- Malaysia

- /

- Semiconductors

- /

- KLSE:UNISEM

Here's Why Unisem (M) Berhad (KLSE:UNISEM) Has A Meaningful Debt Burden

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Unisem (M) Berhad (KLSE:UNISEM) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Unisem (M) Berhad

What Is Unisem (M) Berhad's Net Debt?

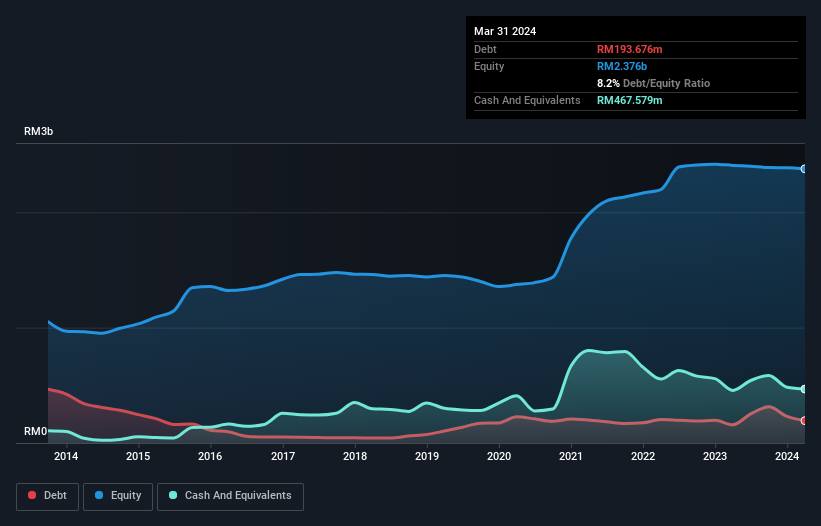

The image below, which you can click on for greater detail, shows that at March 2024 Unisem (M) Berhad had debt of RM193.7m, up from RM157.9m in one year. However, its balance sheet shows it holds RM467.6m in cash, so it actually has RM273.9m net cash.

A Look At Unisem (M) Berhad's Liabilities

We can see from the most recent balance sheet that Unisem (M) Berhad had liabilities of RM483.0m falling due within a year, and liabilities of RM247.4m due beyond that. Offsetting these obligations, it had cash of RM467.6m as well as receivables valued at RM279.1m due within 12 months. So it can boast RM16.4m more liquid assets than total liabilities.

Having regard to Unisem (M) Berhad's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the RM6.95b company is short on cash, but still worth keeping an eye on the balance sheet. Succinctly put, Unisem (M) Berhad boasts net cash, so it's fair to say it does not have a heavy debt load!

In fact Unisem (M) Berhad's saving grace is its low debt levels, because its EBIT has tanked 61% in the last twelve months. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Unisem (M) Berhad's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Unisem (M) Berhad has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Unisem (M) Berhad saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Unisem (M) Berhad has net cash of RM273.9m, as well as more liquid assets than liabilities. So while Unisem (M) Berhad does not have a great balance sheet, it's certainly not too bad. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Unisem (M) Berhad (1 shouldn't be ignored) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KLSE:UNISEM

Unisem (M) Berhad

Provides semiconductor assembly and test services for electronic companies in Asia, Europe, and the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026