SNS Network Technology Berhad's (KLSE:SNS) Returns Have Hit A Wall

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So, when we ran our eye over SNS Network Technology Berhad's (KLSE:SNS) trend of ROCE, we liked what we saw.

Our free stock report includes 1 warning sign investors should be aware of before investing in SNS Network Technology Berhad. Read for free now.Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on SNS Network Technology Berhad is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = RM46m ÷ (RM560m - RM255m) (Based on the trailing twelve months to January 2025).

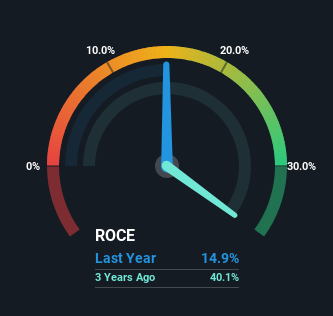

Therefore, SNS Network Technology Berhad has an ROCE of 15%. On its own, that's a standard return, however it's much better than the 12% generated by the Electronic industry.

See our latest analysis for SNS Network Technology Berhad

Historical performance is a great place to start when researching a stock so above you can see the gauge for SNS Network Technology Berhad's ROCE against it's prior returns. If you're interested in investigating SNS Network Technology Berhad's past further, check out this free graph covering SNS Network Technology Berhad's past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

The trend of ROCE doesn't stand out much, but returns on a whole are decent. Over the past five years, ROCE has remained relatively flat at around 15% and the business has deployed 287% more capital into its operations. 15% is a pretty standard return, and it provides some comfort knowing that SNS Network Technology Berhad has consistently earned this amount. Over long periods of time, returns like these might not be too exciting, but with consistency they can pay off in terms of share price returns.

One more thing to note, even though ROCE has remained relatively flat over the last five years, the reduction in current liabilities to 45% of total assets, is good to see from a business owner's perspective. This can eliminate some of the risks inherent in the operations because the business has less outstanding obligations to their suppliers and or short-term creditors than they did previously. Although because current liabilities are still 45%, some of that risk is still prevalent.

The Bottom Line

In the end, SNS Network Technology Berhad has proven its ability to adequately reinvest capital at good rates of return. However, over the last year, the stock hasn't provided much growth to shareholders in the way of total returns. For that reason, savvy investors might want to look further into this company in case it's a prime investment.

On a final note, we've found 1 warning sign for SNS Network Technology Berhad that we think you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:SNS

SNS Network Technology Berhad

Provides technology solutions and integrated information systems to end consumers, SME businesses, large corporations, and education and government institutions.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026