Stock Analysis

- Netherlands

- /

- Electrical

- /

- ENXTAM:ALFEN

If You Had Bought Alfen (AMS:ALFEN) Shares A Year Ago You'd Have Earned 161% Returns

Alfen N.V. (AMS:ALFEN) shareholders might be concerned after seeing the share price drop 22% in the last month. Despite this, the stock is a strong performer over the last year, no doubt about that. Indeed, the share price is up an impressive 161% in that time. So we think most shareholders won't be too upset about the recent fall. Only time will tell if there is still too much optimism currently reflected in the share price.

View our latest analysis for Alfen

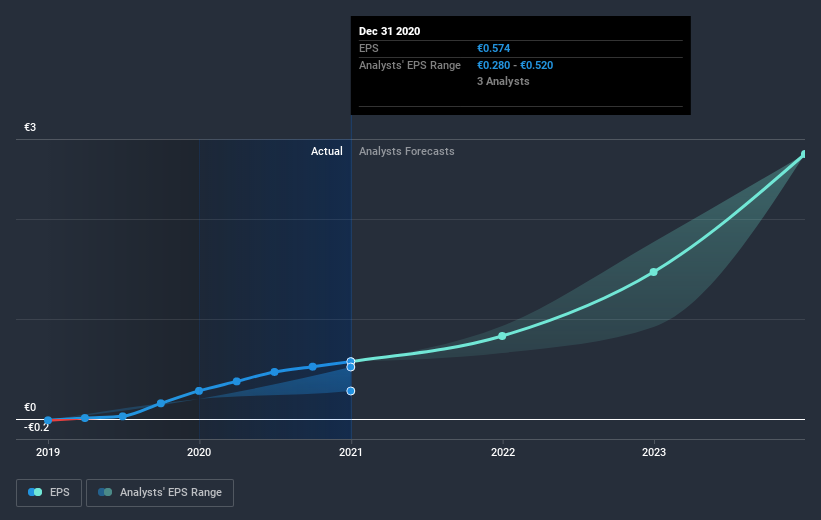

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Alfen grew its earnings per share (EPS) by 103%. The share price gain of 161% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock. The fairly generous P/E ratio of 117.99 also points to this optimism.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Alfen's earnings, revenue and cash flow.

A Different Perspective

Alfen shareholders should be happy with the total gain of 161% over the last twelve months. We regret to report that the share price is down 0.3% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Alfen that you should be aware of before investing here.

But note: Alfen may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NL exchanges.

When trading Alfen or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Alfen is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTAM:ALFEN

Alfen

Through its subsidiaries, engages in the design, engineering, development, production, and service of smart grids, energy storage systems, and electric vehicle charging equipment.

High growth potential with excellent balance sheet.