- Malaysia

- /

- Telecom Services and Carriers

- /

- KLSE:BINACOM

Here's Why Binasat Communications Berhad (KLSE:BINACOM) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Binasat Communications Berhad (KLSE:BINACOM) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Binasat Communications Berhad

What Is Binasat Communications Berhad's Net Debt?

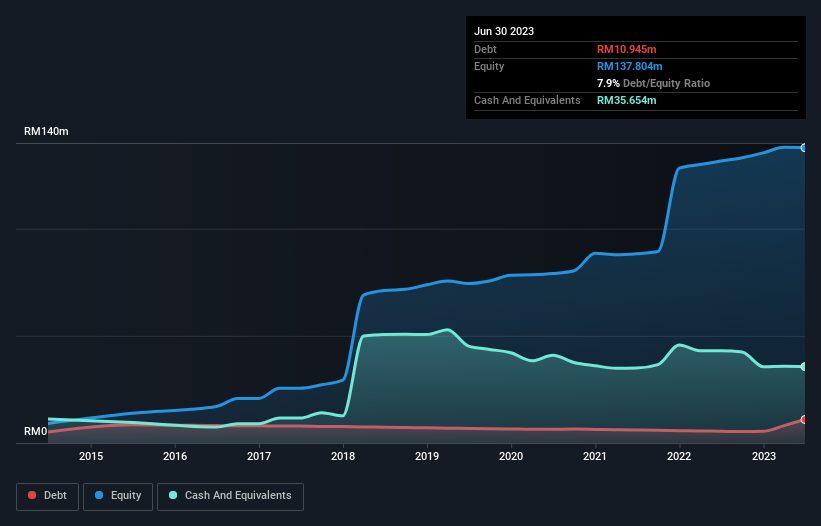

The image below, which you can click on for greater detail, shows that at June 2023 Binasat Communications Berhad had debt of RM10.9m, up from RM5.48m in one year. But on the other hand it also has RM35.7m in cash, leading to a RM24.7m net cash position.

How Strong Is Binasat Communications Berhad's Balance Sheet?

The latest balance sheet data shows that Binasat Communications Berhad had liabilities of RM31.7m due within a year, and liabilities of RM20.1m falling due after that. On the other hand, it had cash of RM35.7m and RM80.9m worth of receivables due within a year. So it can boast RM64.8m more liquid assets than total liabilities.

This surplus strongly suggests that Binasat Communications Berhad has a rock-solid balance sheet (and the debt is of no concern whatsoever). Having regard to this fact, we think its balance sheet is as strong as an ox. Succinctly put, Binasat Communications Berhad boasts net cash, so it's fair to say it does not have a heavy debt load!

Also positive, Binasat Communications Berhad grew its EBIT by 25% in the last year, and that should make it easier to pay down debt, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Binasat Communications Berhad's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Binasat Communications Berhad may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Binasat Communications Berhad burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing Up

While it is always sensible to investigate a company's debt, in this case Binasat Communications Berhad has RM24.7m in net cash and a decent-looking balance sheet. And it impressed us with its EBIT growth of 25% over the last year. So we don't think Binasat Communications Berhad's use of debt is risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 3 warning signs for Binasat Communications Berhad you should be aware of, and 1 of them is a bit concerning.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Binasat Communications Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:BINACOM

Binasat Communications Berhad

Provides supporting services for very small aperture terminal (VSAT), mobile and fiber network engineering services, satellite hub/teleport and digital satellite news gathering (DSNG), and ICT solution and connectivity in Malaysia.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives