Improved Revenues Required Before Microlink Solutions Berhad (KLSE:MICROLN) Stock's 40% Jump Looks Justified

Microlink Solutions Berhad (KLSE:MICROLN) shares have had a really impressive month, gaining 40% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 38% over that time.

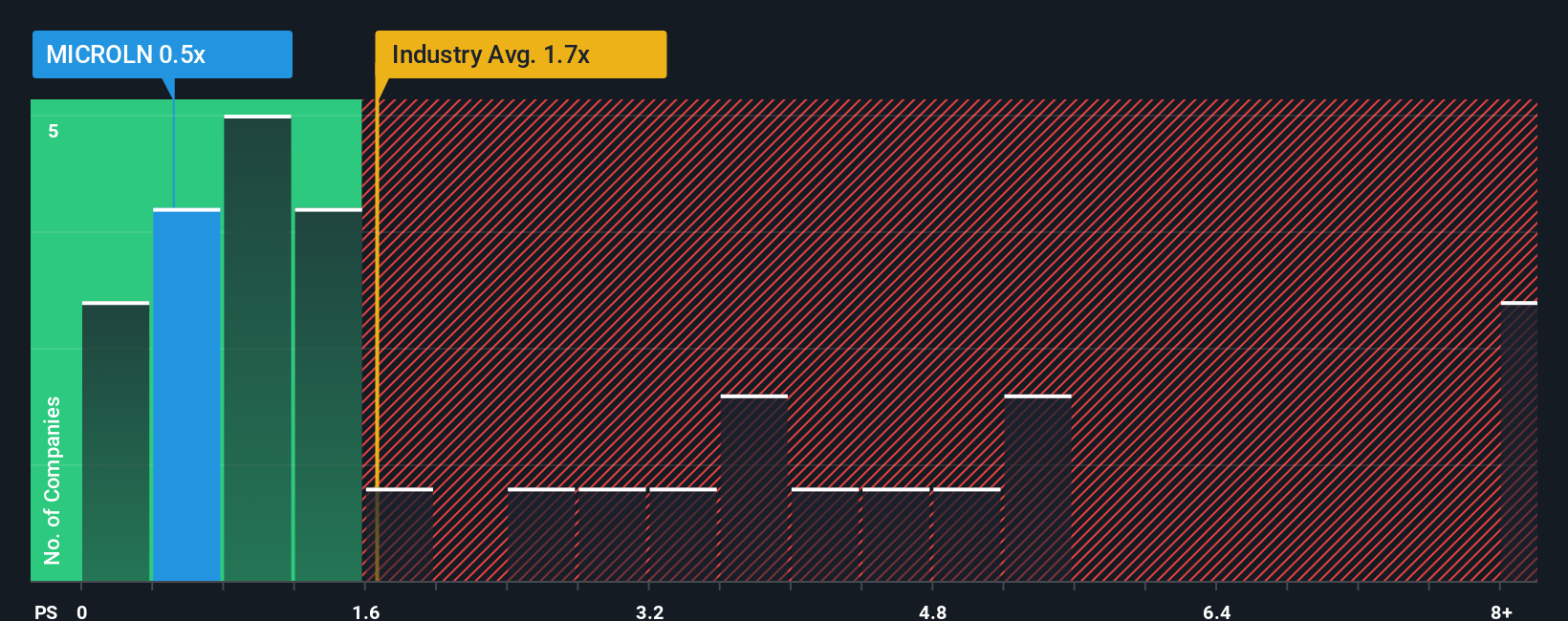

Even after such a large jump in price, Microlink Solutions Berhad may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Software industry in Malaysia have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Microlink Solutions Berhad

What Does Microlink Solutions Berhad's Recent Performance Look Like?

The revenue growth achieved at Microlink Solutions Berhad over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Microlink Solutions Berhad will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Microlink Solutions Berhad will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Microlink Solutions Berhad's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The latest three year period has also seen an excellent 44% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 26% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Microlink Solutions Berhad's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Bottom Line On Microlink Solutions Berhad's P/S

Microlink Solutions Berhad's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Microlink Solutions Berhad revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 4 warning signs for Microlink Solutions Berhad you should be aware of, and 2 of them can't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:MICROLN

Microlink Solutions Berhad

An investment holding company, researches and develops information technology solutions to the financial services industry in Malaysia and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Rare Pure High Grade Silver with 35% Insider (Near Producer)

Swedens Constellation Software

Inotiv NAMs Test Center

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.