- Malaysia

- /

- Wireless Telecom

- /

- KLSE:MAXIS

Some Investors May Be Worried About Maxis Berhad's (KLSE:MAXIS) Returns On Capital

If we're looking to avoid a business that is in decline, what are the trends that can warn us ahead of time? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. In light of that, from a first glance at Maxis Berhad (KLSE:MAXIS), we've spotted some signs that it could be struggling, so let's investigate.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Maxis Berhad:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.095 = RM1.6b ÷ (RM23b - RM5.4b) (Based on the trailing twelve months to December 2023).

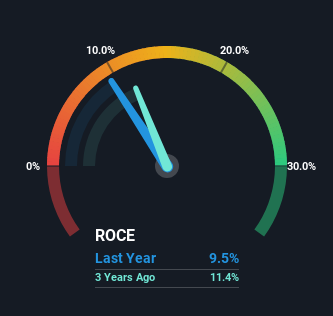

Therefore, Maxis Berhad has an ROCE of 9.5%. On its own, that's a low figure but it's around the 10% average generated by the Wireless Telecom industry.

View our latest analysis for Maxis Berhad

In the above chart we have measured Maxis Berhad's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Maxis Berhad .

The Trend Of ROCE

There is reason to be cautious about Maxis Berhad, given the returns are trending downwards. About five years ago, returns on capital were 16%, however they're now substantially lower than that as we saw above. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. Companies that exhibit these attributes tend to not be shrinking, but they can be mature and facing pressure on their margins from competition. If these trends continue, we wouldn't expect Maxis Berhad to turn into a multi-bagger.

What We Can Learn From Maxis Berhad's ROCE

In summary, it's unfortunate that Maxis Berhad is generating lower returns from the same amount of capital. Long term shareholders who've owned the stock over the last five years have experienced a 20% depreciation in their investment, so it appears the market might not like these trends either. With underlying trends that aren't great in these areas, we'd consider looking elsewhere.

Maxis Berhad does have some risks though, and we've spotted 2 warning signs for Maxis Berhad that you might be interested in.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MAXIS

Maxis Berhad

An investment holding company, provides a suite of converged telecommunications, digital, and related services and solutions in Malaysia and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026