- Netherlands

- /

- Banks

- /

- ENXTAM:ABN

How ABN AMRO Bank’s €250 Million Buyback (ENXTAM:ABN) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Earlier this month, ABN AMRO Bank completed the repurchase of 9,847,302 shares for €250 million, representing 1.18% of its outstanding shares under its latest buyback programme.

- This move may signal management’s optimism about the bank’s financial health and could be viewed as a shareholder-friendly allocation of capital.

- We'll examine how the recently finished €250 million share buyback may influence ABN AMRO's investment outlook and analyst expectations.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ABN AMRO Bank Investment Narrative Recap

To be a shareholder in ABN AMRO Bank, you need confidence in the group's ability to balance stable Dutch market earnings with ongoing cost control and effective risk management amid a rapidly evolving banking sector. The recent €250 million share buyback does not significantly shift the primary short-term catalyst, continued margin expansion through efficiency gains, or address the biggest near-term risk of tighter regulatory capital requirements impacting lending capacity and return on equity.

The most recent announcement relevant to this buyback is the half-year 2025 results, which showed both net interest and net income ticking lower compared to the previous period. While capital returns like buybacks can enhance shareholder value in the short run, slower revenue and earnings trends highlight why operational improvements remain essential alongside these financial measures.

In contrast, investors should pay close attention to shifts in regulatory capital requirements, as these...

Read the full narrative on ABN AMRO Bank (it's free!)

ABN AMRO Bank's narrative projects €9.5 billion revenue and €2.0 billion earnings by 2028. This requires 2.4% yearly revenue growth and a €0.1 billion decrease in earnings from €2.1 billion today.

Uncover how ABN AMRO Bank's forecasts yield a €24.78 fair value, a 3% downside to its current price.

Exploring Other Perspectives

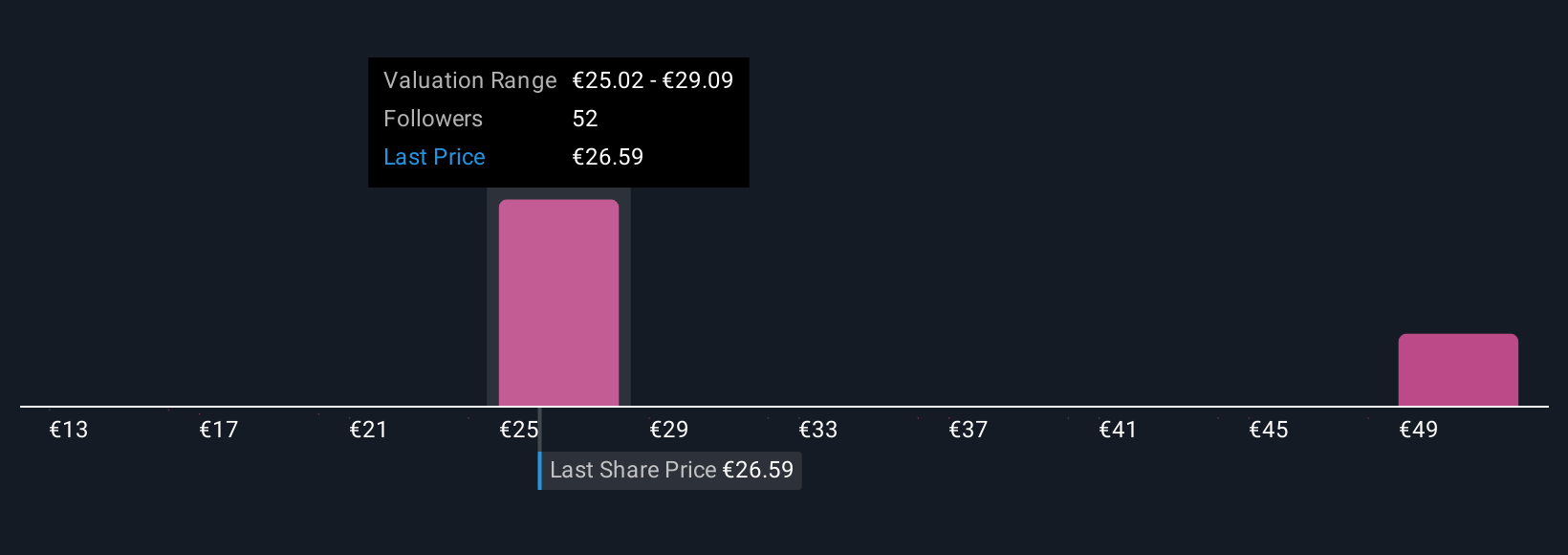

Simply Wall St Community members estimate ABN AMRO's fair value anywhere from €12.79 to €47.43 based on five analyses. While some see the bank as deeply undervalued, others focus on the risk that increased regulatory capital could constrain future profitability, making it important to review several perspectives before forming your own view.

Explore 5 other fair value estimates on ABN AMRO Bank - why the stock might be worth as much as 85% more than the current price!

Build Your Own ABN AMRO Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ABN AMRO Bank research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free ABN AMRO Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ABN AMRO Bank's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ABN

ABN AMRO Bank

Provides various banking products and financial services to retail, private, and business clients in the Netherlands, rest of Europe, the United States, Asia, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives