Additional Considerations Required While Assessing NEXG Berhad's (KLSE:NEXG) Strong Earnings

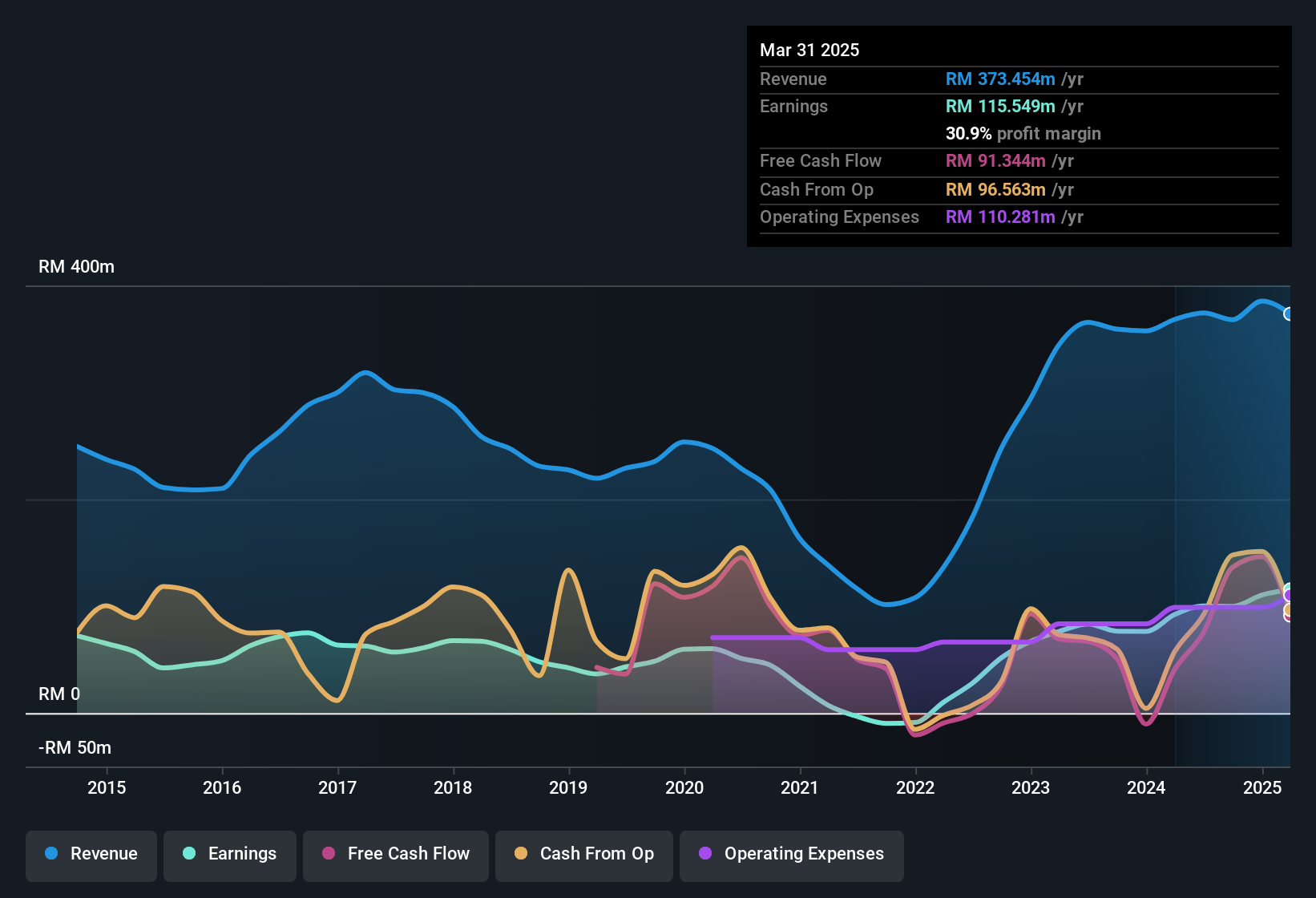

NEXG Berhad's (KLSE:NEXG) robust earnings report didn't manage to move the market for its stock. Our analysis suggests that this might be because shareholders have noticed some concerning underlying factors.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, NEXG Berhad issued 13% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of NEXG Berhad's EPS by clicking here.

How Is Dilution Impacting NEXG Berhad's Earnings Per Share (EPS)?

As you can see above, NEXG Berhad has been growing its net income over the last few years, with an annualized gain of 1,028% over three years. And at a glance the 25% gain in profit over the last year impresses. On the other hand, earnings per share are only up 27% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if NEXG Berhad can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

How Do Unusual Items Influence Profit?

Finally, we should also consider the fact that unusual items boosted NEXG Berhad's net profit by RM16m over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On NEXG Berhad's Profit Performance

To sum it all up, NEXG Berhad got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. For the reasons mentioned above, we think that a perfunctory glance at NEXG Berhad's statutory profits might make it look better than it really is on an underlying level. If you'd like to know more about NEXG Berhad as a business, it's important to be aware of any risks it's facing. Case in point: We've spotted 1 warning sign for NEXG Berhad you should be aware of.

Our examination of NEXG Berhad has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if NEXG Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:NEXG

NEXG Berhad

An investment holding company, provides security-based information and communication technology (ICT) solutions primarily in Malaysia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026