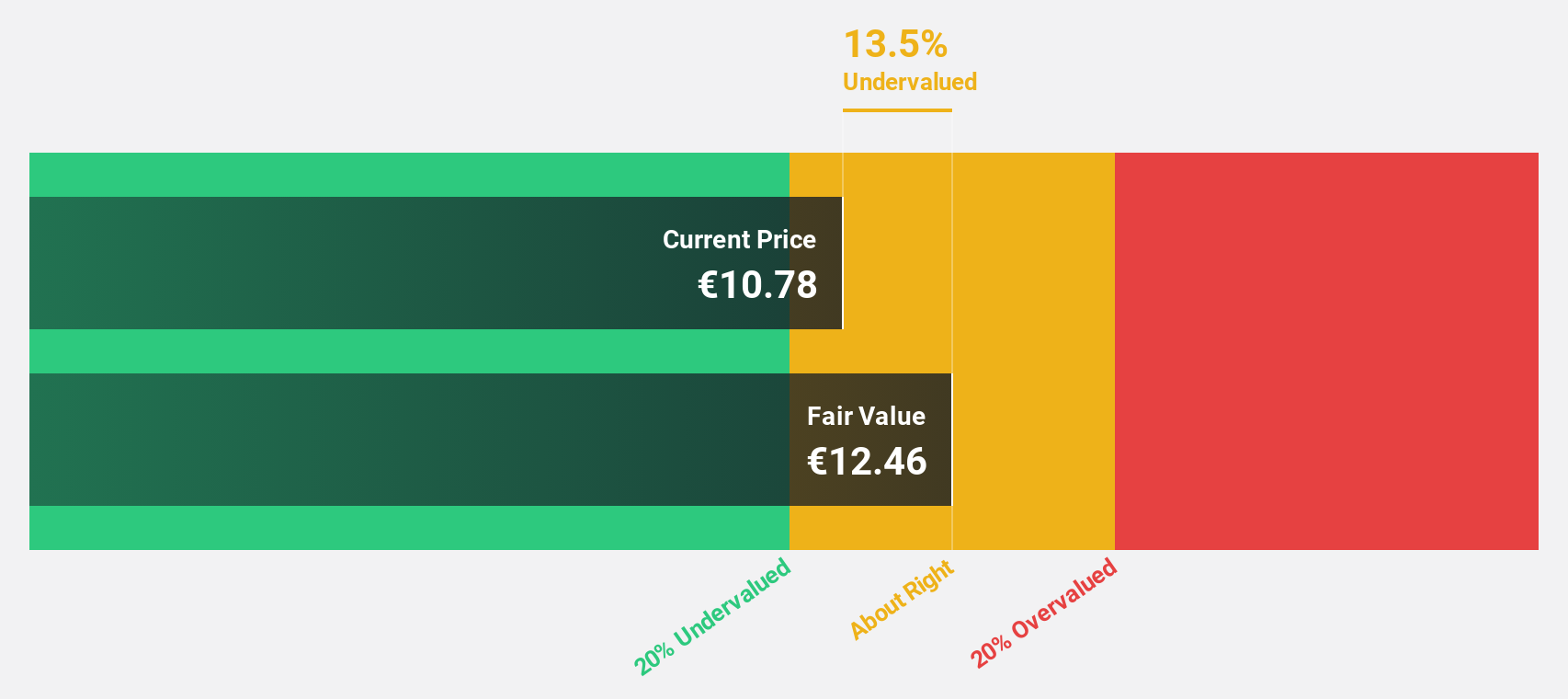

Estimated Discount To Fair Value: 46.3%

Alfen N.V. is trading at €14.79, significantly below its estimated fair value of €27.53, making it highly undervalued based on discounted cash flow analysis. Despite recent revenue guidance reductions to €485 million to €500 million for 2024, Alfen's earnings are expected to grow over 20% annually in the next three years, outpacing the Dutch market's growth rate. However, profit margins have declined from 12.1% last year to 5.9%, and share price volatility remains high.

- Upon reviewing our latest growth report, Alfen's projected financial performance appears quite optimistic.

- Dive into the specifics of Alfen here with our thorough financial health report.

ASML Holding (ENXTAM:ASML)

Overview: ASML Holding N.V. develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers and has a market cap of €308.50 billion.

Operations: ASML generates €25.44 billion in revenue from its Semiconductor Equipment and Services segment.

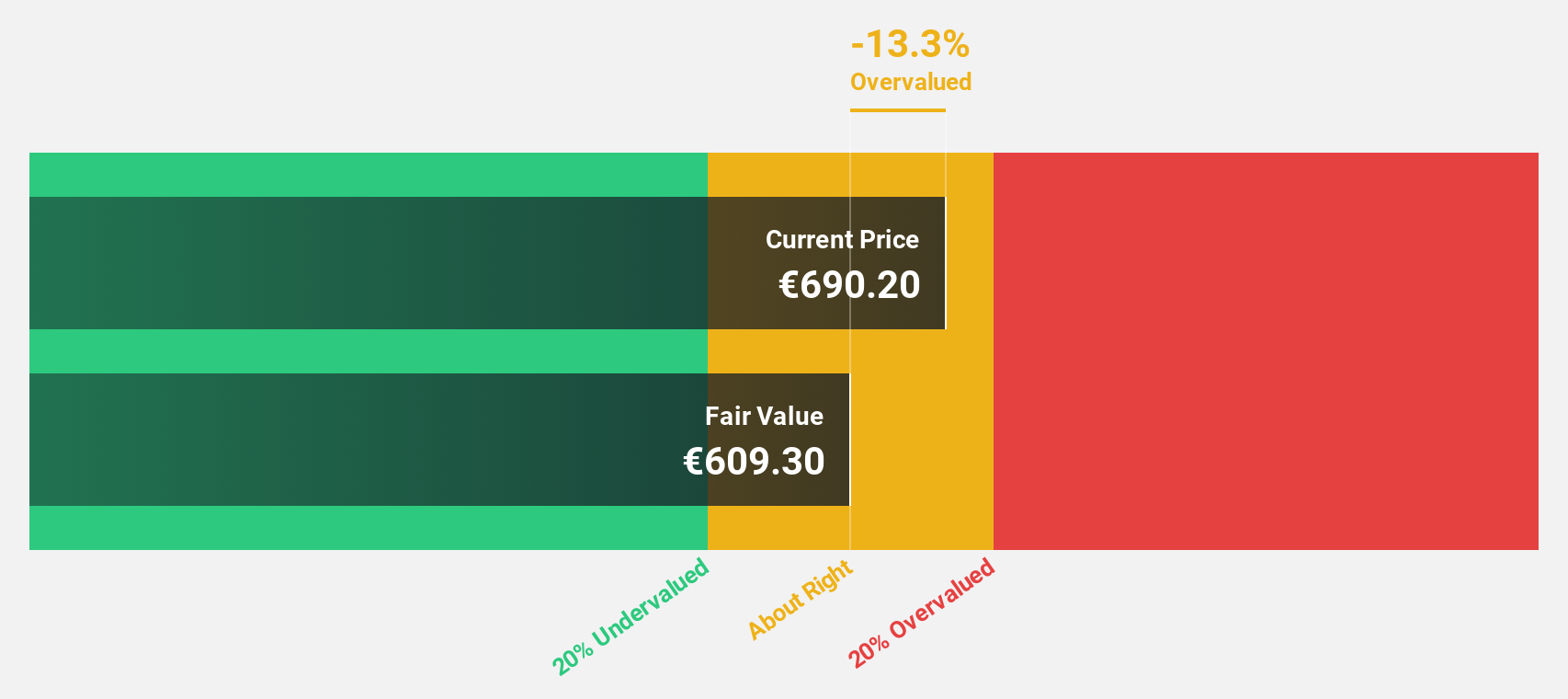

Estimated Discount To Fair Value: 10.7%

ASML Holding is trading at €784.6, below its estimated fair value of €878.31, suggesting it is undervalued based on cash flows. Despite a recent dip in quarterly revenue to €6.24 billion and net income to €1.58 billion, the company expects higher earnings in the second half of 2024 and maintains strong future growth prospects with annual profit growth forecasted at 23.2%. The stock has shown high volatility recently but remains a solid performer based on discounted cash flow analysis.

- Our earnings growth report unveils the potential for significant increases in ASML Holding's future results.

- Navigate through the intricacies of ASML Holding with our comprehensive financial health report here.

Envipco Holding (ENXTAM:ENVI)

Overview: Envipco Holding N.V. designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines for collecting and processing used beverage containers primarily in the Netherlands, North America, and Europe with a market cap of €334.60 million.

Operations: Envipco Holding N.V. generates revenue primarily through the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines for used beverage containers in the Netherlands, North America, and Europe.

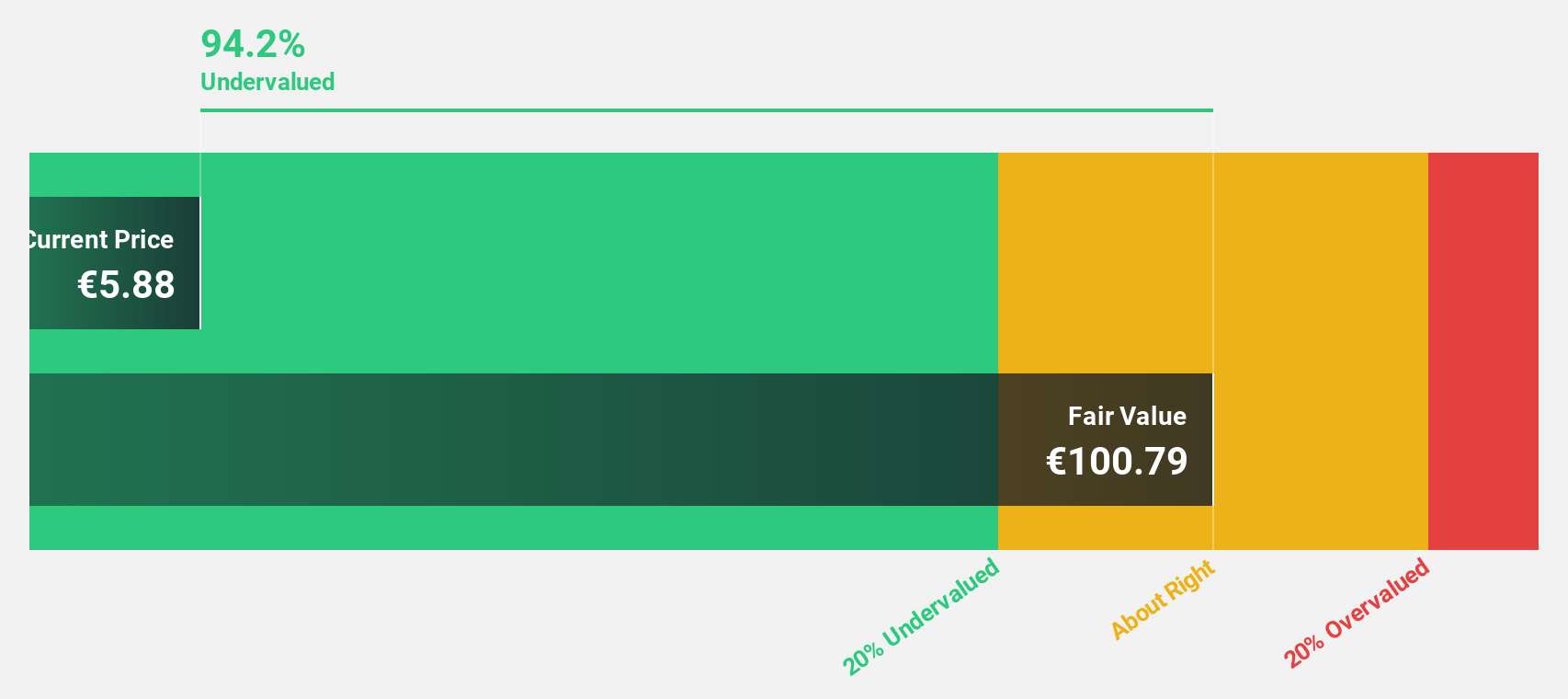

Estimated Discount To Fair Value: 24.4%

Envipco Holding, trading at €5.8, is undervalued based on a discounted cash flow analysis with a fair value estimate of €7.68. The company recently became profitable and reported Q1 2024 sales of €27.44 million, up from €10.41 million the previous year, with net income of €0.147 million compared to a net loss of €2.57 million last year. Forecasts indicate strong revenue growth at 33.3% per year and earnings growth at 68.9% per year, despite recent share price volatility and past shareholder dilution.

- The analysis detailed in our Envipco Holding growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Envipco Holding.

Taking Advantage

- Click here to access our complete index of 6 Undervalued Euronext Amsterdam Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ASML

ASML Holding

Develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers.

High growth potential with excellent balance sheet.