Investors Aren't Entirely Convinced By JHM Consolidation Berhad's (KLSE:JHM) Revenues

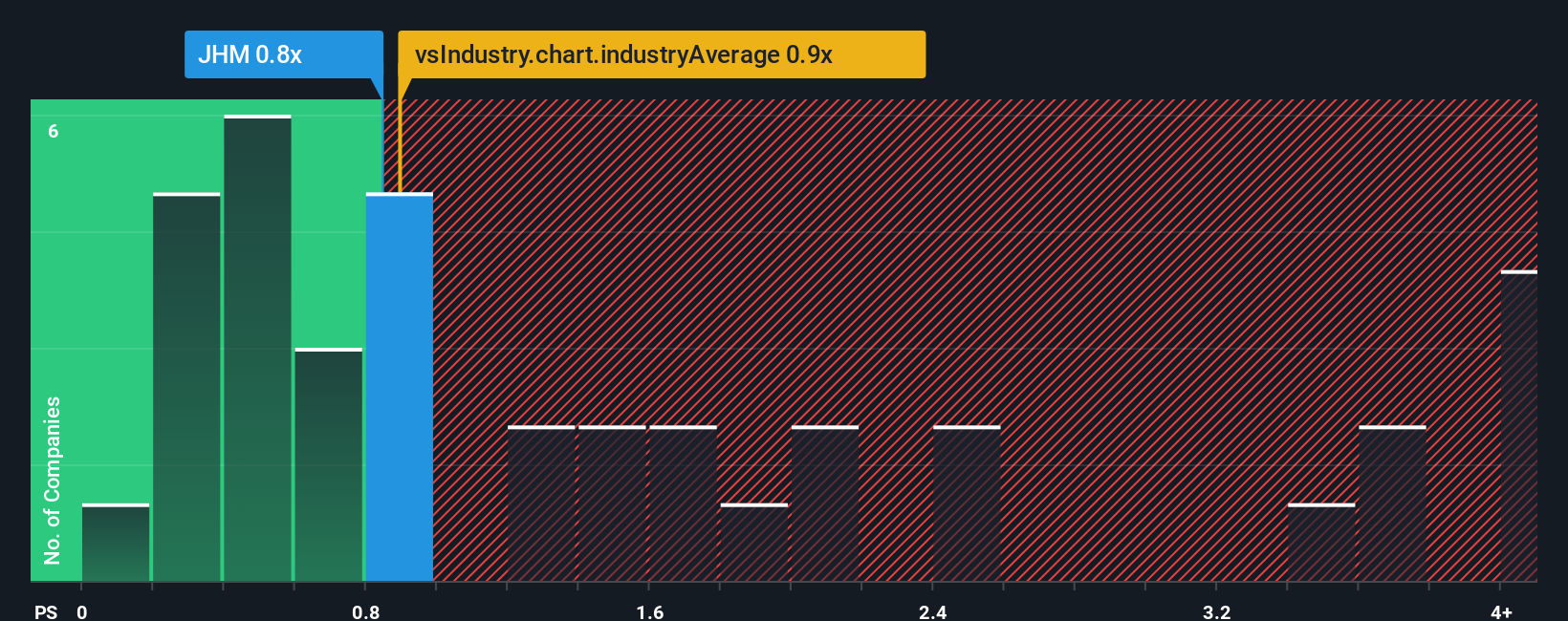

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Electronic industry in Malaysia, you could be forgiven for feeling indifferent about JHM Consolidation Berhad's (KLSE:JHM) P/S ratio of 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for JHM Consolidation Berhad

What Does JHM Consolidation Berhad's Recent Performance Look Like?

Recent times haven't been great for JHM Consolidation Berhad as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on JHM Consolidation Berhad will help you uncover what's on the horizon.How Is JHM Consolidation Berhad's Revenue Growth Trending?

JHM Consolidation Berhad's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. Still, revenue has fallen 25% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next year should generate growth of 23% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 4.4% growth forecast for the broader industry.

With this in consideration, we find it intriguing that JHM Consolidation Berhad's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at JHM Consolidation Berhad's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware JHM Consolidation Berhad is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:JHM

JHM Consolidation Berhad

An investment holding company, designs, assembles, and manufactures metal parts and components, and electronic components in Malaysia, the United States, Europe, Malaysia, Oceania, and the Asia Pacific.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives