- Malaysia

- /

- Other Utilities

- /

- KLSE:YTL

YTL Corporation Berhad's (KLSE:YTL) Price Is Right But Growth Is Lacking After Shares Rocket 27%

The YTL Corporation Berhad (KLSE:YTL) share price has done very well over the last month, posting an excellent gain of 27%. The annual gain comes to 230% following the latest surge, making investors sit up and take notice.

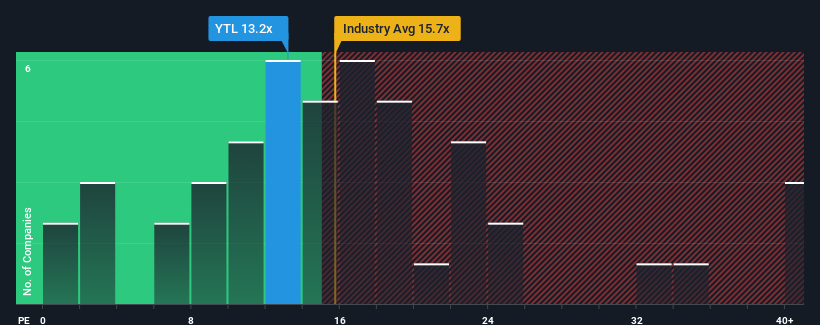

In spite of the firm bounce in price, YTL Corporation Berhad's price-to-earnings (or "P/E") ratio of 13.2x might still make it look like a buy right now compared to the market in Malaysia, where around half of the companies have P/E ratios above 16x and even P/E's above 28x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

YTL Corporation Berhad certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for YTL Corporation Berhad

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like YTL Corporation Berhad's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 152%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings growth is heading into negative territory, declining 1.8% per annum over the next three years. Meanwhile, the broader market is forecast to expand by 13% per annum, which paints a poor picture.

In light of this, it's understandable that YTL Corporation Berhad's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From YTL Corporation Berhad's P/E?

The latest share price surge wasn't enough to lift YTL Corporation Berhad's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of YTL Corporation Berhad's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 5 warning signs for YTL Corporation Berhad you should be aware of, and 3 of them can't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:YTL

YTL Corporation Berhad

Operates as an integrated infrastructure developer.

Undervalued with moderate growth potential.

Market Insights

Community Narratives