- Netherlands

- /

- Machinery

- /

- ENXTAM:AALB

3 Top Dividend Stocks On Euronext Amsterdam

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index rebounds, driven by hopes of interest rate cuts amid slowing business activity, investors are increasingly attentive to dividend stocks on Euronext Amsterdam for their potential stability and income generation. In this environment, a good dividend stock is often characterized by a strong track record of consistent payouts and robust financial health, which can offer resilience against market fluctuations.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 3.42% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 5.21% | ★★★★☆☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.61% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 7.22% | ★★★★☆☆ |

| Aalberts (ENXTAM:AALB) | 3.14% | ★★★★☆☆ |

| ING Groep (ENXTAM:INGA) | 6.93% | ★★★★☆☆ |

| Acomo (ENXTAM:ACOMO) | 6.45% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Aalberts (ENXTAM:AALB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aalberts N.V. provides mission-critical technologies for the aerospace, automotive, building, and maritime sectors with a market cap of approximately €3.98 billion.

Operations: Aalberts N.V. generates revenue through its Building Technology segment with €1.74 billion and its Industrial Technology segment with €1.49 billion.

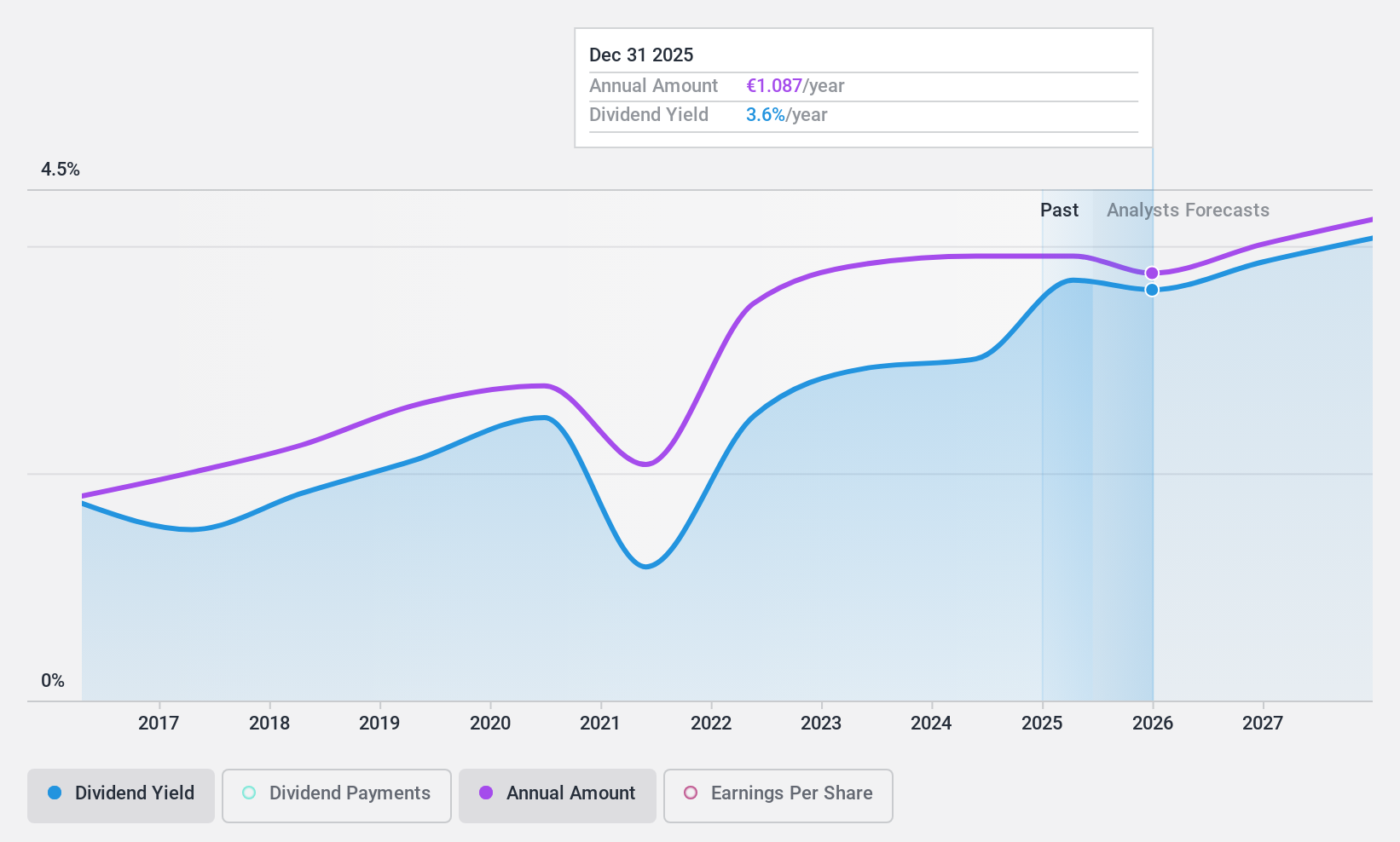

Dividend Yield: 3.1%

Aalberts offers a mixed dividend profile with both strengths and challenges. While its dividends are covered by earnings (41% payout ratio) and cash flows (60.4% cash payout ratio), they have been volatile over the past decade, showing unreliability due to inconsistent growth. Recent earnings showed a decline, with net income at €149.2 million for H1 2024 compared to €160 million the previous year, potentially impacting future dividend stability despite trading below estimated fair value.

- Take a closer look at Aalberts' potential here in our dividend report.

- The analysis detailed in our Aalberts valuation report hints at an deflated share price compared to its estimated value.

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors primarily in the Netherlands and internationally, with a market cap of €698.81 million.

Operations: Koninklijke Heijmans N.V.'s revenue segments include €871.03 million from Connecting and €1.83 billion from Segment Adjustment.

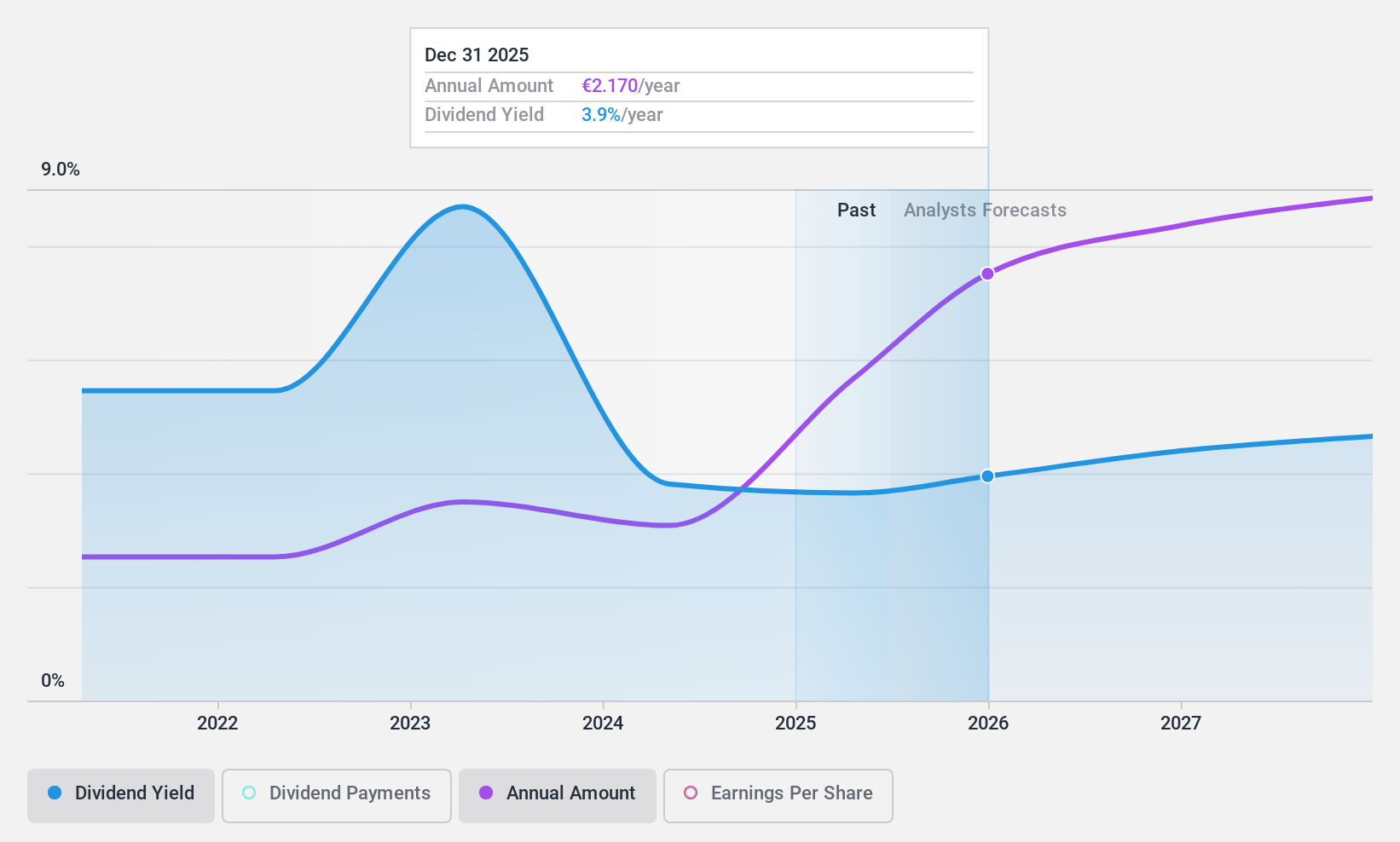

Dividend Yield: 3.4%

Koninklijke Heijmans shows a complex dividend profile. Despite a history of volatile and unreliable dividends, recent earnings growth is robust, with net income doubling to €37 million for H1 2024. Dividends are well-covered by both earnings (30% payout ratio) and cash flows (20.7% cash payout ratio), suggesting sustainability despite past instability. Trading significantly below fair value might appeal to value-focused investors, although the dividend yield remains modest compared to top-tier Dutch payers.

- Dive into the specifics of Koninklijke Heijmans here with our thorough dividend report.

- Our expertly prepared valuation report Koninklijke Heijmans implies its share price may be lower than expected.

Signify (ENXTAM:LIGHT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Signify N.V. is a company that offers lighting products, systems, and services across Europe, the Americas, and globally with a market cap of €2.71 billion.

Operations: Signify N.V.'s revenue segments include Conventional lighting, which generated €519 million.

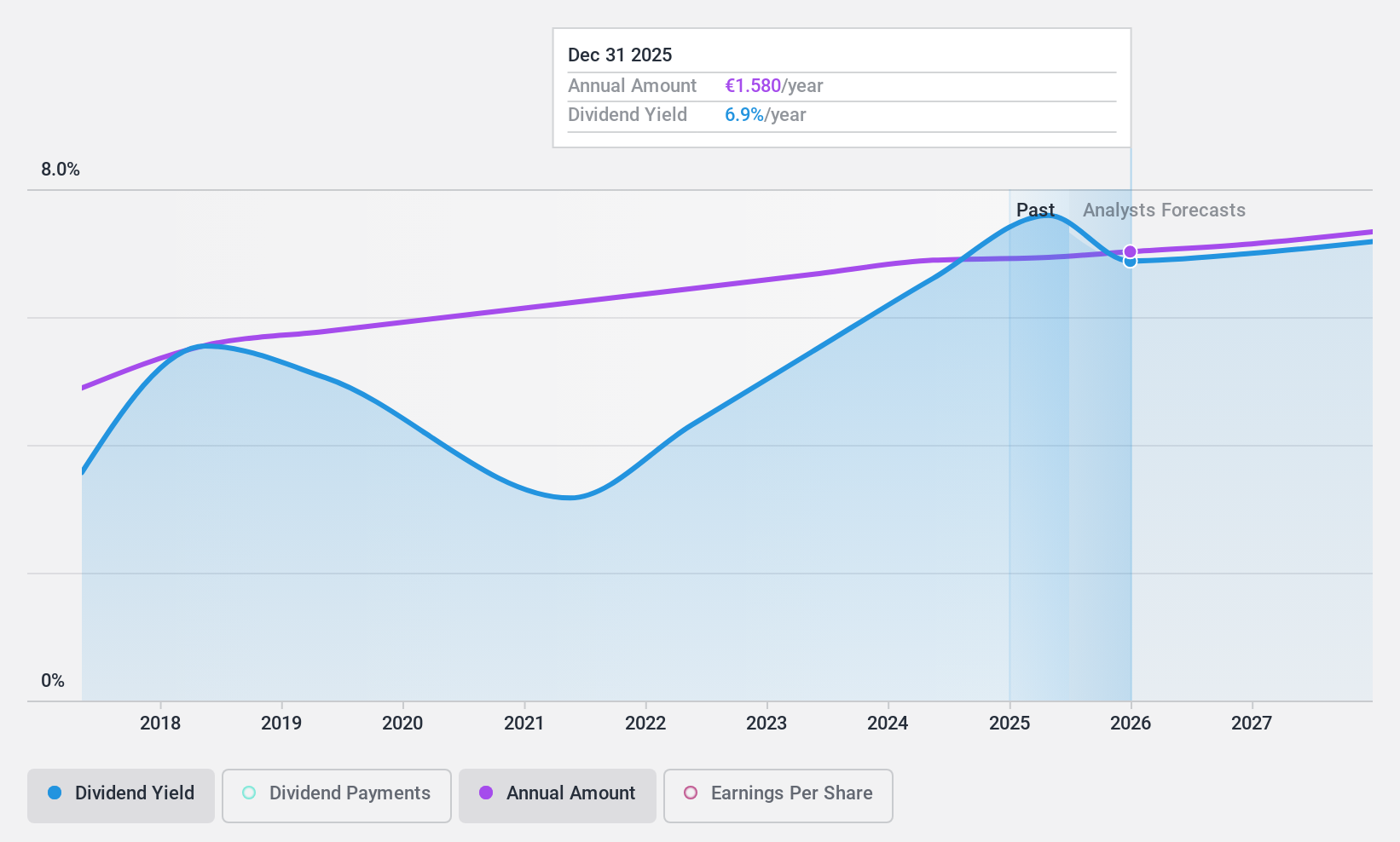

Dividend Yield: 7.2%

Signify offers a mixed dividend profile with a high yield of 7.22%, placing it in the top 25% of Dutch payers, yet its history is marked by volatility and unreliability over eight years. Recent earnings growth, with net income rising to €106 million for H1 2024, supports dividend coverage alongside a low cash payout ratio of 34.2%. However, its removal from the FTSE All-World Index may raise concerns about long-term stability.

- Click to explore a detailed breakdown of our findings in Signify's dividend report.

- Our valuation report unveils the possibility Signify's shares may be trading at a discount.

Taking Advantage

- Embark on your investment journey to our 7 Top Euronext Amsterdam Dividend Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:AALB

Aalberts

Offers mission-critical technologies for aerospace, automotive, building, and maritime sectors.

Very undervalued with flawless balance sheet and pays a dividend.