- Malaysia

- /

- Marine and Shipping

- /

- KLSE:HARBOUR

Harbour-Link Group Berhad (KLSE:HARBOUR) Seems To Use Debt Rather Sparingly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Harbour-Link Group Berhad (KLSE:HARBOUR) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Harbour-Link Group Berhad

What Is Harbour-Link Group Berhad's Net Debt?

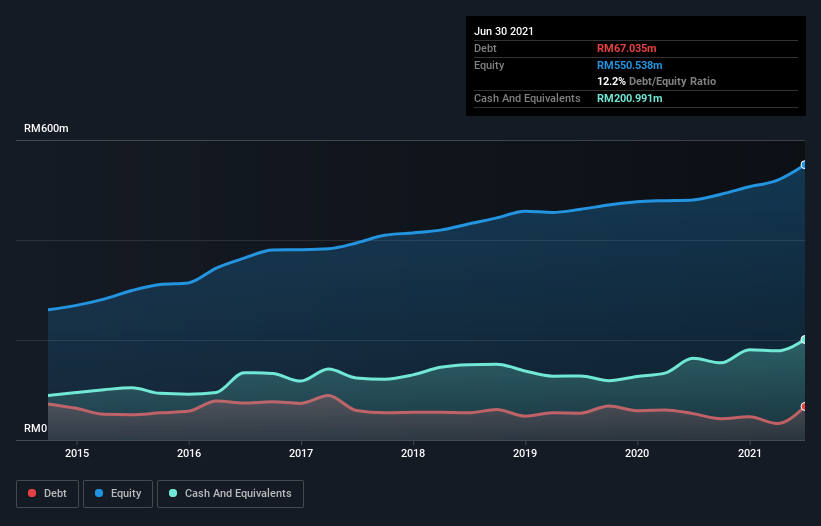

The image below, which you can click on for greater detail, shows that at June 2021 Harbour-Link Group Berhad had debt of RM67.0m, up from RM52.7m in one year. However, its balance sheet shows it holds RM201.0m in cash, so it actually has RM134.0m net cash.

A Look At Harbour-Link Group Berhad's Liabilities

Zooming in on the latest balance sheet data, we can see that Harbour-Link Group Berhad had liabilities of RM133.7m due within 12 months and liabilities of RM53.4m due beyond that. On the other hand, it had cash of RM201.0m and RM162.9m worth of receivables due within a year. So it actually has RM176.7m more liquid assets than total liabilities.

This luscious liquidity implies that Harbour-Link Group Berhad's balance sheet is sturdy like a giant sequoia tree. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Simply put, the fact that Harbour-Link Group Berhad has more cash than debt is arguably a good indication that it can manage its debt safely.

Even more impressive was the fact that Harbour-Link Group Berhad grew its EBIT by 115% over twelve months. That boost will make it even easier to pay down debt going forward. When analysing debt levels, the balance sheet is the obvious place to start. But it is Harbour-Link Group Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Harbour-Link Group Berhad may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the most recent three years, Harbour-Link Group Berhad recorded free cash flow worth 70% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While it is always sensible to investigate a company's debt, in this case Harbour-Link Group Berhad has RM134.0m in net cash and a decent-looking balance sheet. And we liked the look of last year's 115% year-on-year EBIT growth. The bottom line is that we do not find Harbour-Link Group Berhad's debt levels at all concerning. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Harbour-Link Group Berhad (of which 1 can't be ignored!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Harbour-Link Group Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:HARBOUR

Harbour-Link Group Berhad

An investment holding company, engages in management services in Malaysia, Hong Kong, China, Singapore, and Brunei.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion