A Quick Analysis On ManagePay Systems Berhad's (KLSE:MPAY) CEO Compensation

Chee Chew has been the CEO of ManagePay Systems Berhad (KLSE:MPAY) since 2000, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether ManagePay Systems Berhad pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for ManagePay Systems Berhad

Comparing ManagePay Systems Berhad's CEO Compensation With the industry

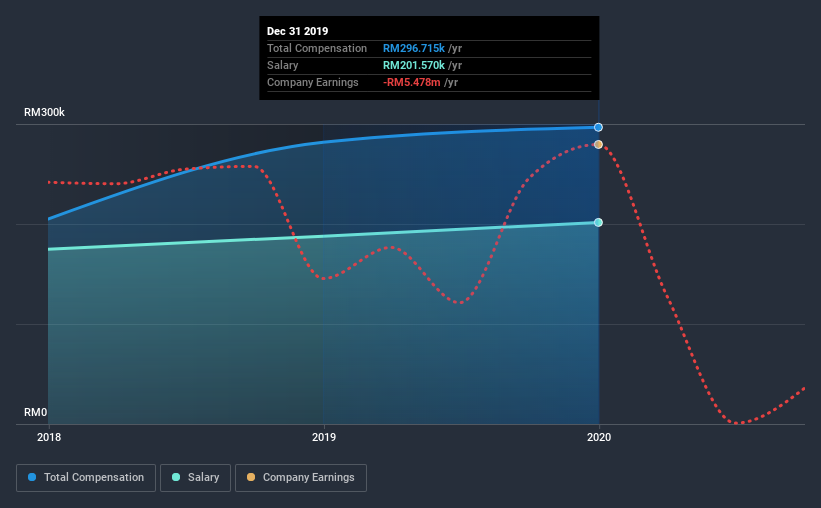

Our data indicates that ManagePay Systems Berhad has a market capitalization of RM110m, and total annual CEO compensation was reported as RM297k for the year to December 2019. That's a fairly small increase of 5.3% over the previous year. We note that the salary portion, which stands at RM201.6k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under RM811m, the reported median total CEO compensation was RM773k. This suggests that Chee Chew is paid below the industry median. Furthermore, Chee Chew directly owns RM28m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | RM202k | RM188k | 68% |

| Other | RM95k | RM94k | 32% |

| Total Compensation | RM297k | RM282k | 100% |

Speaking on an industry level, nearly 76% of total compensation represents salary, while the remainder of 24% is other remuneration. In ManagePay Systems Berhad's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

ManagePay Systems Berhad's Growth

ManagePay Systems Berhad has reduced its earnings per share by 18% a year over the last three years. Its revenue is up 19% over the last year.

The reduction in EPS, over three years, is arguably concerning. But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has ManagePay Systems Berhad Been A Good Investment?

Since shareholders would have lost about 31% over three years, some ManagePay Systems Berhad investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

As previously discussed, Chee is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. But ManagePay Systems Berhad has recorded negative shareholder returns and EPS growth over the last three years. On the flip side, recent revenue growth has been positive. Although it's fair to say CEO compensation is modest, shareholders might want to see healthier investor returns before thinking Chee deserves a raise.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 3 warning signs (and 1 which shouldn't be ignored) in ManagePay Systems Berhad we think you should know about.

Switching gears from ManagePay Systems Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading ManagePay Systems Berhad or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KLSE:MPAY

ManagePay Systems Berhad

An investment holding company, engages in the provision of electronic payment solutions for banks and financial institutions, merchants, and card issuers in Malaysia.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion