- Malaysia

- /

- Transportation

- /

- KLSE:XINHWA

Xin Hwa Holdings Berhad (KLSE:XINHWA) Soars 26% But It's A Story Of Risk Vs Reward

The Xin Hwa Holdings Berhad (KLSE:XINHWA) share price has done very well over the last month, posting an excellent gain of 26%. Notwithstanding the latest gain, the annual share price return of 5.4% isn't as impressive.

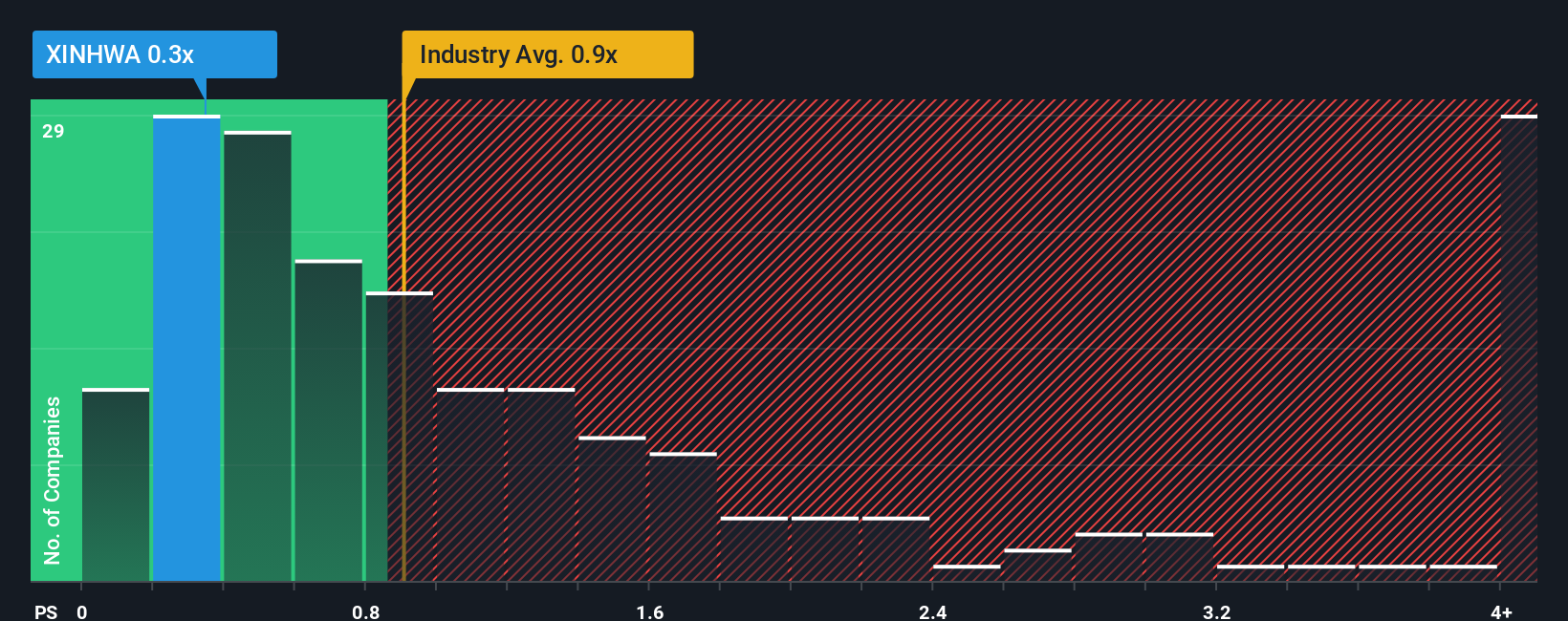

Even after such a large jump in price, when close to half the companies operating in Malaysia's Transportation industry have price-to-sales ratios (or "P/S") above 2.1x, you may still consider Xin Hwa Holdings Berhad as an enticing stock to check out with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Xin Hwa Holdings Berhad

What Does Xin Hwa Holdings Berhad's P/S Mean For Shareholders?

The revenue growth achieved at Xin Hwa Holdings Berhad over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Xin Hwa Holdings Berhad will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Xin Hwa Holdings Berhad will help you shine a light on its historical performance.How Is Xin Hwa Holdings Berhad's Revenue Growth Trending?

In order to justify its P/S ratio, Xin Hwa Holdings Berhad would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The latest three year period has also seen a 30% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 2.2% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Xin Hwa Holdings Berhad is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Despite Xin Hwa Holdings Berhad's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see Xin Hwa Holdings Berhad currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

It is also worth noting that we have found 2 warning signs for Xin Hwa Holdings Berhad (1 is a bit concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Xin Hwa Holdings Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:XINHWA

Xin Hwa Holdings Berhad

An investment holding company, engage in the provision of integrated logistics services in Malaysia, Singapore, and Indonesia.

Good value with mediocre balance sheet.

Market Insights

Community Narratives