Swift Haulage Berhad Just Missed Earnings - But Analysts Have Updated Their Models

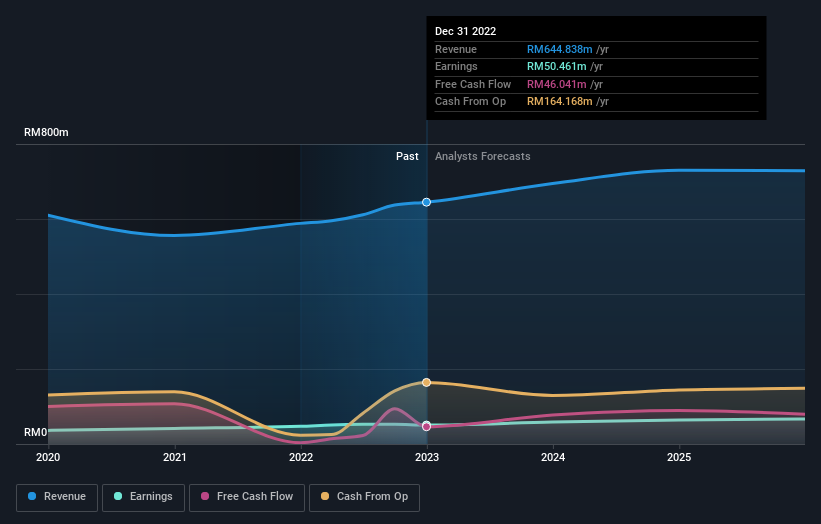

Swift Haulage Berhad (KLSE:SWIFT) came out with its yearly results last week, and we wanted to see how the business is performing and what industry forecasters think of the company following this report. It looks like the results were a bit of a negative overall. While revenues of RM645m were in line with analyst predictions, statutory earnings were less than expected, missing estimates by 7.0% to hit RM0.057 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Swift Haulage Berhad

Taking into account the latest results, the current consensus from Swift Haulage Berhad's six analysts is for revenues of RM694.7m in 2023, which would reflect an okay 7.7% increase on its sales over the past 12 months. Statutory earnings per share are predicted to expand 17% to RM0.067. Before this earnings report, the analysts had been forecasting revenues of RM702.6m and earnings per share (EPS) of RM0.069 in 2023. The analysts seem to have become a little more negative on the business after the latest results, given the small dip in their earnings per share numbers for next year.

It might be a surprise to learn that the consensus price target was broadly unchanged at RM0.82, with the analysts clearly implying that the forecast decline in earnings is not expected to have much of an impact on valuation. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Swift Haulage Berhad, with the most bullish analyst valuing it at RM1.05 and the most bearish at RM0.58 per share. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Swift Haulage Berhad shareholders.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's clear from the latest estimates that Swift Haulage Berhad's rate of growth is expected to accelerate meaningfully, with the forecast 7.7% annualised revenue growth to the end of 2023 noticeably faster than its historical growth of 2.5% p.a. over the past three years. Compare this with other companies in the same industry, which are forecast to grow their revenue 7.3% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Swift Haulage Berhad is expected to grow at about the same rate as the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. They also reconfirmed their revenue estimates, with the company predicted to grow at about the same rate as the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Swift Haulage Berhad. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Swift Haulage Berhad analysts - going out to 2025, and you can see them free on our platform here.

You should always think about risks though. Case in point, we've spotted 4 warning signs for Swift Haulage Berhad you should be aware of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SWIFT

Swift Haulage Berhad

An investment holding company, provides integrated logistics services in Malaysia and internationally.

Undervalued with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion