Investors Will Want EA Holdings Berhad's (KLSE:EAH) Growth In ROCE To Persist

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. So on that note, EA Holdings Berhad (KLSE:EAH) looks quite promising in regards to its trends of return on capital.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on EA Holdings Berhad is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0075 = RM1.0m ÷ (RM143m - RM7.3m) (Based on the trailing twelve months to December 2021).

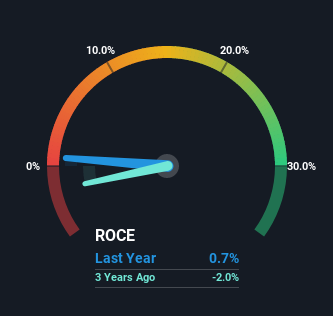

Thus, EA Holdings Berhad has an ROCE of 0.7%. Ultimately, that's a low return and it under-performs the IT industry average of 10%.

Check out our latest analysis for EA Holdings Berhad

Historical performance is a great place to start when researching a stock so above you can see the gauge for EA Holdings Berhad's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of EA Holdings Berhad, check out these free graphs here.

The Trend Of ROCE

EA Holdings Berhad has broken into the black (profitability) and we're sure it's a sight for sore eyes. The company now earns 0.7% on its capital, because five years ago it was incurring losses. On top of that, what's interesting is that the amount of capital being employed has remained steady, so the business hasn't needed to put any additional money to work to generate these higher returns. That being said, while an increase in efficiency is no doubt appealing, it'd be helpful to know if the company does have any investment plans going forward. Because in the end, a business can only get so efficient.

The Bottom Line

To sum it up, EA Holdings Berhad is collecting higher returns from the same amount of capital, and that's impressive. And since the stock has dived 83% over the last five years, there may be other factors affecting the company's prospects. Still, it's worth doing some further research to see if the trends will continue into the future.

EA Holdings Berhad does come with some risks though, we found 4 warning signs in our investment analysis, and 1 of those shouldn't be ignored...

While EA Holdings Berhad isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if EA Holdings Berhad might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:EAH

EA Holdings Berhad

An investment holding company, provides business intelligence software and development, IT service management consultancy, and system integration services in Malaysia.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026