- Malaysia

- /

- Semiconductors

- /

- KLSE:VITROX

ViTrox Corporation Berhad's (KLSE:VITROX) 33% Price Boost Is Out Of Tune With Revenues

The ViTrox Corporation Berhad (KLSE:VITROX) share price has done very well over the last month, posting an excellent gain of 33%. Taking a wider view, although not as strong as the last month, the full year gain of 23% is also fairly reasonable.

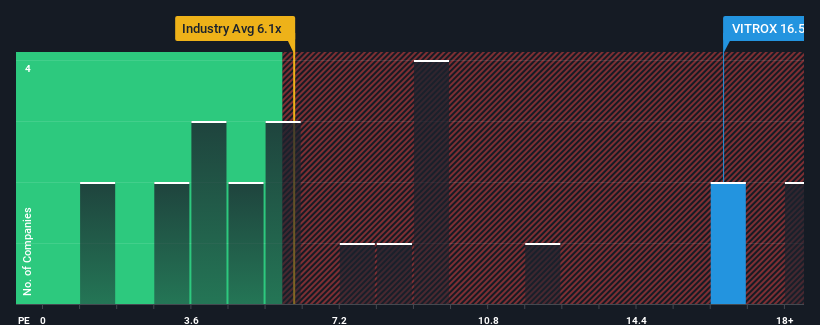

After such a large jump in price, ViTrox Corporation Berhad may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 16.5x, since almost half of all companies in the Semiconductor industry in Malaysia have P/S ratios under 6.1x and even P/S lower than 3x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for ViTrox Corporation Berhad

How Has ViTrox Corporation Berhad Performed Recently?

ViTrox Corporation Berhad has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think ViTrox Corporation Berhad's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

ViTrox Corporation Berhad's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 19%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.1% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 21% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 22% each year, which is not materially different.

With this information, we find it interesting that ViTrox Corporation Berhad is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

Shares in ViTrox Corporation Berhad have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Analysts are forecasting ViTrox Corporation Berhad's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 1 warning sign for ViTrox Corporation Berhad you should know about.

If you're unsure about the strength of ViTrox Corporation Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:VITROX

ViTrox Corporation Berhad

An investment holding company, designs, manufactures, and sells automated vision inspection equipment and system-on-chip embedded electronics devices for the semiconductor and electronics packaging industries worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026