Further Upside For Cloudaron Group Berhad (KLSE:CLOUD) Shares Could Introduce Price Risks After 100% Bounce

Cloudaron Group Berhad (KLSE:CLOUD) shareholders would be excited to see that the share price has had a great month, posting a 100% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

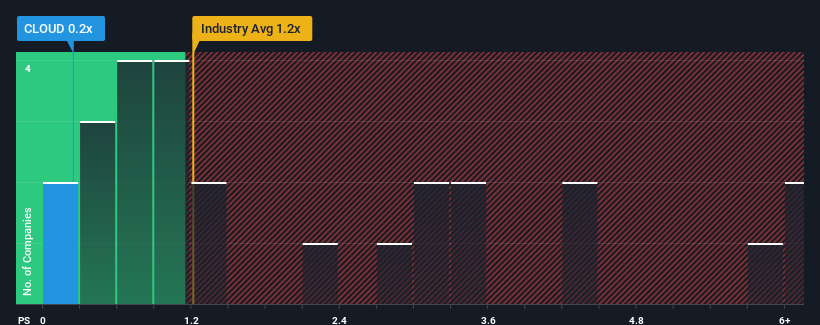

Even after such a large jump in price, Cloudaron Group Berhad's price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the IT industry in Malaysia, where around half of the companies have P/S ratios above 1.2x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Cloudaron Group Berhad

What Does Cloudaron Group Berhad's Recent Performance Look Like?

Recent times have been quite advantageous for Cloudaron Group Berhad as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Cloudaron Group Berhad will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Cloudaron Group Berhad, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Cloudaron Group Berhad's Revenue Growth Trending?

In order to justify its P/S ratio, Cloudaron Group Berhad would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 94%. The strong recent performance means it was also able to grow revenue by 133% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 11% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Cloudaron Group Berhad's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Cloudaron Group Berhad's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Cloudaron Group Berhad's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Cloudaron Group Berhad currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Cloudaron Group Berhad you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:CLOUD

Cloudaron Group Berhad

An investment holding company, provides enterprise solutions, digital platforms, and infrastructure services for businesses primarily in Singapore, Malaysia, People's Republic of China, Thailand, North America, Indonesia, and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives