David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Tenaga Nasional Berhad (KLSE:TENAGA) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Tenaga Nasional Berhad

How Much Debt Does Tenaga Nasional Berhad Carry?

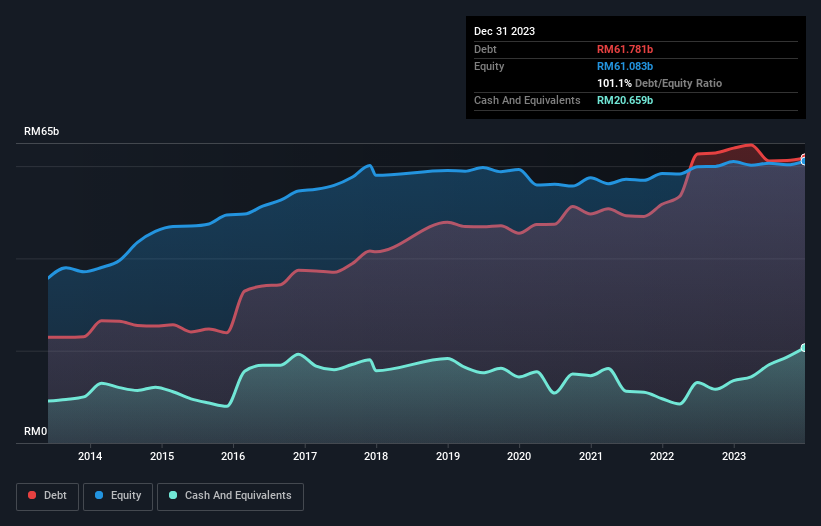

The chart below, which you can click on for greater detail, shows that Tenaga Nasional Berhad had RM61.8b in debt in December 2023; about the same as the year before. However, it does have RM20.7b in cash offsetting this, leading to net debt of about RM41.1b.

How Healthy Is Tenaga Nasional Berhad's Balance Sheet?

We can see from the most recent balance sheet that Tenaga Nasional Berhad had liabilities of RM32.8b falling due within a year, and liabilities of RM110.8b due beyond that. On the other hand, it had cash of RM20.7b and RM16.1b worth of receivables due within a year. So it has liabilities totalling RM106.9b more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's massive market capitalization of RM75.8b, we think shareholders really should watch Tenaga Nasional Berhad's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While we wouldn't worry about Tenaga Nasional Berhad's net debt to EBITDA ratio of 2.8, we think its super-low interest cover of 2.0 times is a sign of high leverage. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Even worse, Tenaga Nasional Berhad saw its EBIT tank 22% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Tenaga Nasional Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, Tenaga Nasional Berhad actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

To be frank both Tenaga Nasional Berhad's level of total liabilities and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. We should also note that Electric Utilities industry companies like Tenaga Nasional Berhad commonly do use debt without problems. Looking at the bigger picture, it seems clear to us that Tenaga Nasional Berhad's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example Tenaga Nasional Berhad has 2 warning signs (and 1 which is a bit concerning) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Tenaga Nasional Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:TENAGA

Tenaga Nasional Berhad

Engages in the generation, transmission, distribution, and sale of electricity in Malaysia, the United Kingdom, Kuwait, the Republic of Ireland, Australia, and internationally.

Very undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives