- Malaysia

- /

- Semiconductors

- /

- KLSE:VIS

Here's Why Shareholders Should Examine Visdynamics Holdings Berhad's (KLSE:VIS) CEO Compensation Package More Closely

Key Insights

- Visdynamics Holdings Berhad to hold its Annual General Meeting on 8th of April

- Salary of RM750.0k is part of CEO Ngee Hoe Choy's total remuneration

- The total compensation is similar to the average for the industry

- Visdynamics Holdings Berhad's EPS declined by 90% over the past three years while total shareholder loss over the past three years was 56%

The results at Visdynamics Holdings Berhad (KLSE:VIS) have been quite disappointing recently and CEO Ngee Hoe Choy bears some responsibility for this. At the upcoming AGM on 8th of April, shareholders can hear from the board including their plans for turning around performance. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. From our analysis, we think CEO compensation may need a review in light of the recent performance.

See our latest analysis for Visdynamics Holdings Berhad

How Does Total Compensation For Ngee Hoe Choy Compare With Other Companies In The Industry?

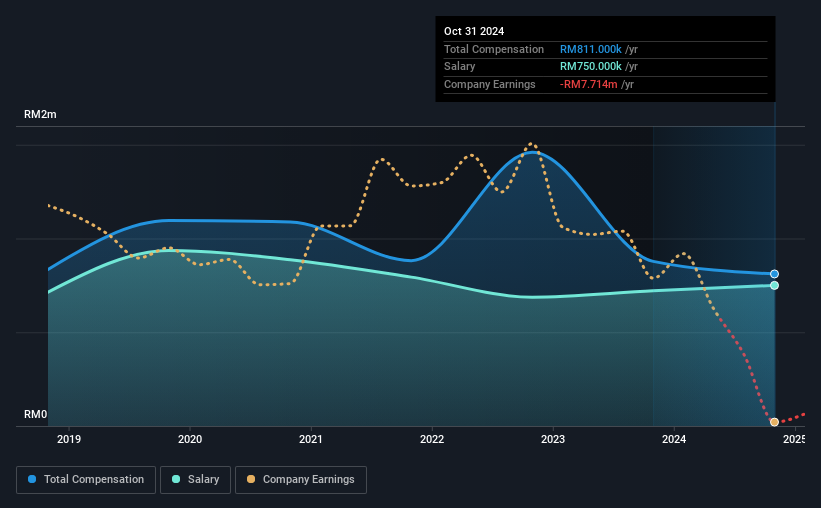

According to our data, Visdynamics Holdings Berhad has a market capitalization of RM58m, and paid its CEO total annual compensation worth RM811k over the year to October 2024. That's a slight decrease of 7.6% on the prior year. Notably, the salary which is RM750.0k, represents most of the total compensation being paid.

For comparison, other companies in the Malaysian Semiconductor industry with market capitalizations below RM888m, reported a median total CEO compensation of RM706k. From this we gather that Ngee Hoe Choy is paid around the median for CEOs in the industry. Furthermore, Ngee Hoe Choy directly owns RM16m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | RM750k | RM721k | 92% |

| Other | RM61k | RM157k | 8% |

| Total Compensation | RM811k | RM878k | 100% |

Talking in terms of the industry, salary represented approximately 90% of total compensation out of all the companies we analyzed, while other remuneration made up 10% of the pie. Although there is a difference in how total compensation is set, Visdynamics Holdings Berhad more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Visdynamics Holdings Berhad's Growth Numbers

Visdynamics Holdings Berhad has reduced its earnings per share by 90% a year over the last three years. In the last year, its revenue is down 55%.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Visdynamics Holdings Berhad Been A Good Investment?

With a total shareholder return of -56% over three years, Visdynamics Holdings Berhad shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 3 warning signs for Visdynamics Holdings Berhad (1 is concerning!) that you should be aware of before investing here.

Switching gears from Visdynamics Holdings Berhad, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:VIS

Visdynamics Holdings Berhad

Engages in the research and development, design, assembly, and tuning of test and backend equipment in the automated test equipment industry for semiconductors and non-semiconductors in Malaysia, South East Asia, North Asia, and internationally.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives