- Netherlands

- /

- Construction

- /

- ENXTAM:HEIJM

Top Dividend Stocks On Euronext Amsterdam For August 2024

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties and fluctuating indices, the Netherlands' stock market has shown resilience amidst broader European declines. With investors seeking stability in a volatile environment, dividend stocks on Euronext Amsterdam offer an attractive option for steady income. In this context, identifying strong dividend stocks becomes crucial; these are typically characterized by consistent earnings, robust cash flows, and a history of reliable payouts.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.60% | ★★★★☆☆ |

| Aalberts (ENXTAM:AALB) | 3.38% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 7.47% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.48% | ★★★★☆☆ |

| ING Groep (ENXTAM:INGA) | 7.48% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.87% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Aalberts (ENXTAM:AALB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aalberts N.V. provides mission-critical technologies for aerospace, automotive, building, and maritime sectors with a market cap of €3.70 billion.

Operations: Aalberts N.V. generates revenue through two main segments: Building Technology (€1.74 billion) and Industrial Technology (€1.49 billion).

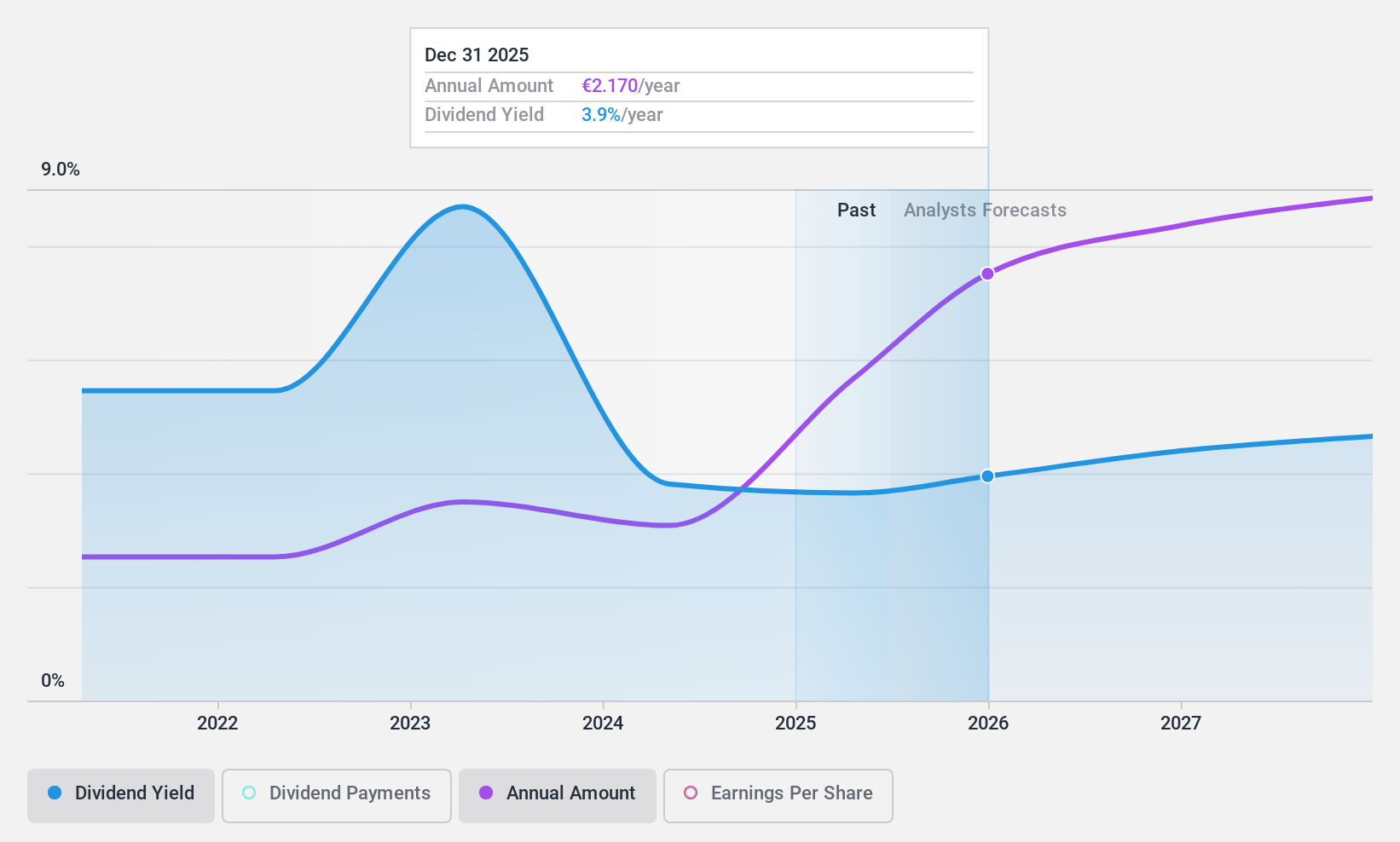

Dividend Yield: 3.4%

Aalberts N.V.'s recent earnings report showed a slight decline in sales and net income, with EUR 1.62 billion in sales and EUR 149.2 million in net income for H1 2024. Despite this, the company inaugurated a new production site to enhance efficiency and sustainability efforts. Dividend payments have been volatile over the past decade but are currently well-covered by earnings (41% payout ratio) and cash flows (60.4% cash payout ratio). The dividend yield stands at 3.38%, lower than the top quartile of Dutch dividend payers.

- Click here to discover the nuances of Aalberts with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Aalberts is priced lower than what may be justified by its financials.

Acomo (ENXTAM:ACOMO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acomo N.V., with a market cap of €495.80 million, operates in sourcing, trading, processing, packaging, and distributing conventional and organic food ingredients and solutions for the food and beverage industry across the Netherlands, Europe, North America, and internationally.

Operations: Acomo N.V.'s revenue segments include Tea (€124.04 million), Edible Seeds (€246.52 million), Food Solutions (€23.47 million), Spices and Nuts (€445.76 million), and Organic Ingredients (€429.28 million).

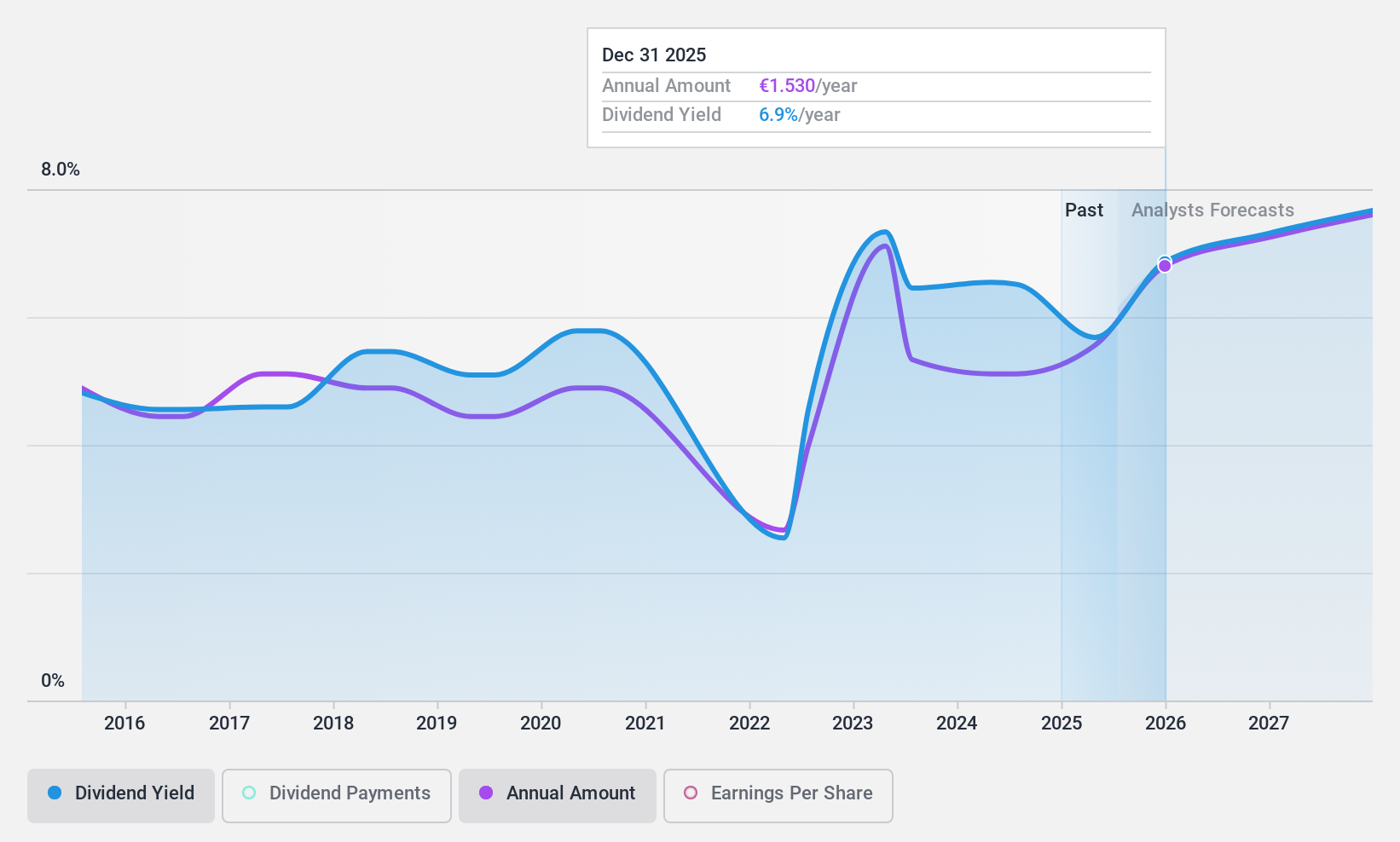

Dividend Yield: 6.9%

Acomo's recent earnings report revealed stable sales at €668.2 million but a decline in net income to €17.94 million for H1 2024. The company's dividend yield of 6.87% is among the top 25% in the Dutch market, though its high payout ratio (95.7%) and volatile dividend history raise concerns about sustainability. Despite this, dividends are covered by cash flows with a reasonable cash payout ratio of 51%.

- Get an in-depth perspective on Acomo's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Acomo is trading beyond its estimated value.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors both in the Netherlands and internationally, with a market cap of €663.94 million.

Operations: Koninklijke Heijmans N.V. generates revenue from its Connecting segment (€871.03 million) and Segment Adjustment (€1.83 billion).

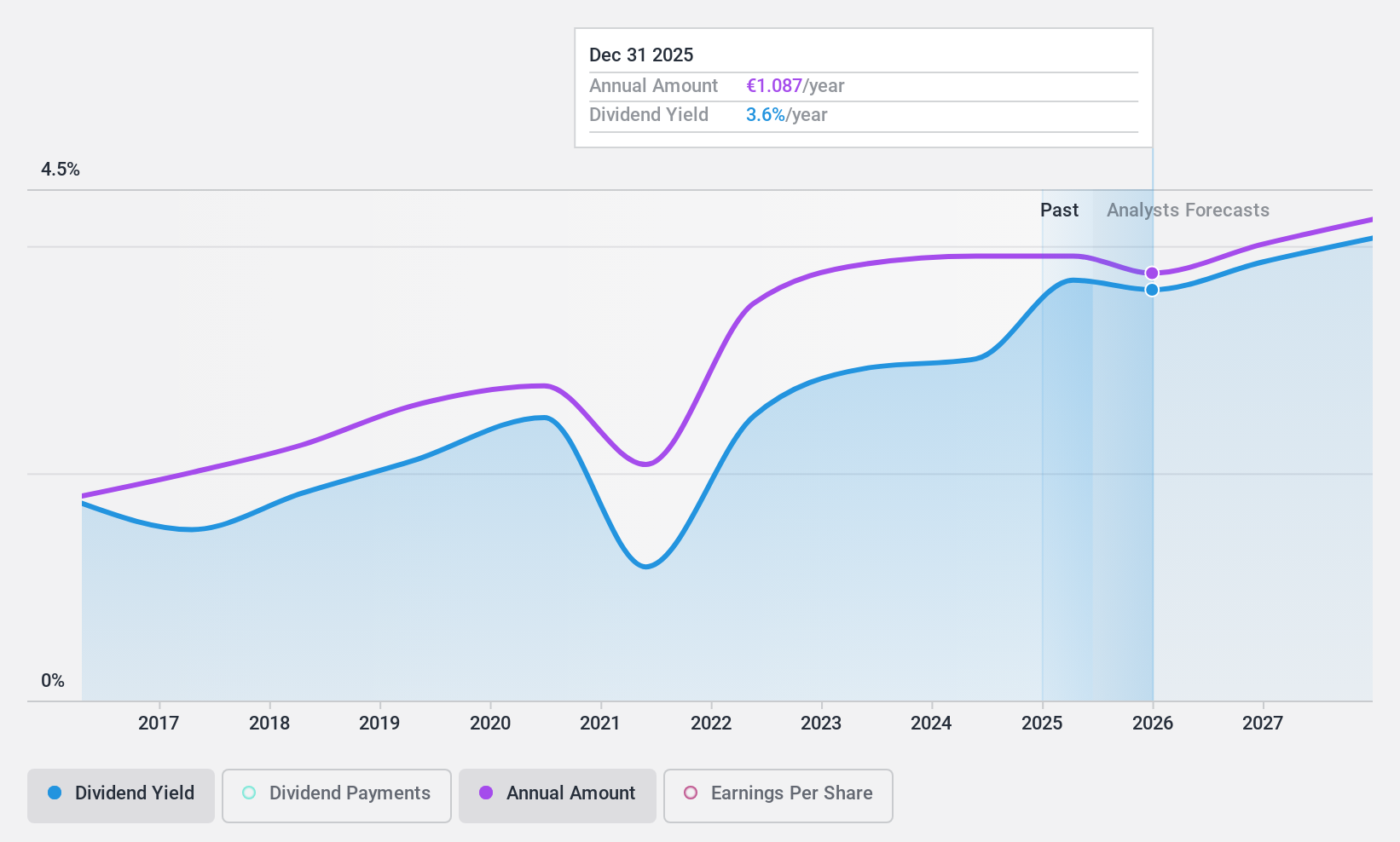

Dividend Yield: 3.6%

Koninklijke Heijmans N.V. reported strong earnings for H1 2024, with sales increasing to €1.22 billion and net income doubling to €37 million. Despite a low dividend yield of 3.6%, dividends are well-covered by both earnings (30% payout ratio) and cash flows (20.7% cash payout ratio). However, the company's dividend history has been volatile over the past decade, raising concerns about reliability despite recent growth in payments.

- Click here and access our complete dividend analysis report to understand the dynamics of Koninklijke Heijmans.

- Insights from our recent valuation report point to the potential undervaluation of Koninklijke Heijmans shares in the market.

Where To Now?

- Unlock more gems! Our Top Euronext Amsterdam Dividend Stocks screener has unearthed 3 more companies for you to explore.Click here to unveil our expertly curated list of 6 Top Euronext Amsterdam Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke Heijmans might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:HEIJM

Koninklijke Heijmans

Engages in the property development, construction, and infrastructure businesses in the Netherlands and internationally.

Flawless balance sheet with solid track record and pays a dividend.