- Malaysia

- /

- Water Utilities

- /

- KLSE:SALCON

Would Shareholders Who Purchased Salcon Berhad's (KLSE:SALCON) Stock Five Years Be Happy With The Share price Today?

It is doubtless a positive to see that the Salcon Berhad (KLSE:SALCON) share price has gained some 39% in the last three months. But over the last half decade, the stock has not performed well. You would have done a lot better buying an index fund, since the stock has dropped 43% in that half decade.

See our latest analysis for Salcon Berhad

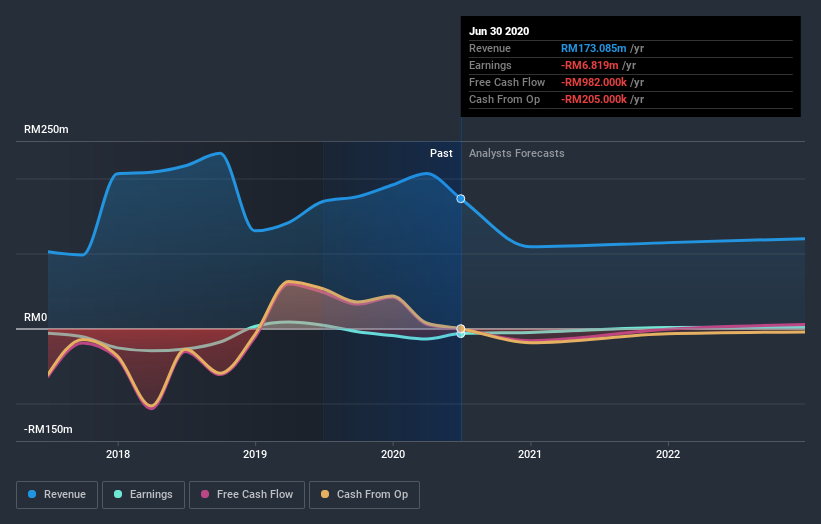

Salcon Berhad wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, Salcon Berhad grew its revenue at 9.0% per year. That's a pretty good rate for a long time period. Shareholders have seen the share price fall at 7% per year, for five years: a poor performance. Those who bought back then clearly believed in stronger growth - and maybe even profits. The lesson is that if you buy shares in a money losing company you could end up losing money.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Salcon Berhad stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Salcon Berhad's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Salcon Berhad's TSR of was a loss of 39% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Salcon Berhad shareholders have received a total shareholder return of 33% over one year. That certainly beats the loss of about 7% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Salcon Berhad better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Salcon Berhad you should be aware of.

Of course Salcon Berhad may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on MY exchanges.

If you decide to trade Salcon Berhad, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:SALCON

Salcon Berhad

Operates as water and wastewater engineering company in Malaysia, the United States, India, the United Kingdom, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.