- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:SALUTE

We're Hopeful That Salutica Berhad (KLSE:SALUTE) Will Use Its Cash Wisely

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether Salutica Berhad (KLSE:SALUTE) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Salutica Berhad

Does Salutica Berhad Have A Long Cash Runway?

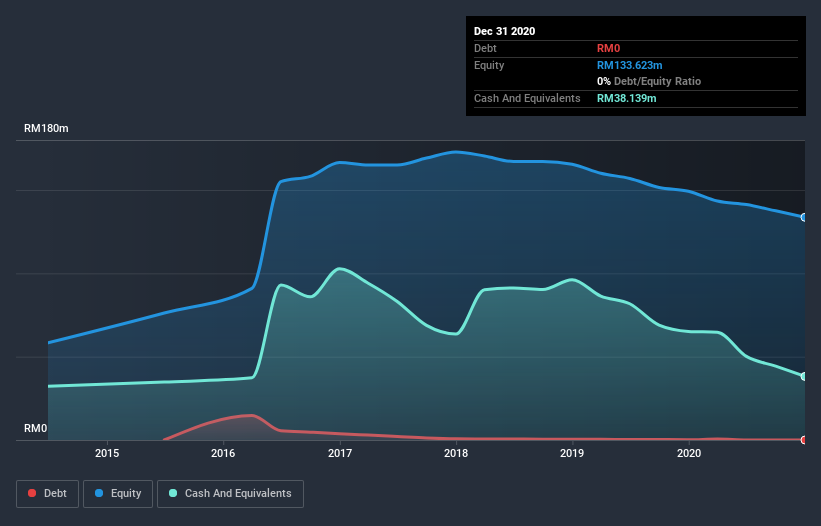

A company's cash runway is calculated by dividing its cash hoard by its cash burn. When Salutica Berhad last reported its balance sheet in December 2020, it had zero debt and cash worth RM38m. Importantly, its cash burn was RM26m over the trailing twelve months. Therefore, from December 2020 it had roughly 18 months of cash runway. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. The image below shows how its cash balance has been changing over the last few years.

How Well Is Salutica Berhad Growing?

At first glance it's a bit worrying to see that Salutica Berhad actually boosted its cash burn by 10%, year on year. The good news is that operating revenue increased by 46% in the last year, indicating that the business is gaining some traction. It seems to be growing nicely. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic revenue growth shows how Salutica Berhad is building its business over time.

Can Salutica Berhad Raise More Cash Easily?

Salutica Berhad seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of RM212m, Salutica Berhad's RM26m in cash burn equates to about 12% of its market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

So, Should We Worry About Salutica Berhad's Cash Burn?

On this analysis of Salutica Berhad's cash burn, we think its revenue growth was reassuring, while its increasing cash burn has us a bit worried. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Salutica Berhad's situation. Separately, we looked at different risks affecting the company and spotted 3 warning signs for Salutica Berhad (of which 1 is a bit concerning!) you should know about.

Of course Salutica Berhad may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Salutica Berhad, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KLSE:SALUTE

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success