AE Multi Holdings Berhad (KLSE:AEM) Might Not Be As Mispriced As It Looks After Plunging 50%

AE Multi Holdings Berhad (KLSE:AEM) shares have had a horrible month, losing 50% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 67% loss during that time.

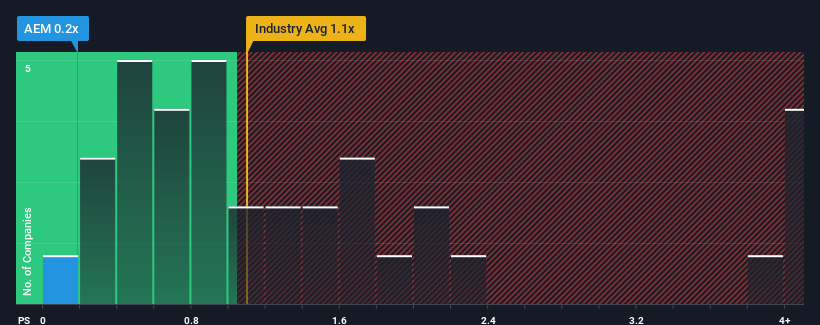

Since its price has dipped substantially, when close to half the companies operating in Malaysia's Electronic industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider AE Multi Holdings Berhad as an enticing stock to check out with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for AE Multi Holdings Berhad

How AE Multi Holdings Berhad Has Been Performing

For instance, AE Multi Holdings Berhad's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on AE Multi Holdings Berhad will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for AE Multi Holdings Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as AE Multi Holdings Berhad's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.4%. Even so, admirably revenue has lifted 74% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 21% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

In light of this, it's peculiar that AE Multi Holdings Berhad's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

AE Multi Holdings Berhad's recently weak share price has pulled its P/S back below other Electronic companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of AE Multi Holdings Berhad revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for AE Multi Holdings Berhad that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:AEM

AE Multi Holdings Berhad

An investment holding company, manufactures and sells printed circuit boards (PCBs) and related products in Malaysia and Thailand.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)