Cloudpoint Technology Berhad (KLSE:CLOUDPT) Has Affirmed Its Dividend Of MYR0.01

The board of Cloudpoint Technology Berhad (KLSE:CLOUDPT) has announced that it will pay a dividend on the 23rd of December, with investors receiving MYR0.01 per share. This payment means the dividend yield will be 2.4%, which is below the average for the industry.

See our latest analysis for Cloudpoint Technology Berhad

Cloudpoint Technology Berhad's Future Dividends May Potentially Be At Risk

Even a low dividend yield can be attractive if it is sustained for years on end. Based on the last dividend, Cloudpoint Technology Berhad is earning enough to cover the payment, but then it makes up 272% of cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

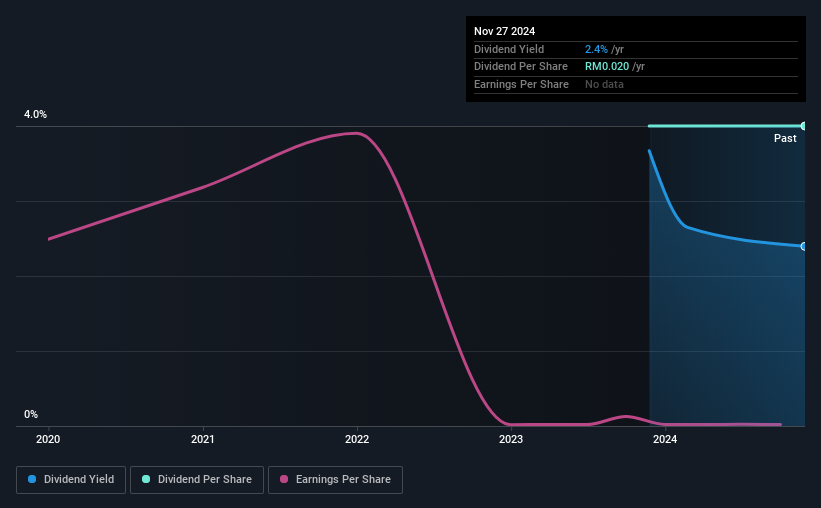

Looking forward, EPS could fall by 61.9% if the company can't turn things around from the last few years. If the dividend continues along recent trends, we estimate the payout ratio could reach 115%, which could put the dividend in jeopardy if the company's earnings don't improve.

Cloudpoint Technology Berhad Is Still Building Its Track Record

It is tough to make a judgement on how stable a dividend is when the company hasn't been paying one for very long. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately things aren't as good as they seem. Over the past five years, it looks as though Cloudpoint Technology Berhad's EPS has declined at around 62% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

Cloudpoint Technology Berhad's Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Cloudpoint Technology Berhad's payments, as there could be some issues with sustaining them into the future. While Cloudpoint Technology Berhad is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 3 warning signs for Cloudpoint Technology Berhad (1 is concerning!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CLOUDPT

Cloudpoint Technology Berhad

An investment holding company, provides information technology (IT) and artificial intelligence (AI) solutions, digital applications, and cloud services in Malaysia.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Micron Technology will experience a robust 16.5% revenue growth

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion