- Malaysia

- /

- Marine and Shipping

- /

- KLSE:KGW

A Piece Of The Puzzle Missing From KGW Group Berhad's (KLSE:KGW) Share Price

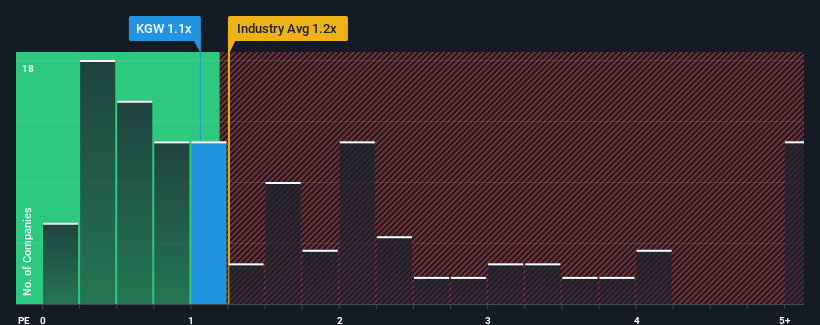

There wouldn't be many who think KGW Group Berhad's (KLSE:KGW) price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S for the Shipping industry in Malaysia is similar at about 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for KGW Group Berhad

How Has KGW Group Berhad Performed Recently?

For example, consider that KGW Group Berhad's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on KGW Group Berhad will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like KGW Group Berhad's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 64%. Still, the latest three year period has seen an excellent 44% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

In contrast to the company, the rest of the industry is expected to decline by 8.7% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it odd that KGW Group Berhad is trading at a fairly similar P/S to the industry. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What Does KGW Group Berhad's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As mentioned previously, KGW Group Berhad currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from outpacing the industry much like its revenue performance. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 3 warning signs for KGW Group Berhad (1 makes us a bit uncomfortable!) that you should be aware of.

If these risks are making you reconsider your opinion on KGW Group Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if KGW Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:KGW

KGW Group Berhad

An investment holding company, provides logistics services in Malaysia and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives