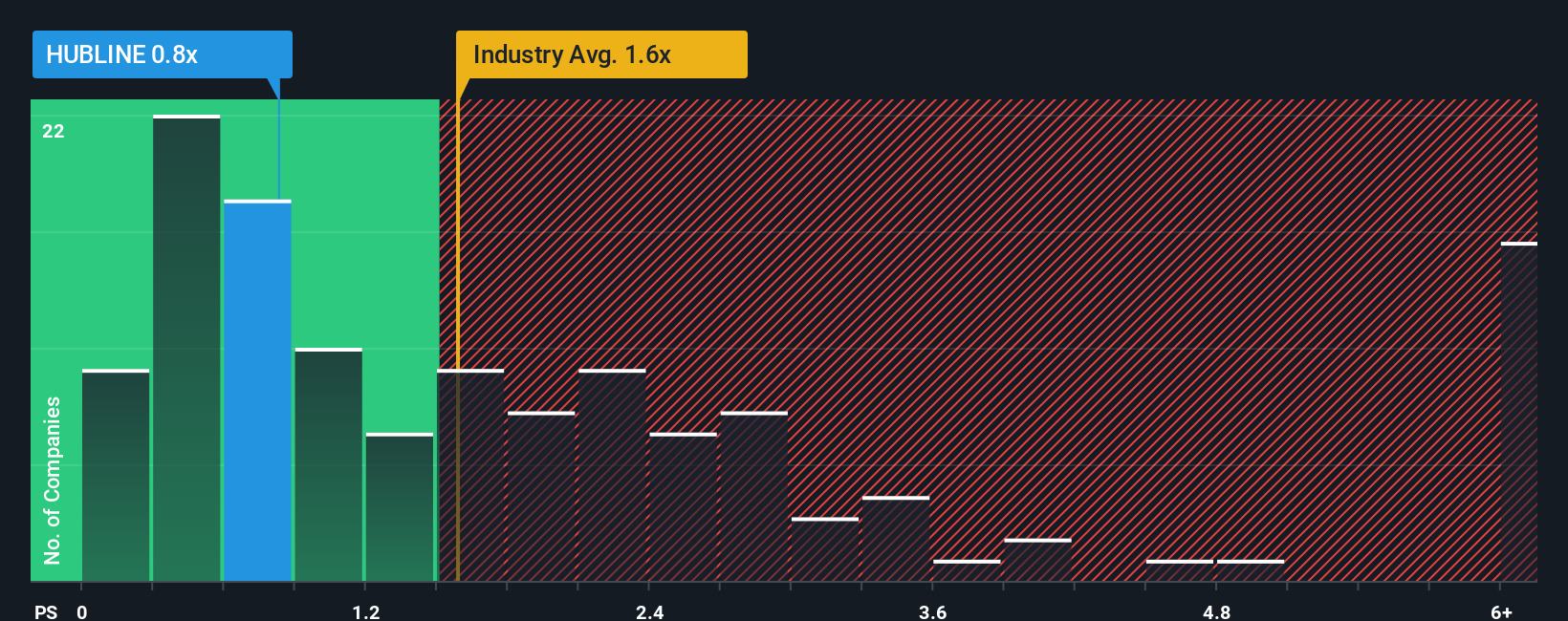

It's not a stretch to say that Hubline Berhad's (KLSE:HUBLINE) price-to-sales (or "P/S") ratio of 0.8x seems quite "middle-of-the-road" for Shipping companies in Malaysia, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Hubline Berhad

What Does Hubline Berhad's Recent Performance Look Like?

For example, consider that Hubline Berhad's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hubline Berhad will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hubline Berhad's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 17% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 8.4% shows the industry is even less attractive on an annualised basis.

In light of this, the fact Hubline Berhad's P/S sits in line with the majority of other companies is unanticipated but certainly not shocking. Even if the company's recent growth rates continue outperforming the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. It's conceivable that the P/S falls to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hubline Berhad currently trades on a slightly lower than expected P/S if you consider its recent three-year revenues aren't as bad as the forecasts for a struggling industry. There could be some unobserved threats to revenue preventing the P/S ratio from matching this more attractive performance. Perhaps investors have reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Hubline Berhad (including 1 which is significant).

If these risks are making you reconsider your opinion on Hubline Berhad, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hubline Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:HUBLINE

Hubline Berhad

An investment holding company, provides dry bulk shipping services in the South East Asian region.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives