- Netherlands

- /

- Construction

- /

- ENXTAM:BAMNB

Why Investors Shouldn't Be Surprised By Koninklijke BAM Groep nv's (AMS:BAMNB) 27% Share Price Surge

Koninklijke BAM Groep nv (AMS:BAMNB) shareholders have had their patience rewarded with a 27% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 56%.

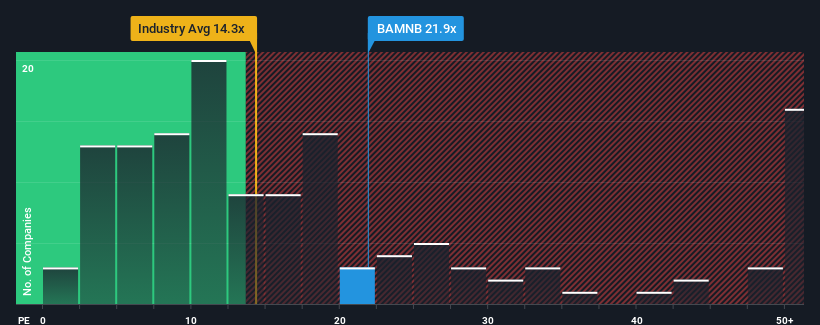

After such a large jump in price, Koninklijke BAM Groep may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 21.9x, since almost half of all companies in the Netherlands have P/E ratios under 18x and even P/E's lower than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Koninklijke BAM Groep hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Koninklijke BAM Groep

Is There Enough Growth For Koninklijke BAM Groep?

In order to justify its P/E ratio, Koninklijke BAM Groep would need to produce impressive growth in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 64%. Still, the latest three year period has seen an excellent 256% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 51% each year during the coming three years according to the dual analysts following the company. With the market only predicted to deliver 16% per annum, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Koninklijke BAM Groep's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Koninklijke BAM Groep's P/E

Koninklijke BAM Groep's P/E is getting right up there since its shares have risen strongly. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Koninklijke BAM Groep maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Koninklijke BAM Groep.

If you're unsure about the strength of Koninklijke BAM Groep's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke BAM Groep might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:BAMNB

Koninklijke BAM Groep

Provides products and services in the construction and property, civil engineering, and public private partnerships (PPP) sectors worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives