Here's What's Concerning About IFCA MSC Berhad's (KLSE:IFCAMSC) Returns On Capital

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. Basically the company is earning less on its investments and it is also reducing its total assets. On that note, looking into IFCA MSC Berhad (KLSE:IFCAMSC), we weren't too upbeat about how things were going.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on IFCA MSC Berhad is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.011 = RM1.3m ÷ (RM153m - RM30m) (Based on the trailing twelve months to June 2023).

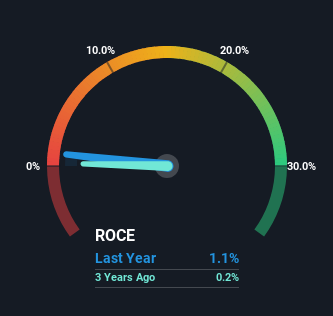

Therefore, IFCA MSC Berhad has an ROCE of 1.1%. In absolute terms, that's a low return and it also under-performs the Software industry average of 9.0%.

Check out our latest analysis for IFCA MSC Berhad

Historical performance is a great place to start when researching a stock so above you can see the gauge for IFCA MSC Berhad's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of IFCA MSC Berhad, check out these free graphs here.

What Can We Tell From IFCA MSC Berhad's ROCE Trend?

We are a bit worried about the trend of returns on capital at IFCA MSC Berhad. To be more specific, the ROCE was 4.8% five years ago, but since then it has dropped noticeably. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. Companies that exhibit these attributes tend to not be shrinking, but they can be mature and facing pressure on their margins from competition. If these trends continue, we wouldn't expect IFCA MSC Berhad to turn into a multi-bagger.

In Conclusion...

In summary, it's unfortunate that IFCA MSC Berhad is generating lower returns from the same amount of capital. In spite of that, the stock has delivered a 38% return to shareholders who held over the last five years. Either way, we aren't huge fans of the current trends and so with that we think you might find better investments elsewhere.

On a final note, we found 3 warning signs for IFCA MSC Berhad (1 makes us a bit uncomfortable) you should be aware of.

While IFCA MSC Berhad may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:IFCAMSC

IFCA MSC Berhad

A business software solution company, engages in the research and development of enterprise-wide business solutions in Malaysia, China, Indonesia, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives