- Malaysia

- /

- Electronic Equipment and Components

- /

- KLSE:NOTION

Some Notion VTec Berhad (KLSE:NOTION) Shareholders Look For Exit As Shares Take 26% Pounding

Notion VTec Berhad (KLSE:NOTION) shares have had a horrible month, losing 26% after a relatively good period beforehand. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 176% in the last twelve months.

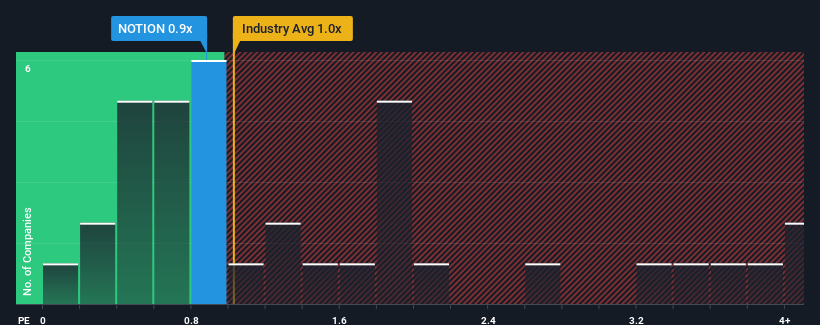

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Notion VTec Berhad's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in Malaysia is also close to 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Notion VTec Berhad

What Does Notion VTec Berhad's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Notion VTec Berhad has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Notion VTec Berhad.Do Revenue Forecasts Match The P/S Ratio?

Notion VTec Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 46%. The strong recent performance means it was also able to grow revenue by 37% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 3.6% as estimated by the dual analysts watching the company. That's not great when the rest of the industry is expected to grow by 40%.

With this information, we find it concerning that Notion VTec Berhad is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Bottom Line On Notion VTec Berhad's P/S

With its share price dropping off a cliff, the P/S for Notion VTec Berhad looks to be in line with the rest of the Electronic industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our check of Notion VTec Berhad's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

You should always think about risks. Case in point, we've spotted 2 warning signs for Notion VTec Berhad you should be aware of, and 1 of them is concerning.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Notion VTec Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NOTION

Notion VTec Berhad

An investment holding company, engages in design, manufacture, and sale of precision components and tools.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.